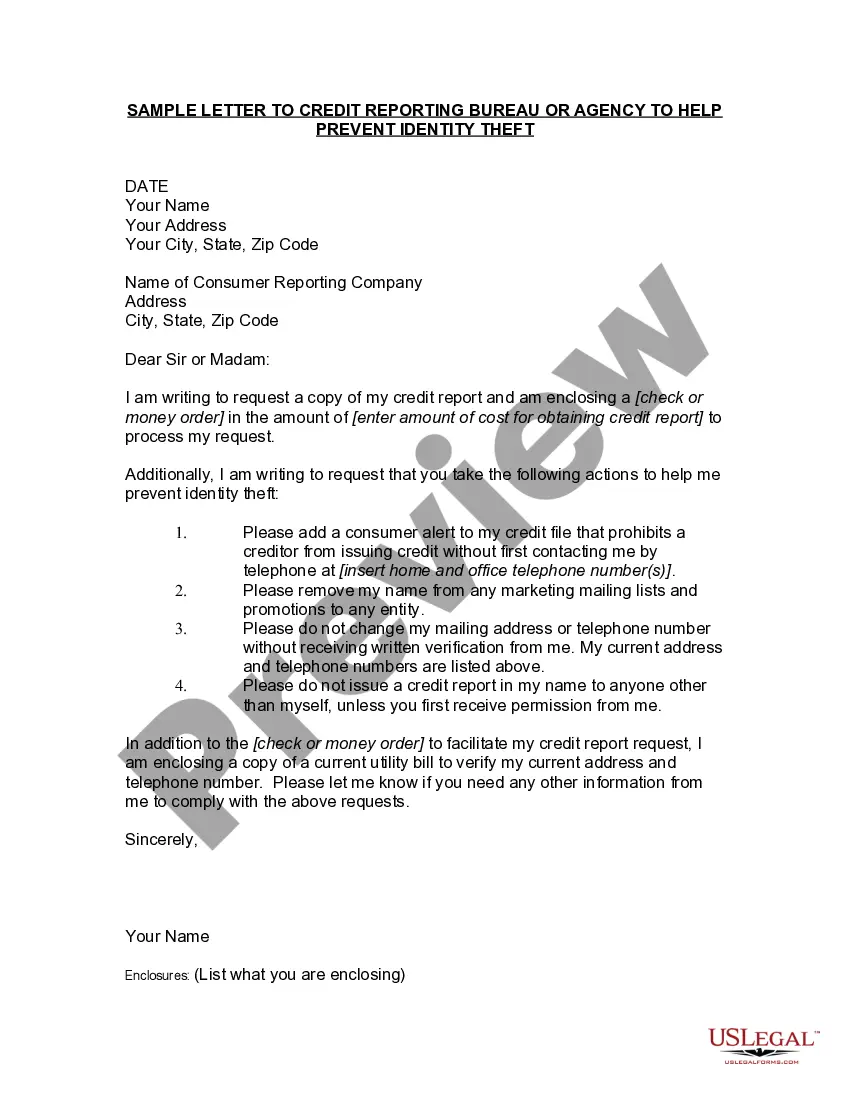

Subject: Delaware Sample Letter to Credit Reporting Bureau — Assisting in Identity Theft Prevention Dear [Credit Reporting Bureau or Agency's Name], I hope this letter finds you in good health. I am writing to seek your invaluable assistance in taking the necessary actions to prevent identity theft by closely monitoring my credit activities and maintaining the security of my personal information. My primary objective is to ensure that my credit information remains secure and is not misused in any fraudulent activity. I have recently become aware of the increasing instances of identity theft and the potential damages it can cause if left unaddressed. Therefore, it is my utmost priority to safeguard my personal information and mitigate any potential risk that may arise from such incidents. To that end, I kindly request your support in implementing the following measures to enhance my credit protection: 1. Initial Fraud Alert: To be proactive against potential identity theft, I kindly request you to place an initial fraud alert on my credit file. This measure will help ensure that any new credit accounts are diligently verified before being opened in my name. Please include a statement in my file instructing creditors to contact me directly for authorization before granting credit. 2. Extended Fraud Alert: In addition to the initial fraud alert, I would also appreciate it if you could consider placing an extended fraud alert on my credit file. This type of alert will provide an extended protection period of seven years, making it more difficult for identity thieves to misuse my information. 3. Secure PIN and Password: To guarantee the utmost security of my credit information, I kindly request you to assist me in generating a secure Personal Identification Number (PIN) or password. This PIN will serve as an additional layer of authentication for any credit-related actions initiated under my name, providing an added level of security against unauthorized access. 4. Periodic Credit Monitoring: As an extra precautionary measure, I would appreciate if you could keep a close eye on any suspicious or unauthorized activity on my credit file. Regularly monitoring my credit activities will help identify and mitigate any potential fraudulent actions promptly. 5. Free Annual Credit Reports: In accordance with the Fair Credit Reporting Act (FCRA), kindly ensure that I receive my free annual credit reports from each of the credit bureaus (TransUnion, Equifax, and Experian) to review for any discrepancies or signs of unauthorized activity. Prompt reporting and resolution are pivotal to preventing any further damage. I trust that you will handle this matter with the utmost care and urgency, reflecting your commitment to consumer protection and identity theft prevention. Your assistance in implementing the aforementioned measures will undoubtedly contribute to maintaining the integrity of my credit profile. Please feel free to reach out to me through the contact information provided below for any additional details or clarifications. I sincerely appreciate your dedication to securing my personal information and look forward to your prompt response. Thank you for your attention to this matter. Sincerely, [Your Full Name] [Your Address] [City, State, ZIP Code] [Phone Number] [Email Address] Note: This letter serves as a sample and should be customized according to your personal circumstances and the requirements of the specific credit reporting bureau or agency. Ensure to adapt the letter's content to best suit your needs, while considering any additional state-specific regulations or guidelines outlined by Delaware law.

