Delaware Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act

Description

How to fill out Gift Of Unregistered Securities Pursuant To The Uniform Gifts To Minors Act?

Have you been in a position where you need to have documents for both company or personal reasons almost every day? There are a lot of legitimate papers layouts available on the net, but getting versions you can depend on isn`t easy. US Legal Forms offers thousands of develop layouts, much like the Delaware Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act, that are composed to meet state and federal specifications.

If you are already knowledgeable about US Legal Forms site and have an account, basically log in. Next, you may acquire the Delaware Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act web template.

If you do not provide an bank account and wish to begin to use US Legal Forms, follow these steps:

- Find the develop you will need and make sure it is to the appropriate town/area.

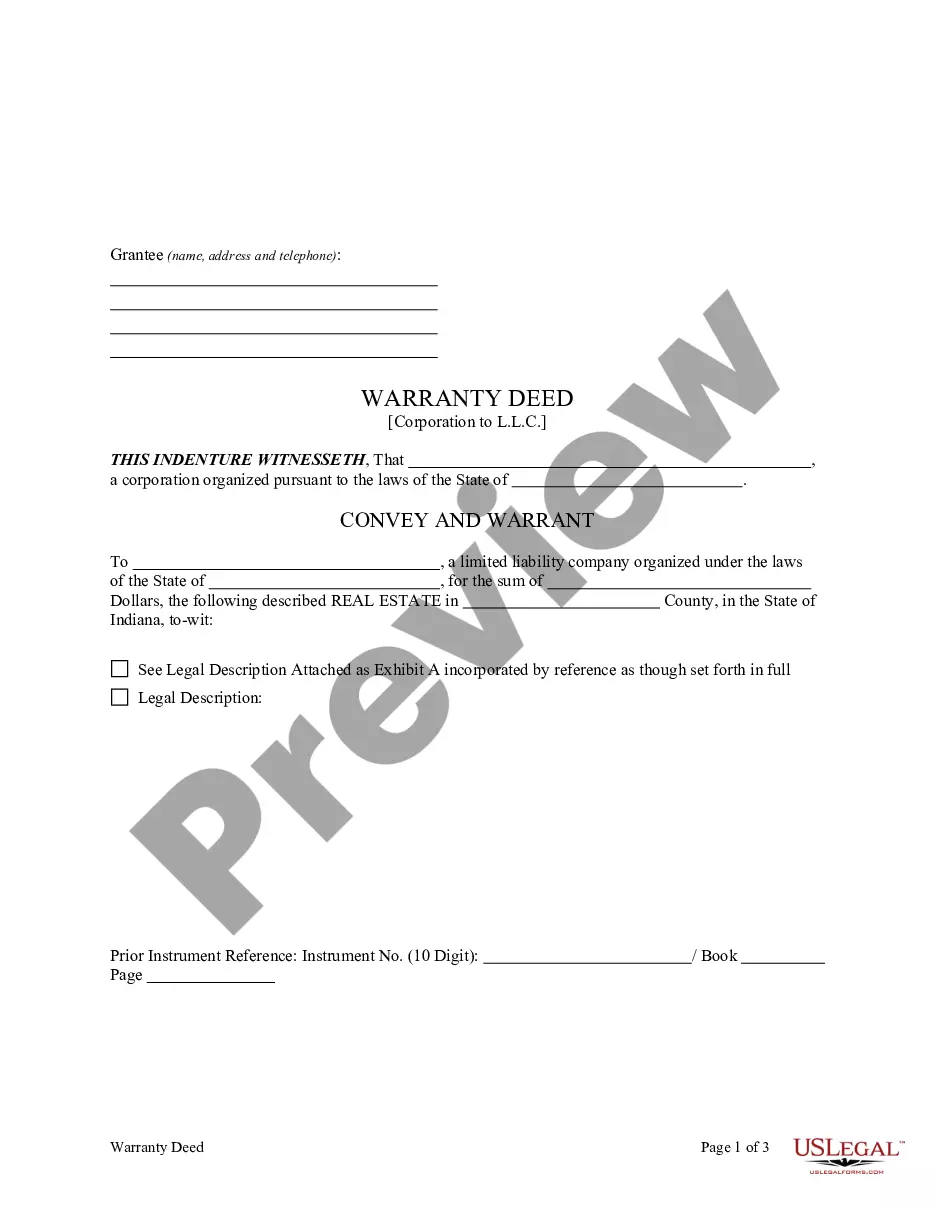

- Take advantage of the Preview option to examine the form.

- Read the information to actually have selected the right develop.

- When the develop isn`t what you`re looking for, make use of the Research field to discover the develop that meets your requirements and specifications.

- If you discover the appropriate develop, simply click Buy now.

- Pick the prices plan you desire, fill out the desired information and facts to generate your account, and buy the order using your PayPal or bank card.

- Decide on a handy document structure and acquire your version.

Locate all of the papers layouts you possess bought in the My Forms menu. You can obtain a more version of Delaware Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act whenever, if necessary. Just go through the required develop to acquire or printing the papers web template.

Use US Legal Forms, by far the most comprehensive variety of legitimate varieties, to save lots of time as well as steer clear of errors. The services offers expertly made legitimate papers layouts which can be used for a range of reasons. Produce an account on US Legal Forms and start creating your daily life easier.

Form popularity

FAQ

A Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) account is an account into which property is set aside for a minor's benefit. Whether a UGMA or UTMA account is used depends on the law of the state in which the account is established.

Cons Of Uniform Gift to Minors Act & Uniform Transfers to Minors Act Account No tax advantages for contributions. UGMA and UTMA plans offer no tax advantages for ?contributions?. ... No oversight for the use of funds. ... Limited tax advantages on income.

Also, since UGMA and UTMA accounts are in the name of a single child, the funds are not transferrable to another beneficiary. For financial aid purposes, custodial accounts are considered assets of the student. This means that custodial bank and brokerage accounts have a high impact on financial aid eligibility.

Under the laws that govern custodial accounts, including the Uniform Transfers to Minors Act (UTMA), account custodianship ends and the beneficiary becomes eligible to assume control of the account at a specified age?typically 18 or 21, depending on the state.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

Transfers made to a UGMA or UTMA account are irrevocable and belong to the child in whose name the account is registered; however, the account is controlled by the custodian until the child reaches a certain age, which varies by state (usually 18 or 21).

In the United States, a child's money does not belong to the child's parents or guardians. Once the paperwork is in order, as a custodian of a UTMA you become a fiduciary or you owe a fiduciary duty to the beneficiary of that account. "Fiduciary duty" means you can only use the money in their best interest.

Once the minor on a UGMA/UTMA account reaches the applicable state's age of termination, the custodian or the former minor may transfer the shares in the account(s) to the former minor's sole name. Instructions are acceptable from either the custodian or the former minor.