Delaware Office Space Lease Agreement

Description

How to fill out Office Space Lease Agreement?

Are you presently in a scenario where you require documentation for either organizational or personal purposes nearly every day? There are numerous approved document templates accessible online, yet finding ones you can trust isn't simple.

US Legal Forms offers a vast collection of form templates, including the Delaware Office Space Lease Agreement, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Delaware Office Space Lease Agreement template.

Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Delaware Office Space Lease Agreement anytime if needed. Just open the required form to download or print the document template.

Utilize US Legal Forms, the most extensive selection of legal documents, to save time and avoid errors. This service provides professionally crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and start simplifying your life.

- Locate the form you need and ensure it is for the correct city/region.

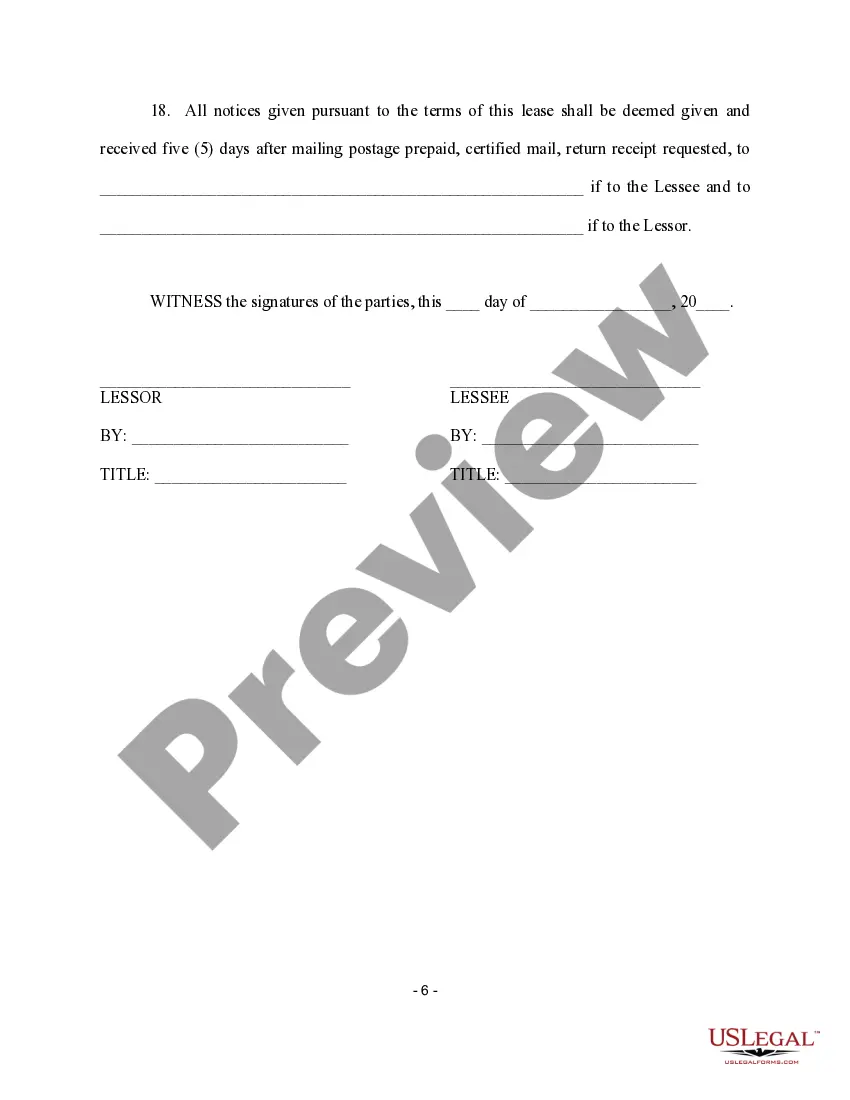

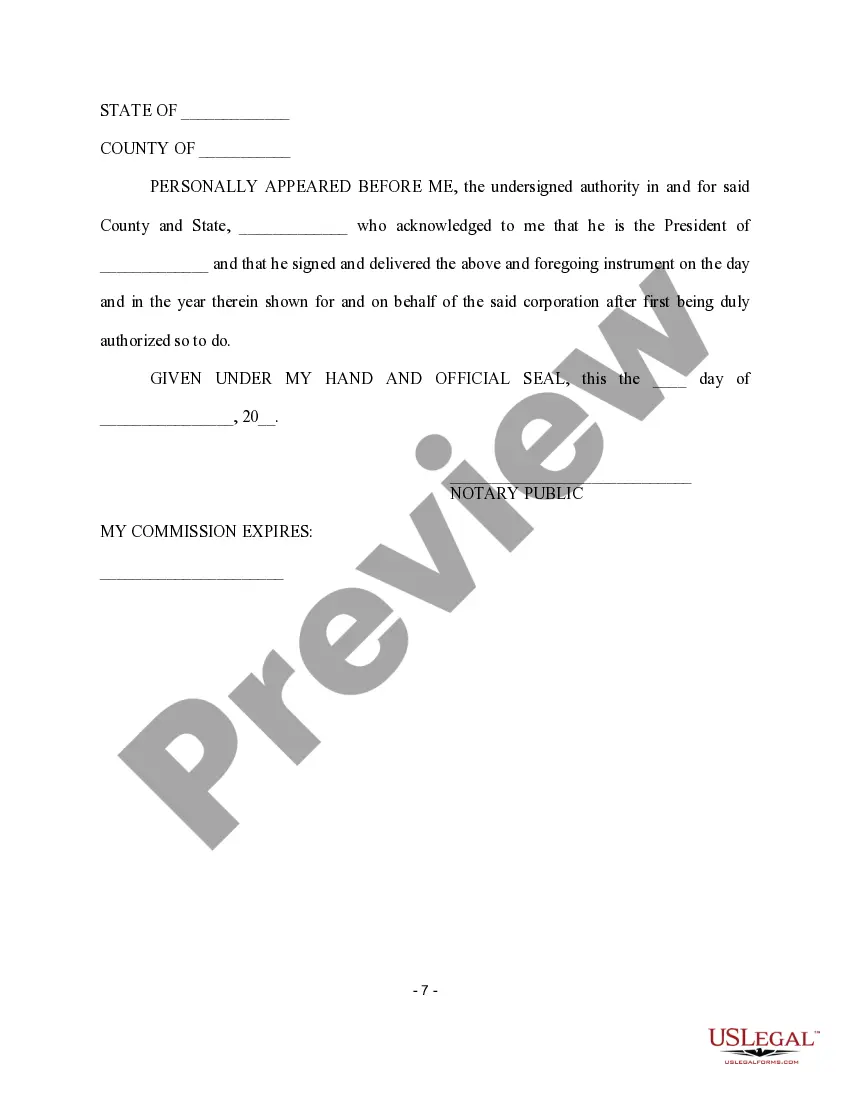

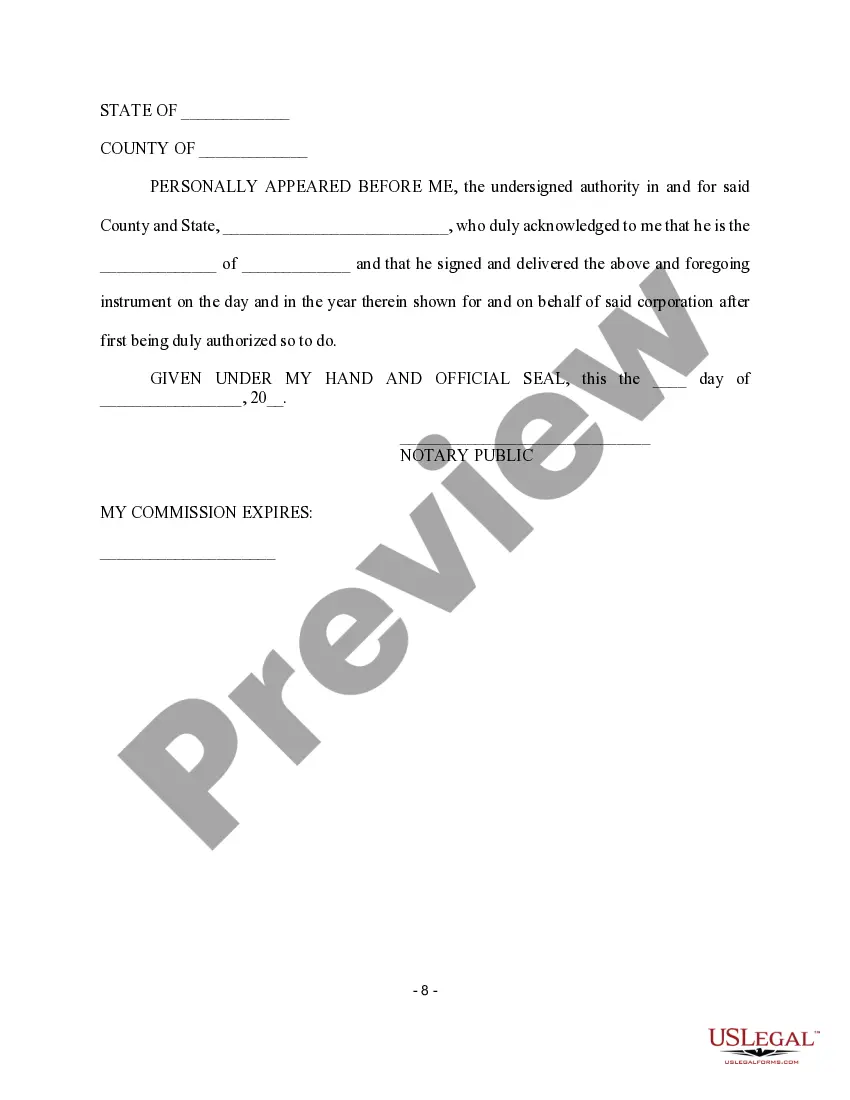

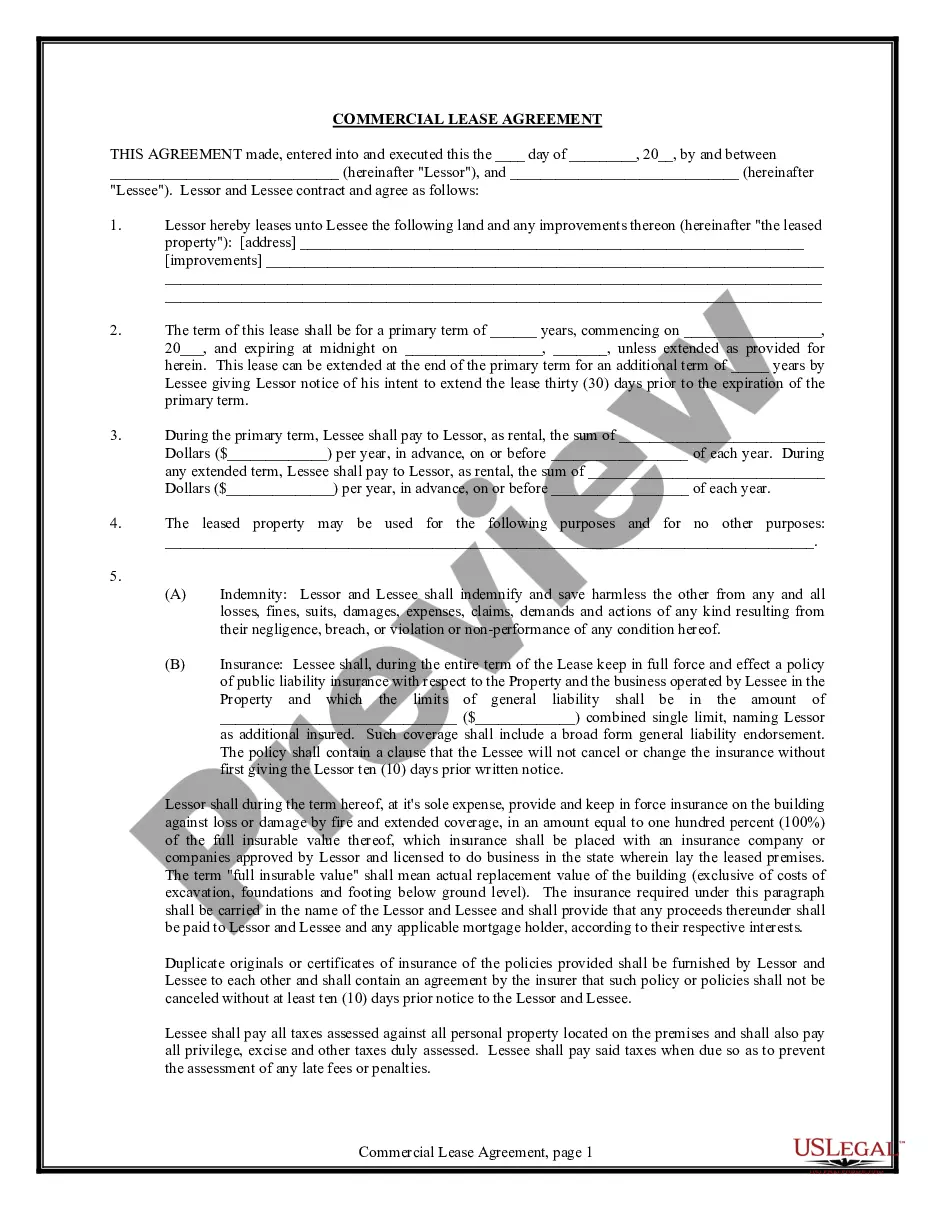

- Utilize the Preview feature to review the document.

- Examine the details to confirm that you have selected the right form.

- If the form isn't what you seek, use the Search box to find the document that matches your needs.

- Once you find the appropriate form, click Get now.

- Select the pricing plan you prefer, fill out the required details to create your account, and pay for your order using PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

The tenant may provide the landlord with a 7 days' written notice to terminate the lease if there is substantial damage to the rental unit. The tenant is only liable for rent only until they vacate the unit after written notice is given.

No, a commercial lease does not need to be notarized in Pennsylvania to be a legally valid document; however, one or both parties may request to have the commercial lease notarized if they so desire. The information for this answer was found on our Pennsylvania Commercial Lease Agreement answers.

