Title: Delaware Letter to Creditors Notifying Them of Identity Theft for New Accounts Introduction: In Delaware, individuals who have fallen victims to identity theft and unauthorized new accounts can use a letter template to inform their creditors about the situation. This detailed letter serves as a formal notification to inform creditors of the fraudulent activities and protects the innocent party from any liability or legal consequences. Below, you will find a comprehensive guide to drafting a Delaware letter to creditors addressing identity theft for new accounts. Keywords: Delaware, letter to creditors, notifying, identity theft, new accounts. 1. Understanding Identity Theft in Delaware: — Definition of identity theft in Delaware — Penalties for identity theft in Delaware 2. Purpose of the Delaware Letter to Creditors: — Informing creditors about the unauthorized new accounts — Establishing the recipient's awareness of the identity theft — Requesting the immediate closure of the fraudulent accounts — Seeking assistance in investigating the incident 3. Components of a Delaware Letter to Creditors: — Your contact information (name, address, phone number, email) — Date of writing thletterte— - Creditor's name, address, and contact details — Account numbers related to the unauthorized accounts — Detailed explanation of the identity theft incident — Mention of any supporting legal documents (police report, FTC affidavit, etc.) — Stressing your innocence and lack of involvement in the fraudulent activities — Requesting immediate closure of the fraudulent accounts — Seeking assistance and cooperation in resolving the matter — Providing any additional relevant information or details 4. Additional Types of Delaware Letters to Creditors: — Delaware Letter to Creditors Refuting Unauthorized New Accounts: Used to dispute the existence of unauthorized accounts and request immediate investigation and removal. — Delaware Letter to Creditors Notifying Them of Unauthorized Charges: Addresses fraudulent charges made on an existing account and urges creditors to take appropriate actions. Conclusion: Drafting a Delaware letter to creditors regarding identity theft for new accounts is crucial when one becomes a victim of such fraudulent activities. By utilizing the template and including all the necessary details and important keywords, victims can effectively protect themselves against any liability and initiate the process of resolving the identity theft problem promptly. Remember to adapt the letter to your unique circumstances and consult legal professionals for guidance, if needed. Keywords: Delaware, letter to creditors, refuting, unauthorized new accounts, unauthorized charges.

