Delaware Trust Agreement — Irrevocable: A Comprehensive Overview A Delaware Trust Agreement — Irrevocable is a legally binding agreement made between a Granter and a Trustee, intended to establish a trust in the state of Delaware. This type of trust agreement is characterized by its "irrevocable" nature, which means that once established, it generally cannot be modified, altered, or revoked without the consent of all involved parties, including the beneficiaries. The primary objective of an Irrevocable Delaware Trust Agreement is to protect and preserve assets, provide estate planning benefits, minimize tax obligations, and ensure the proper distribution of assets to designated beneficiaries upon the Granter's death. This agreement offers excellent asset protection and can confer significant tax advantages to those who create it. There are several types of Delaware Trust Agreements — Irrevocable, each serving specific purposes and addressing different needs: 1. Delaware Dynasty Trust: This trust agreement allows for the preservation and continued administration of assets for multiple generations. It aims to maximize wealth preservation by minimizing or even eliminating estate and gift taxes. 2. Delaware Irrevocable Life Insurance Trust (IIT): Slits are primarily designed for estate planning purposes where life insurance policies are owned by the trust rather than the individual. This trust agreement ensures that the insurance proceeds are not subjected to estate taxes and can provide liquidity to the estate. 3. Delaware Charitable Remainder Trust (CRT): A CRT allows for the transfer of assets to a trust, providing income to the Granter or another named beneficiary for a specific period. At the end of the trust term, the remaining assets are donated to a charitable organization. This arrangement offers income tax deductions to the Granter and can be an effective tool for philanthropic endeavors. 4. Delaware Special Needs Trust (SET): An SET is designed for individuals with disabilities, ensuring that their support needs are adequately met while preserving eligibility for government assistance programs. This trust agreement safeguards the assets and ensures continued financial security for the individual. 5. Delaware Qualified Personnel Residence Trust (PRT): A PRT allows a Granter to transfer a primary residence or vacation home to an irrevocable trust while retaining the right to live in the property for a predetermined term. This agreement provides potential estate tax savings while still allowing the Granter to enjoy the property during the trust term. When establishing a Delaware Trust Agreement — Irrevocable, it is crucial to involve an experienced attorney or financial advisor well-versed in trust law. Due to the complex nature of these agreements, professional guidance can help ensure compliance with legal requirements and maximize the benefits sought by the Granter.

Delaware Trust Agreement - Irrevocable

Description

How to fill out Delaware Trust Agreement - Irrevocable?

Have you ever found yourself in a situation where you require documents for business or personal purposes almost all the time.

There are numerous legitimate document templates accessible online, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of form templates, such as the Delaware Trust Agreement - Irrevocable, which are designed to comply with federal and state regulations.

Choose the payment plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

Select a suitable document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Trust Agreement - Irrevocable template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct municipality/county.