Delaware Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft

Description

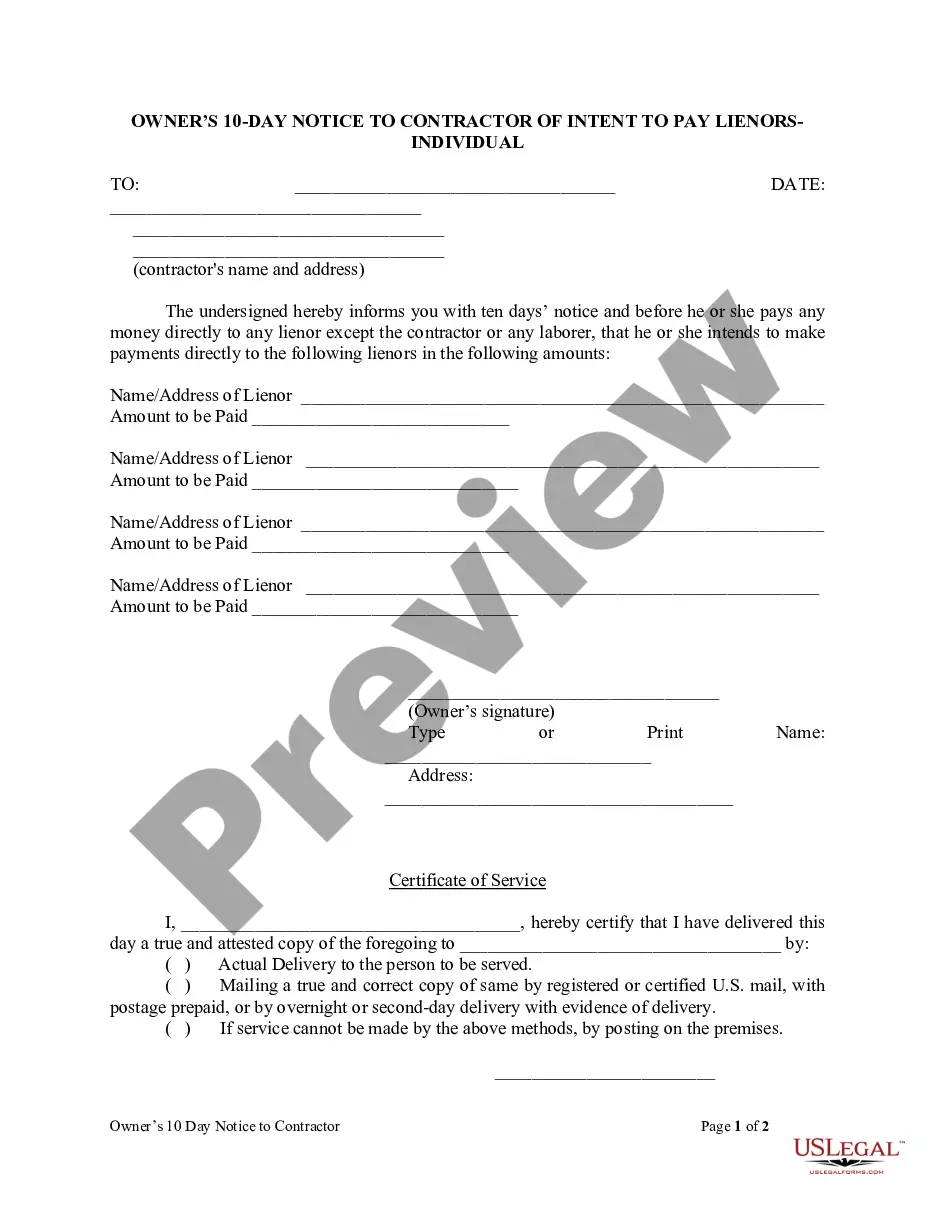

How to fill out Delaware Sample Letter To Credit Reporting Bureau Or Agency To Help Prevent Identity Theft?

If you have to comprehensive, down load, or printing lawful file templates, use US Legal Forms, the biggest variety of lawful kinds, which can be found online. Take advantage of the site`s easy and convenient search to find the documents you need. A variety of templates for enterprise and specific purposes are sorted by categories and says, or search phrases. Use US Legal Forms to find the Delaware Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft in just a few clicks.

Should you be previously a US Legal Forms buyer, log in for your account and click on the Download key to have the Delaware Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft. You may also gain access to kinds you in the past downloaded in the My Forms tab of your account.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Ensure you have chosen the form for the right area/nation.

- Step 2. Make use of the Review option to look over the form`s content. Never forget to learn the explanation.

- Step 3. Should you be not satisfied using the form, make use of the Research area on top of the display to discover other variations of the lawful form template.

- Step 4. Upon having located the form you need, click on the Get now key. Pick the rates program you like and add your accreditations to register on an account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal account to finish the financial transaction.

- Step 6. Pick the formatting of the lawful form and down load it on the product.

- Step 7. Comprehensive, change and printing or sign the Delaware Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft.

Every lawful file template you get is yours permanently. You have acces to every form you downloaded within your acccount. Click on the My Forms portion and select a form to printing or down load once more.

Contend and down load, and printing the Delaware Sample Letter to Credit Reporting Bureau or Agency to Help Prevent Identity Theft with US Legal Forms. There are millions of professional and state-certain kinds you may use for your personal enterprise or specific needs.

Form popularity

FAQ

Report incidents of identity theft to the Federal Trade Commission at or the FTC Identity Theft Hotline at 1-877-438-4338 or TTY 1-866-653-4261. File a report with the local police.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

The core initiatives of the program seek to assist victims, educate consumers, law enforcement and the business community, and maintain and disseminate information from the Identity Theft Data Clearinghouse (?Clearinghouse?).

Each of the three major credit reporting agencies (Equifax, Experian and TransUnion) offers consumers the ability to place a ?security freeze,? or deny access to, their credit reports. A security freeze means that your credit file cannot be shared with potential creditors.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation.