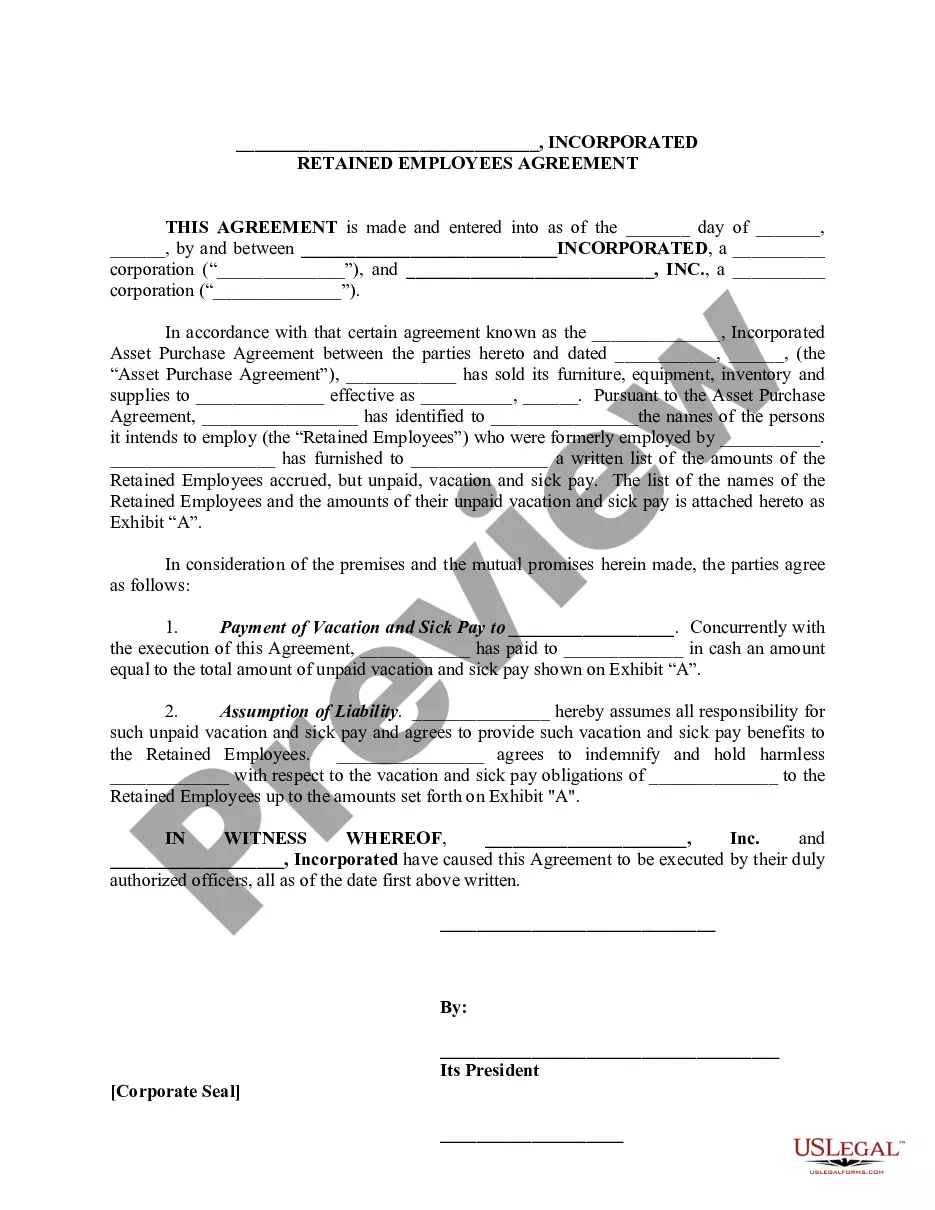

The Delaware Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction refers to a legal document that governs the sale of a business's assets while maintaining the employment of certain employees. This agreement is specific to transactions taking place in the state of Delaware and outlines the terms and conditions of the sale, employee retention, and asset purchase. In a Delaware Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction, the buyer acquires specific assets of the business, such as inventory, equipment, intellectual property, and customer goodwill. This type of agreement is commonly utilized when a business owner wants to sell their assets to another party while ensuring the continuity of certain key employees. The agreement will typically include various provisions, such as: 1. Asset Purchase Terms: This section outlines the specific assets being transferred, their value, and any limitations or conditions for the purchase. 2. Employee Retention: The agreement includes provisions specifying the terms and conditions under which certain employees will be retained by the buyer. This may include details about salary, benefits, job titles, and responsibilities. 3. Non-Compete and Non-Solicitation: The agreement may contain clauses preventing the seller from engaging in activities that compete with the purchased business or from soliciting clients or employees for a specified period of time. 4. Purchase Price and Payment Terms: The agreement will stipulate the total purchase price for the assets and the agreed-upon payment terms, such as a lump sum payment or installments. 5. Closing and Conditions: This section outlines the conditions that must be met for the transaction to be considered finalized, including any regulatory approvals, third-party consents, or other necessary agreements. Different types of Delaware Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transactions can vary depending on the specific industry, size of the business, and other circumstances. For example: 1. Manufacturing Asset Purchase Transaction: This type of agreement would be used when a manufacturing business is sold, and the buyer intends to retain a significant number of employees to continue the production process. 2. Retail Asset Purchase Transaction: In the case of a retail business sale, where the buyer intends to maintain the existing customer base and retain key employees with significant knowledge of customer preferences and relationships. 3. Service Industry Asset Purchase Transaction: This type of agreement would be applicable when a service-based business is sold, and the buyer wishes to retain employees with specialized skills and expertise in providing specific services to clients. In conclusion, the Delaware Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a specific legal document used in Delaware to facilitate the sale of a business's assets while ensuring the continuation of certain employees. It outlines the terms and conditions of the sale, employee retention, and asset purchase, playing a crucial role in protecting the interests of both the buyer and seller in the transaction.

