Delaware Oil, Gas and Mineral Royalty Transfer

Description

How to fill out Oil, Gas And Mineral Royalty Transfer?

If you need to full, down load, or print out lawful record layouts, use US Legal Forms, the most important collection of lawful forms, that can be found on the web. Make use of the site`s basic and hassle-free lookup to obtain the paperwork you will need. A variety of layouts for organization and person functions are sorted by categories and states, or key phrases. Use US Legal Forms to obtain the Delaware Oil, Gas and Mineral Royalty Transfer within a handful of click throughs.

Should you be currently a US Legal Forms client, log in to your accounts and click the Obtain switch to obtain the Delaware Oil, Gas and Mineral Royalty Transfer. You may also access forms you earlier downloaded inside the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape for that proper city/land.

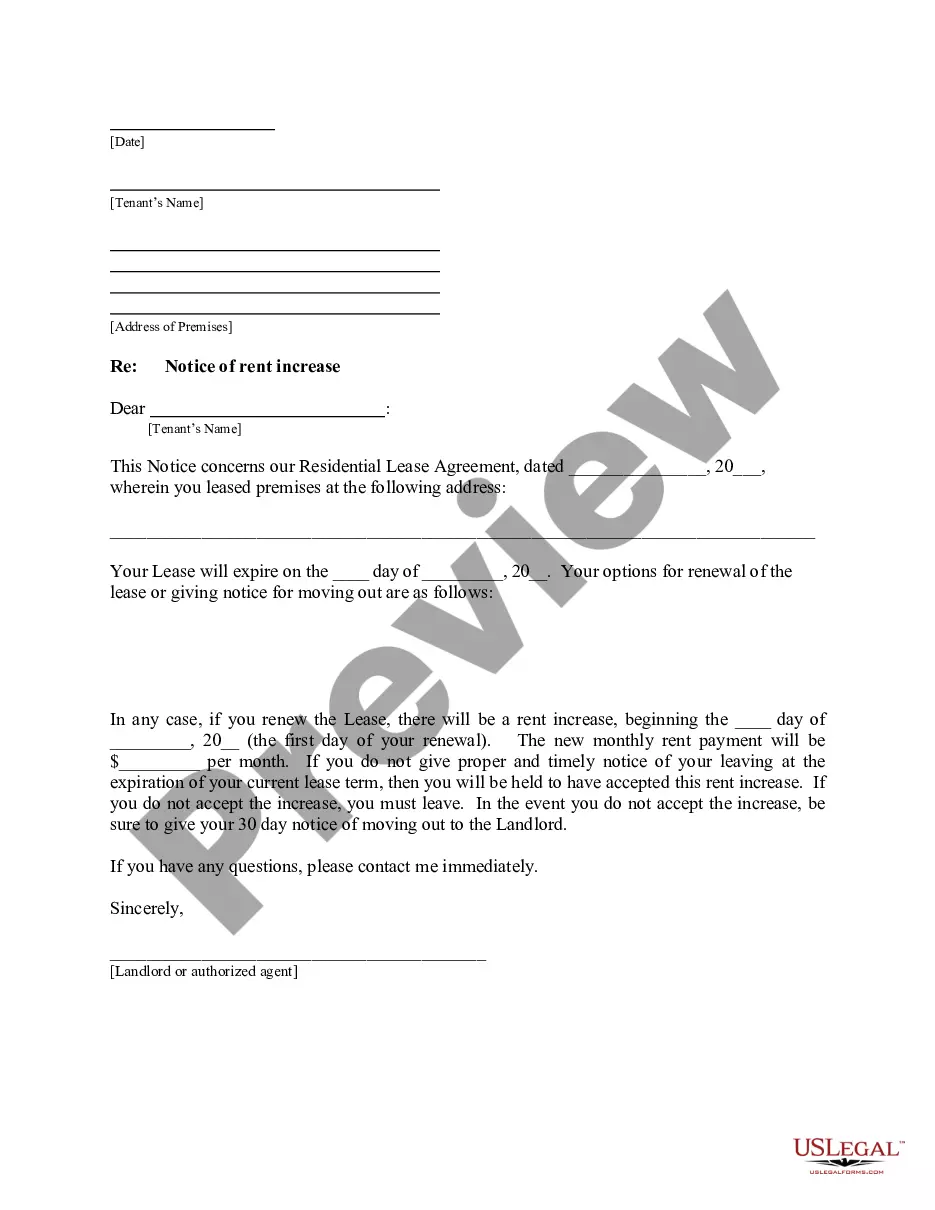

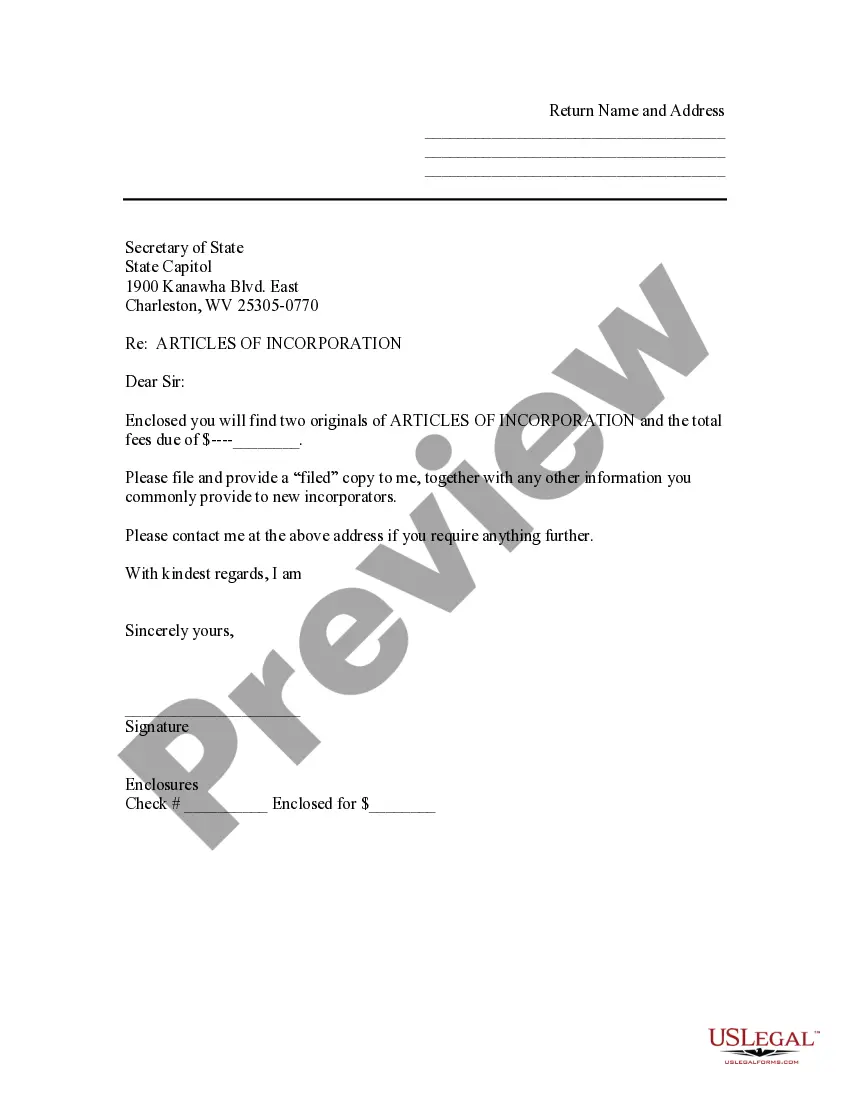

- Step 2. Take advantage of the Preview option to check out the form`s content material. Do not forget to read the description.

- Step 3. Should you be unsatisfied with the kind, utilize the Search industry near the top of the display screen to find other variations in the lawful kind format.

- Step 4. Upon having found the shape you will need, click on the Buy now switch. Choose the rates program you prefer and add your accreditations to sign up for an accounts.

- Step 5. Approach the deal. You can utilize your credit card or PayPal accounts to accomplish the deal.

- Step 6. Select the formatting in the lawful kind and down load it on your device.

- Step 7. Comprehensive, edit and print out or indicator the Delaware Oil, Gas and Mineral Royalty Transfer.

Every single lawful record format you buy is the one you have for a long time. You might have acces to each kind you downloaded with your acccount. Click on the My Forms segment and pick a kind to print out or down load once more.

