Delaware Statement by Business Entity as to Use and Possession of Firearms Involved in Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I

Description

How to fill out Statement By Business Entity As To Use And Possession Of Firearms Involved In Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I?

Have you ever found yourself in a situation where you require documents for either professional or particular purposes almost daily.

There are numerous valid document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Delaware Statement by Business Entity regarding Use and Possession of Firearms Involved in Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I, which can be printed to fulfill state and federal requirements.

Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Delaware Statement by Business Entity regarding Use and Possession of Firearms Involved in Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/region.

- Use the Review button to examine the form.

- Read the details to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search field to locate the form that meets your needs and requirements.

- Once you find the correct form, click on Buy now.

- Choose the pricing plan you want, enter the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Delaware Statement by Business Entity regarding Use and Possession of Firearms Involved in Over-the-Counter Transaction - To Accompany ATF Form 4473-Part I anytime, if needed. Just click on the required form to download or print the document template.

Form popularity

FAQ

SUBMITTED/IN PROCESS - Your tax stamp application has been submitted to the ATF and is either awaiting your fingerprint cards or is in process of being approved. This phase lasts on average ~32 days. But can be approved sooner or later than the average 32 days. APPROVED - Your tax stamp application is approved.

Yes, the ATF Form 4473 is available online, but much of it needs to be filled out by the FFL doing your transfer. If you fill it out online, you must send it to them, or print it out and bring it with you so they can complete their section of the form and submit it.

21b: ?Do you intend to purchase or acquire any firearm listed on this form and any continuation sheet(s) or ammunition, for sale of other disposition to any person described in questions 21(c)-(m) or to a person described in question 21.n.1 who does not fall within a nonimmigrant exception??

Actual Transferee/Buyer: For purposes of this form, a person is the actual transferee/buyer if he/she is purchasing the firearm for him/herself or otherwise acquiring the firearm for him/herself. (e.g., redeeming the firearm from pawn, retrieving it from consignment, firearm raffle winner).

Current ATF Processing Times - September 1, 2023 ATF FormProcessing Time Paper ApplicationProcessing Time eFormsATF Form 155 Days45 DaysATF Form 314 Days7 DaysATF Form 4253 Days193 DaysATF Form 4 Trust327 Days246 Days1 more row ? 12 Sept 2023

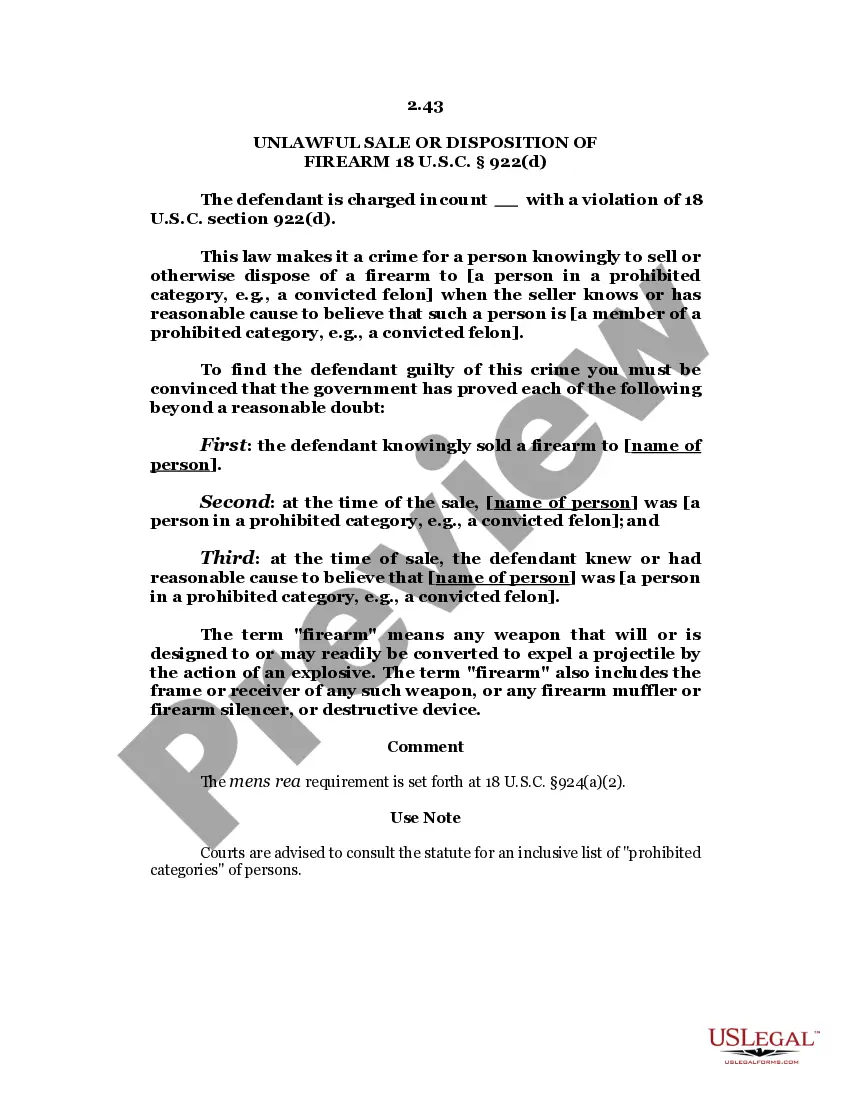

A Firearms Transaction Record, or ATF Form 4473, is a seven-page form prescribed by the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) required to be completed when a person proposes to purchase a firearm from a Federal Firearms License (FFL) holder, such as a gun dealer.

If it is a just simple mistake, you must submit a revised form to attach to the original 4473 with the error & revision clearly indicated, and your FFL will help you with this. If it was a purposely made incorrect answer, that is different and considered a felony.

After the transferor/seller has completed the firearms transaction, he/she must make the completed, original ATF Form 4473 (which includes the Notices, General Instructions, and Definitions), and any supporting documents, part of his/her permanent records.

Revised Form 4473 Changes Privately Made Firearms (PMFs) must now be recorded (Section A, 1) Addition of 'Reside in City Limits' to transferee/buyer address (Section A, 10) Two additional prohibited persons questions (Section B, 21.

The new ATF Form 4473 - Firearms Transaction Record (August 2023 revision) is now available.