Delaware Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out Delaware Sale Of Business - Retained Employees Agreement - Asset Purchase Transaction?

US Legal Forms - among the largest libraries of legal types in America - provides a wide array of legal document templates you can acquire or print. Making use of the website, you may get a huge number of types for organization and person functions, sorted by types, claims, or key phrases.You can find the latest types of types just like the Delaware Sale of Business - Retained Employees Agreement - Asset Purchase Transaction within minutes.

If you already have a membership, log in and acquire Delaware Sale of Business - Retained Employees Agreement - Asset Purchase Transaction from your US Legal Forms catalogue. The Obtain switch can look on each develop you perspective. You have accessibility to all earlier saved types inside the My Forms tab of your respective account.

In order to use US Legal Forms for the first time, allow me to share basic directions to get you started out:

- Make sure you have picked out the best develop for your area/region. Select the Review switch to check the form`s content material. Read the develop description to ensure that you have selected the proper develop.

- If the develop doesn`t fit your specifications, make use of the Look for industry towards the top of the display to discover the one which does.

- Should you be happy with the shape, affirm your decision by clicking the Acquire now switch. Then, select the pricing prepare you want and supply your credentials to register for an account.

- Process the purchase. Make use of your Visa or Mastercard or PayPal account to complete the purchase.

- Choose the formatting and acquire the shape on your product.

- Make alterations. Complete, change and print and sign the saved Delaware Sale of Business - Retained Employees Agreement - Asset Purchase Transaction.

Every single format you put into your money does not have an expiry day and it is your own forever. So, if you want to acquire or print another version, just check out the My Forms portion and click on the develop you need.

Gain access to the Delaware Sale of Business - Retained Employees Agreement - Asset Purchase Transaction with US Legal Forms, by far the most comprehensive catalogue of legal document templates. Use a huge number of specialist and express-distinct templates that fulfill your company or person demands and specifications.