Delaware Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

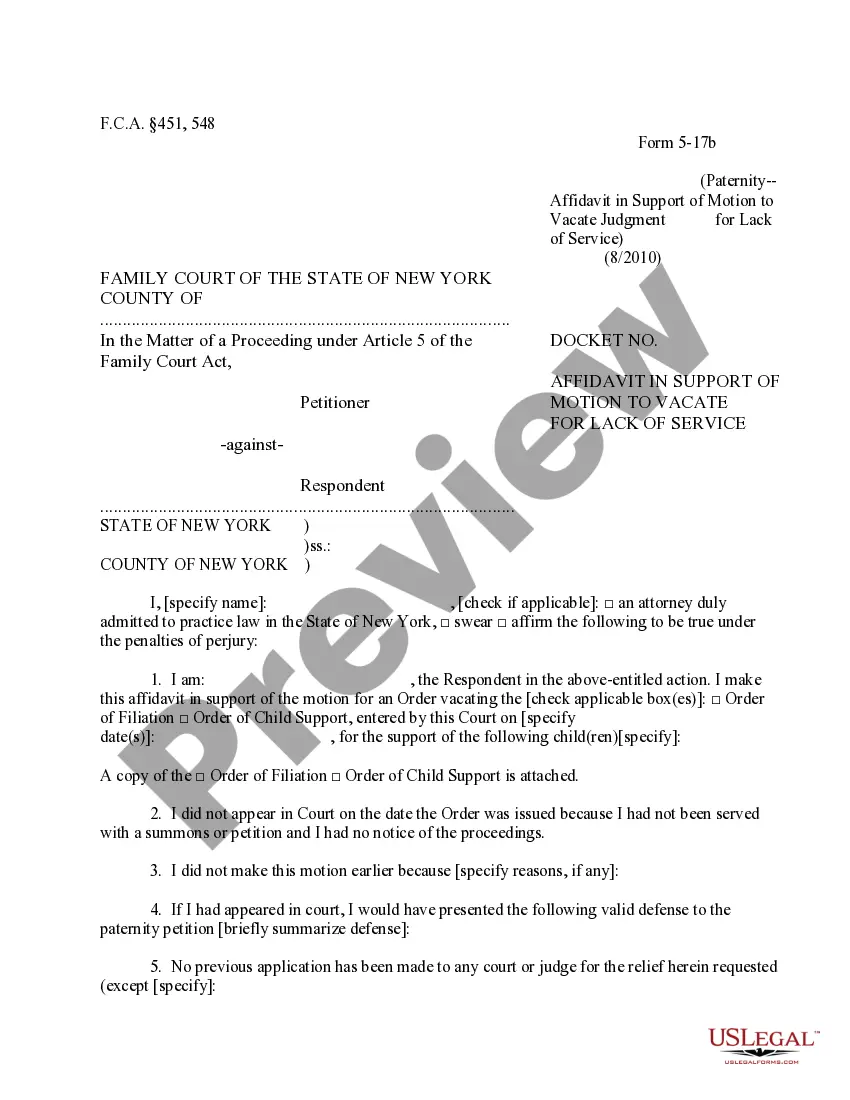

How to fill out Delaware Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

If you need to complete, obtain, or produce legal papers layouts, use US Legal Forms, the biggest collection of legal types, which can be found on the Internet. Make use of the site`s simple and handy lookup to discover the documents you require. Numerous layouts for enterprise and specific purposes are sorted by groups and says, or search phrases. Use US Legal Forms to discover the Delaware Letter to Creditors Notifying Them of Identity Theft for New Accounts with a handful of clicks.

In case you are already a US Legal Forms buyer, log in to the bank account and then click the Obtain option to obtain the Delaware Letter to Creditors Notifying Them of Identity Theft for New Accounts. You can even entry types you previously downloaded in the My Forms tab of the bank account.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Make sure you have chosen the shape to the appropriate metropolis/land.

- Step 2. Take advantage of the Review option to look through the form`s articles. Don`t forget to see the information.

- Step 3. In case you are unsatisfied together with the type, take advantage of the Search industry towards the top of the screen to discover other versions of the legal type web template.

- Step 4. Upon having identified the shape you require, click on the Purchase now option. Choose the prices program you like and add your qualifications to sign up for an bank account.

- Step 5. Method the financial transaction. You can use your credit card or PayPal bank account to accomplish the financial transaction.

- Step 6. Pick the formatting of the legal type and obtain it on the system.

- Step 7. Comprehensive, modify and produce or sign the Delaware Letter to Creditors Notifying Them of Identity Theft for New Accounts.

Every legal papers web template you get is yours permanently. You have acces to every type you downloaded inside your acccount. Go through the My Forms section and choose a type to produce or obtain once again.

Be competitive and obtain, and produce the Delaware Letter to Creditors Notifying Them of Identity Theft for New Accounts with US Legal Forms. There are thousands of expert and state-certain types you can use to your enterprise or specific requirements.

Form popularity

FAQ

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Let's get to work! Contact the companies and banks where the fraud occurred. ... Place fraud alerts with the three credit bureaus. ... Ask for copies of your credit reports. ... Place a security freeze on your credit report. ... Reach out to debt collectors and block the reporting of fraudulent information. ... Report identity theft to the FTC.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Consumers can report identity theft at IdentityTheft.gov, the federal government's one-stop resource to help people report and recover from identity theft. The site provides step-by-step advice and helpful resources like easy-to-print checklists and sample letters.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law). The longer you leave it, the more that financial liability falls on your shoulders.

Your liability for fraudulent purchases made with your credit card is up to $50, if you tell the credit card company about the fraudulent charges within 60 days of when the company sends you the statement showing the fraudulent charges.

Look out for notifications that a tax return has been filed under your name. Additionally, if you receive a W-2, 1099, or any other tax form from a company you've never worked for, it might mean that someone obtained your Social Security number and is using it for employment purposes.

You may be a victim of identity theft if: bills do not arrive. statements show transactions you did not make. creditors ask you about an account or card you have not applied for.

Change the passwords, pin numbers, and log in information for all of your potentially affected accounts, including your email accounts, and any accounts that use the same password, pin, or log in information. Contact your police department, report the crime and obtain a police report.