Remain competitive and down load, and print out the Delaware Oil, Gas and Mineral Royalty Transfer with US Legal Forms. There are millions of professional and express-specific forms you can utilize for the organization or person demands.

Form popularity

FAQ

The base formula for royalty calculation is royalty revenue = sales x royalty percentage. You can choose to keep things old school, and do the math for each and every SKU.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

If you want to get your money, state officials will ask for evidence supporting your right to the unclaimed oil or gas rights located in your search. You may need to show evidence of inheritance or complete an Affidavit of Heirship (AOH) if you are claiming royalty payments on an inherited property.

Royalty is a portion of the proceeds from the sale of production which is paid monthly to the mineral rights owner. The royalty is usually described in the lease as a fraction such as 1/8th, or 1/6th.

It represents the amount the resource owner is expected to receive from the sale of the oil and gas. Royalty rates are between 12.5% to 15%. Price per Unit: This is the current market price of oil and gas at a particular period.

You may have noticed on your check stubs an ?owner interest? or ?net revenue interest? or a ?decimal interest?. The operator will then multiply your interest by the quantity of oil and gas produced and the current price to determine your oil and gas royalty payments.

It really comes down to your personal decision. Figuring out whether to sell oil and gas royalties can be challenging for some. Here are some of the most common reasons for selling an oil and gas royalty: Taxes: You will save substantial money if you inherited mineral rights by selling your oil royalties.

Most states and many private landowners require companies to pay royalty rates higher than 12.5%, with some states charging 20% or more, ing to federal officials. The royalty rate for oil produced from federal reserves in deep waters in the Gulf of Mexico is 18.75%.