Delaware Agreement between Website Owner and Sponsor

Description

How to fill out Agreement Between Website Owner And Sponsor?

Are you presently in a situation where you require documentation for potential organizational or personal purposes almost daily.

There are numerous legal document templates accessible online, but finding reliable ones is not straightforward.

US Legal Forms offers thousands of form templates, including the Delaware Agreement between Website Owner and Sponsor, designed to meet federal and state standards.

Once you locate the correct form, click Buy now.

Choose your preferred payment plan, fill out the necessary information to create your account, and complete the order with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Agreement between Website Owner and Sponsor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct area/region.

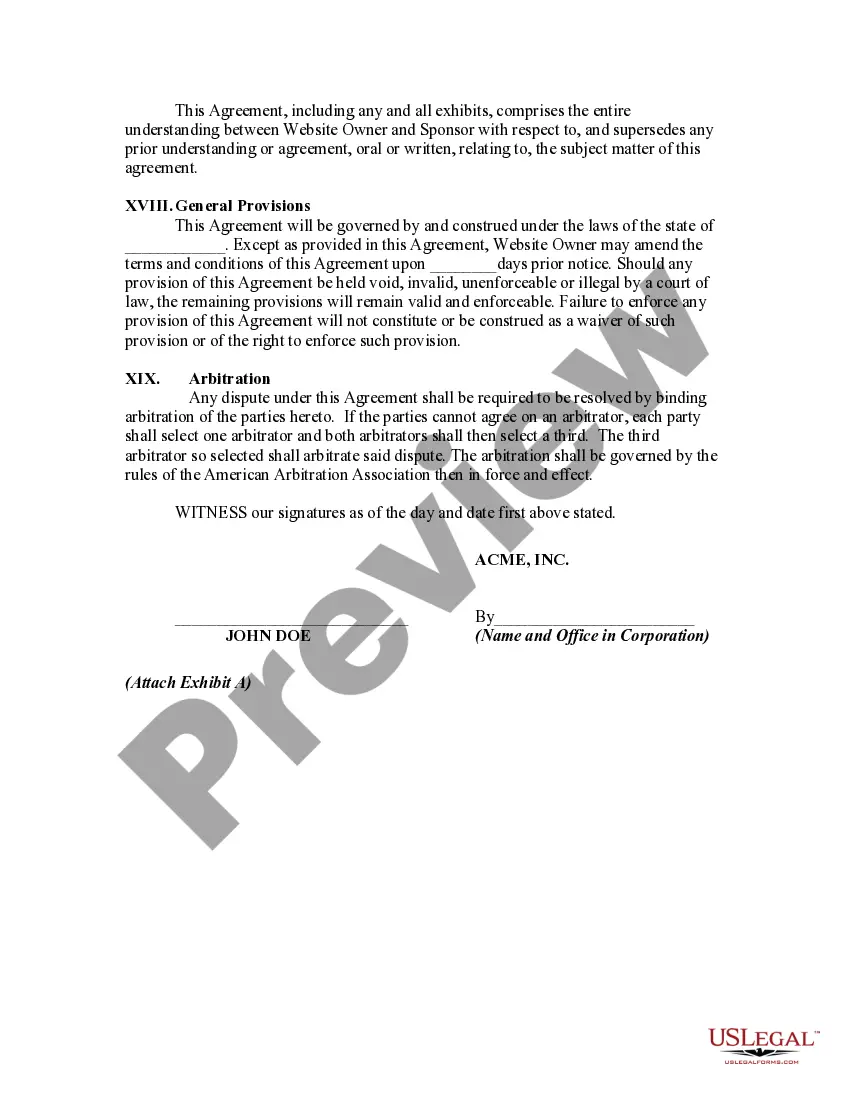

- Use the Review button to examine the form.

- Read the description to ensure you have selected the right document.

- If the form is not what you need, utilize the Search section to find the appropriate template.

Form popularity

FAQ

Generally, Delaware LLCs do not file separate federal tax returns unless they elect to be treated as a corporation. Instead, income flows through to the owners, who report it on their individual tax returns. Therefore, your Delaware Agreement between Website Owner and Sponsor should account for these tax implications. Consulting with a tax professional can provide tailored guidance.

Delaware LLCs are not inherently tax-exempt but may benefit from pass-through taxation if structured correctly. This means profits and losses are reported on the owners' personal tax returns rather than the LLC itself. Understanding this in the context of your Delaware Agreement between Website Owner and Sponsor can enhance your tax strategy. Seeking advice from a tax consultant can clarify your situation further.

To set up a limited partnership in Delaware, you need to file a Certificate of Limited Partnership with the Delaware Secretary of State. This document outlines the general and limited partners, detailing their roles. Your Delaware Agreement between Website Owner and Sponsor may necessitate careful consideration of the partnership structure. For assistance, using platforms like USLegalForms can streamline this procedure.

Yes, a Delaware corporation must have a registered agent with a physical address in Delaware. This agent receives legal documents on behalf of the business. Therefore, if you're entering into a Delaware Agreement between Website Owner and Sponsor, ensure you have a registered agent to maintain compliance and facilitate communication.

Delaware does not impose income tax on LLCs that do not conduct business within the state. However, if your LLC earns income, you may have to file a Delaware tax return. Therefore, understanding the interplay between state requirements and your Delaware Agreement between Website Owner and Sponsor is essential. Engaging a tax advisor can clarify your obligations.

A Delaware LLC does not need to file a federal tax return if it has not elected to be treated as a corporation. Instead, the income typically passes through to the owners, who report it on their personal returns. However, depending on your LLC activities, you might need to file state tax forms. To understand the implications on your Delaware Agreement between Website Owner and Sponsor, consulting a tax professional could be beneficial.

Generally, to be legally valid, most contracts must contain two elements:All parties must agree about an offer made by one party and accepted by the other.Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

Essentially, anyone can draft a contract on their own; an attorney is not required to form a valid contract.

Generally, to be legally valid, most contracts must contain two elements: All parties must agree about an offer made by one party and accepted by the other. Something of value must be exchanged for something else of value. This can include goods, cash, services, or a pledge to exchange these items.

Prepare a contractDrafting a contract.Provide details of the parties.Describe services or results.Set out payment details.Assign intellectual property rights.Explain how to treat confidential information.Identify who is liable indemnity.Provide insurance obligations.More items...?