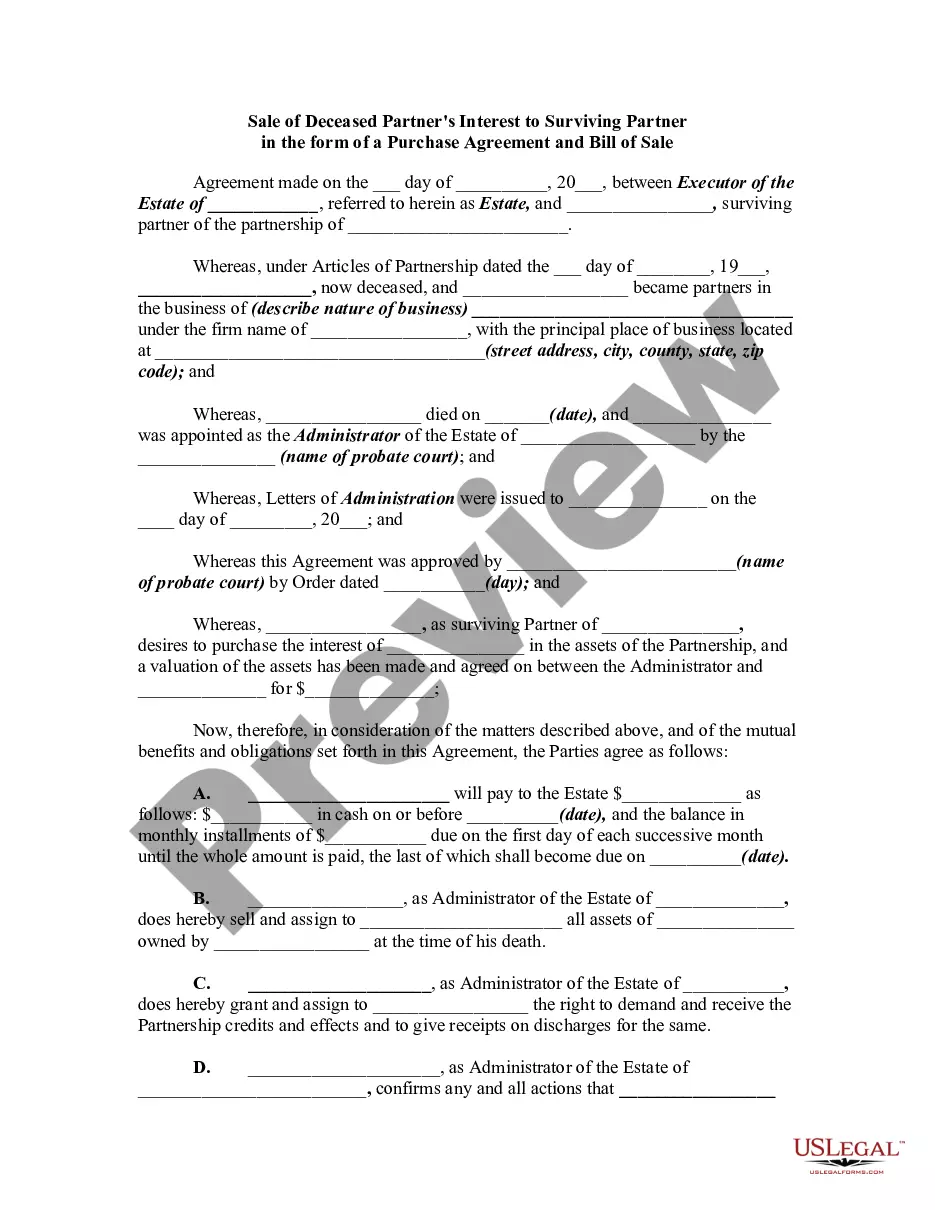

Delaware Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale

Description

How to fill out Sale Of Deceased Partner's Interest To Surviving Partner In The Form Of A Purchase Agreement And Bill Of Sale?

Choosing the right legal file design can be a struggle. Of course, there are a lot of themes available online, but how will you find the legal kind you require? Make use of the US Legal Forms site. The support offers 1000s of themes, including the Delaware Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale, that can be used for company and personal requires. Each of the types are examined by pros and satisfy federal and state specifications.

Should you be presently listed, log in to the accounts and click the Acquire key to obtain the Delaware Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale. Utilize your accounts to check throughout the legal types you possess bought previously. Visit the My Forms tab of your respective accounts and obtain yet another duplicate of the file you require.

Should you be a new end user of US Legal Forms, here are easy instructions that you should stick to:

- Initial, make sure you have selected the proper kind to your metropolis/region. It is possible to examine the form using the Review key and browse the form outline to make sure it will be the right one for you.

- In the event the kind is not going to satisfy your requirements, make use of the Seach area to obtain the correct kind.

- Once you are certain that the form would work, select the Buy now key to obtain the kind.

- Choose the pricing prepare you need and type in the essential info. Design your accounts and purchase the transaction with your PayPal accounts or bank card.

- Choose the data file formatting and acquire the legal file design to the device.

- Complete, change and print out and indicator the received Delaware Sale of Deceased Partner's Interest to Surviving Partner in the form of a Purchase Agreement and Bill of Sale.

US Legal Forms may be the biggest local library of legal types where you can discover a variety of file themes. Make use of the service to acquire skillfully-made documents that stick to condition specifications.

Form popularity

FAQ

The court found that LLC managers are bound by fiduciary duties unless these are restricted or eliminated explicitly in the agreement.

§§ 17-702. Assignment of partnership interest. (4) A partner ceases to be a partner and to have the power to exercise any rights or powers of a partner upon assignment of all of its partnership interests.

In Delaware, unless limited by the partnership agreement, a general partner has the fiduciary duty to manage the partnership in its best interest and in the best interests of the limited partners.

(b) A person who is a general partner, and also at the same time a limited partner, shall have all the rights and powers and be subject to all the restrictions of a general partner; except that, in respect to his contribution, he shall have the rights against the other members which he would have had if he were not ...

Advantages of a Limited Partnership The general partner possesses complete control of the entity and its assets. High investment potential for passive investors. Long-term rents are included in investment potential. Heirs can receive payments without getting the assets.

(2) A substituted limited partner is a person admitted to all the rights of a limited partner who has died or has assigned his interest in the limited partnership.

Non-managing limited partners typically do not owe fiduciary duties to the limited partnership. However, limited partners who participate in directing or operating a limited partnership could end up treated as general partners by a court with the associated fiduciary duties.

1] Directors and officers of a corporation are fiduciaries. Under Delaware law, the general rule is that a director owes fiduciary duties of loyalty and care to the corporation and its stockholders.[ 2]