Conditions for Legally Breaking a Lease in DelawareEarly Termination Clause.Active Military Duty.Unit is Uninhabitable.Landlord Harassment or Privacy Violation.Domestic Violence.Senior Citizen or Health Issue.Tenant's Change of Employment.Subsidized Private/Public Housing.More items...?

The landlord shall give the tenant at least 48 hours' notice of landlord's intent to enter, except for repairs requested by the tenant, and shall enter only between a.m. and p.m. As to prospective tenants or purchasers only, the tenant may expressly waive in a signed addendum to the rental agreement or other

No, lease agreements do not need to be notarized in Delaware. Some states require residential leases to be notarized based on the duration of the lease, but Delaware is not one of them. If the lease meets the requirements to be binding, it does not need to be notarized.

The important thing to remember is that with commercial real estate, short term leases are generally anything that is 3 years or less, while long term is 10+ years.

If there is a rental agreement, the tenant can terminate the lease before it expires in specific situations under the law. There is a requirement that there be 30 days' written notice that starts on the first day of the month the day after the notice was given.

If there is a rental agreement, the tenant can terminate the lease before it expires in specific situations under the law. There is a requirement that there be 30 days' written notice that starts on the first day of the month the day after the notice was given.

Yes, a tenant may terminate a fixed term lease agreement prematurely.

State law regulates several rent-related issues, including late fees, the amount of notice (at least 60 days in Delaware for month-to-month rental agreements) landlords must give tenants to raise the rent, and how much time (five days in Delaware) a tenant has to pay rent or move before a landlord can file for eviction