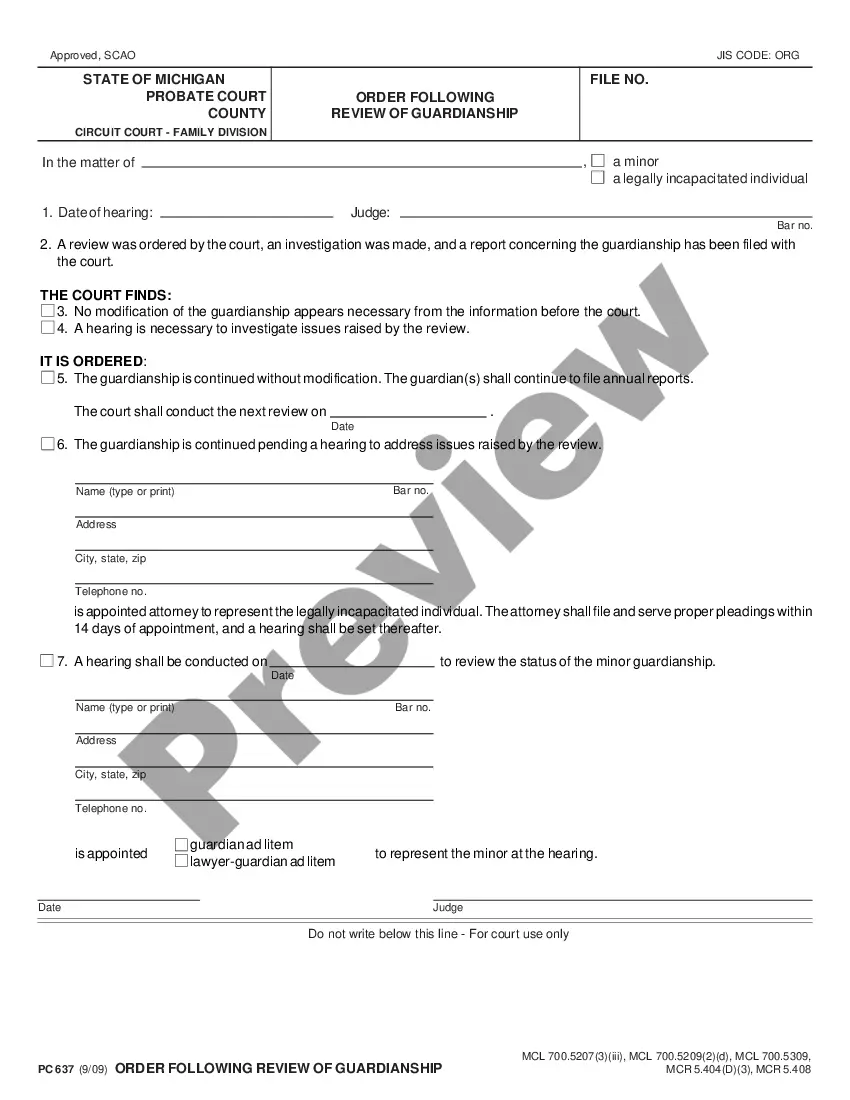

- Use the Preview button to examine the form.

- Read the description to ensure you have chosen the right document.

- If the form is not what you are looking for, use the Search box to find the document that meets your needs and criteria.

- Once you find the correct form, click Get now.

Form popularity

FAQ

Delaware statutory trusts can last for an indefinite period, provided they are managed according to the terms outlined in the trust agreement. The duration is generally specified within the Delaware Trust Agreement - Irrevocable itself. It's essential to understand the terms of the trust to ensure it meets your long-term planning goals.

One potential downside of a Delaware statutory trust is its irreversible nature; once established, it cannot be modified without potential legal complications. This lack of flexibility can be a concern for some individuals. Additionally, there may be ongoing administrative costs and complexities associated with maintaining a Delaware Trust Agreement - Irrevocable.

Filing a trust in Delaware involves creating a Delaware Trust Agreement - Irrevocable and submitting it to the Delaware Division of Corporations. You'll need to include all necessary details, such as the trust's name, purpose, and managing parties. Utilizing services from uslegalforms can help streamline this process, ensuring all documentation is accurately prepared and submitted.

A Delaware statutory trust offers numerous benefits, including asset protection, flexibility in management, and favorable tax treatment. Additionally, it allows for easier transfer of interests and can provide liability protection to its beneficiaries. Establishing a Delaware Trust Agreement - Irrevocable can be a strategic move for both estate planning and investment purposes.

Generally, a Delaware statutory trust does not file a separate tax return, as it is often treated as a passthrough entity for tax purposes. Income generated by the trust is reported on the tax returns of the beneficiaries. It's essential to consult with tax professionals to understand how a Delaware Trust Agreement - Irrevocable affects your personal tax situation.

Delaware is often regarded as the best state for establishing an irrevocable trust due to its favorable laws and established legal framework. This makes it a popular choice for individuals seeking to protect their assets and ensure effective estate planning. Delaware's statutes support various types of trust arrangements, including the Delaware Trust Agreement - Irrevocable.

Yes, you can create your own Delaware statutory trust by drafting a Delaware Trust Agreement - Irrevocable. The process involves filing the trust agreement with the appropriate Delaware authorities, including detailing the trust's purpose and management structure. Using a reliable platform like uslegalforms can simplify the formation process and ensure compliance.

Yes, a Delaware statutory trust (DST) is inherently an irrevocable agreement. Once established, the terms cannot be modified or revoked by the grantor without following specific legal procedures. This characteristic helps ensure the trust's assets are protected and managed according to the set guidelines.

The best assets for an irrevocable trust include life insurance policies, real estate, and irrevocable retirement accounts. A Delaware Trust Agreement - Irrevocable allows you to transfer these assets, providing tax benefits and protecting them from creditors. By strategically placing assets in this trust, you can effectively plan your estate and manage your wealth. It's essential to consult with a professional to determine the best assets for your specific situation.

The primary downside of an irrevocable trust is the loss of control over the assets placed within it. Once you execute a Delaware Trust Agreement - Irrevocable, you cannot change the terms or reclaim assets, which might pose challenges if your financial situation changes. However, the benefits often outweigh these concerns, as such trusts provide significant estate tax advantages and protect assets from creditors.

More info

PREVENTATIVE TRUSTEES Article Deleted All Rights To Use Article Deleted All Rights To Use Article Deleted All Rights To Use Article Deleted All Rights To Use.