If you have to comprehensive, download, or printing authorized papers themes, use US Legal Forms, the biggest selection of authorized types, that can be found on the web. Make use of the site`s simple and convenient search to discover the documents you want. Different themes for business and individual reasons are categorized by categories and states, or key phrases. Use US Legal Forms to discover the Delaware Plan of Liquidation and Dissolution of a Corporation within a handful of mouse clicks.

In case you are presently a US Legal Forms customer, log in to your account and then click the Down load button to have the Delaware Plan of Liquidation and Dissolution of a Corporation. Also you can gain access to types you formerly acquired from the My Forms tab of your account.

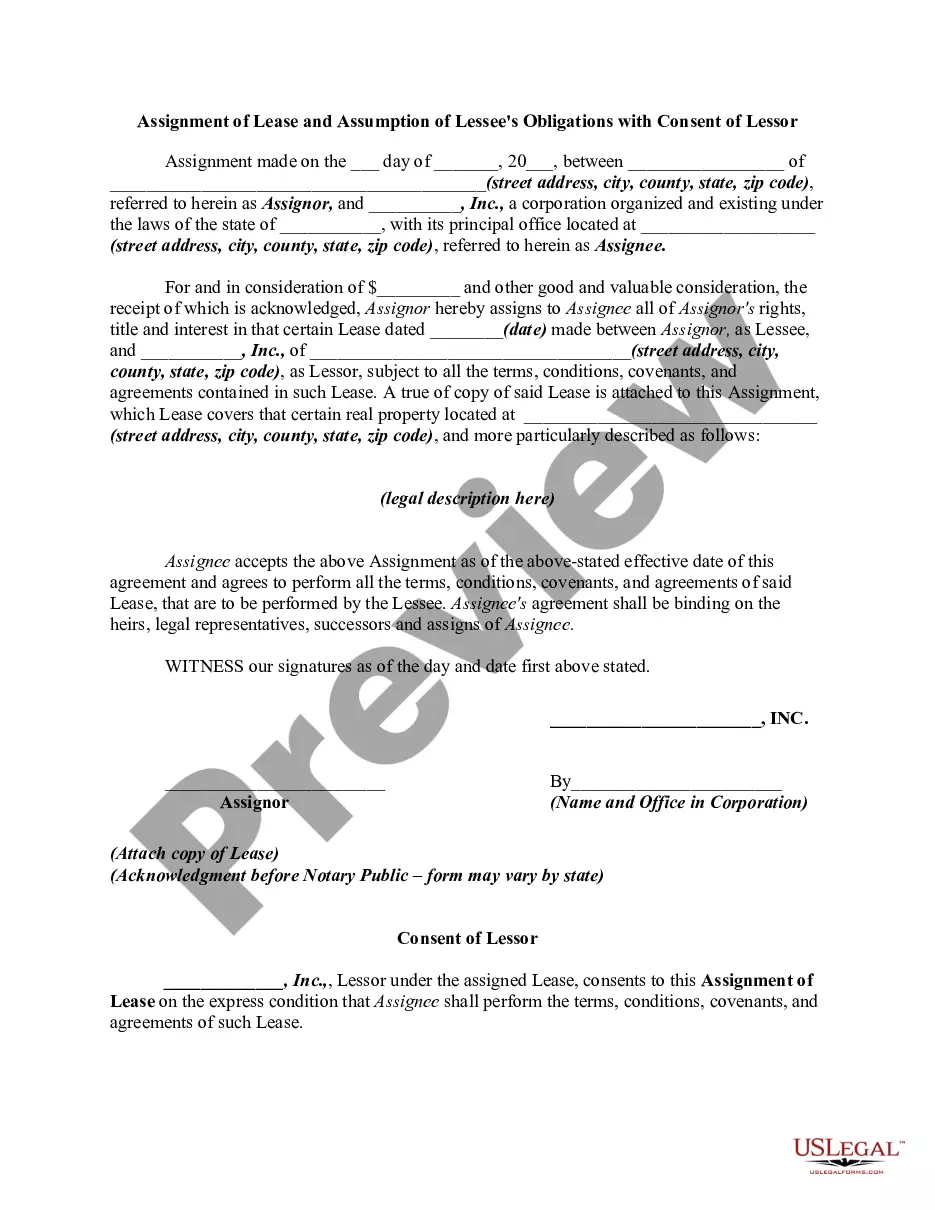

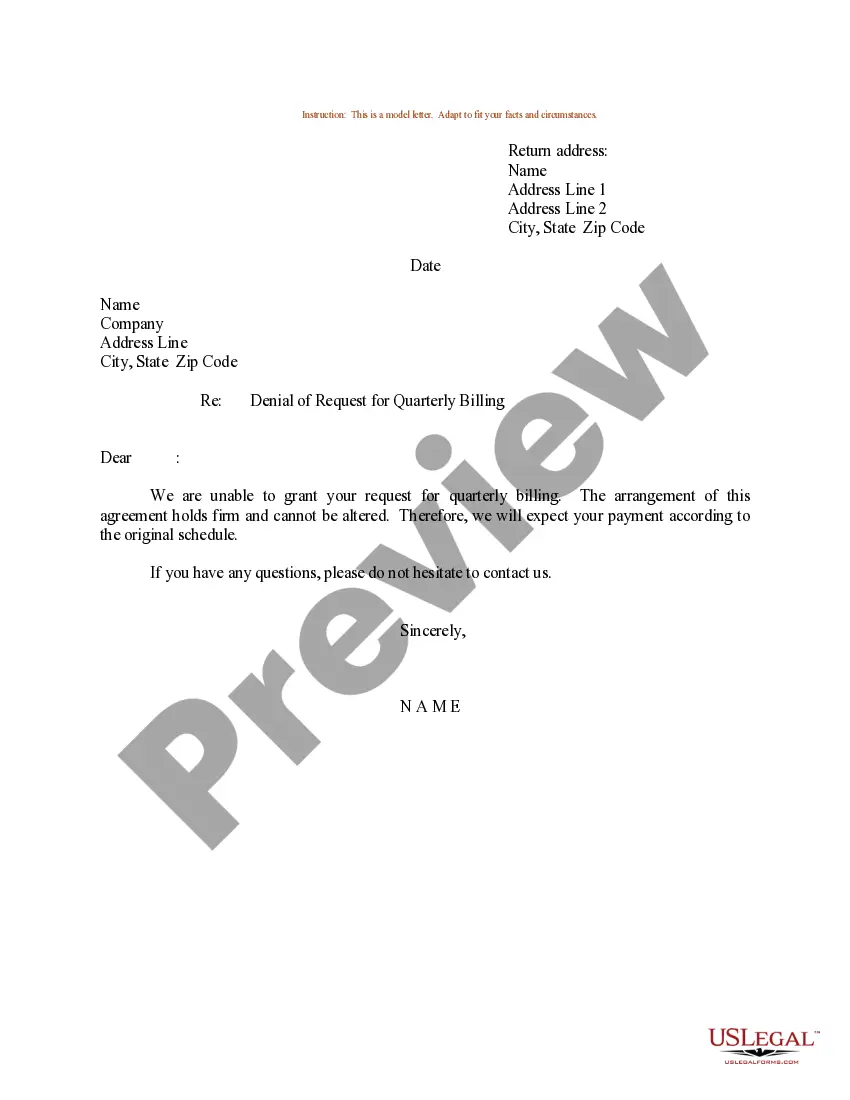

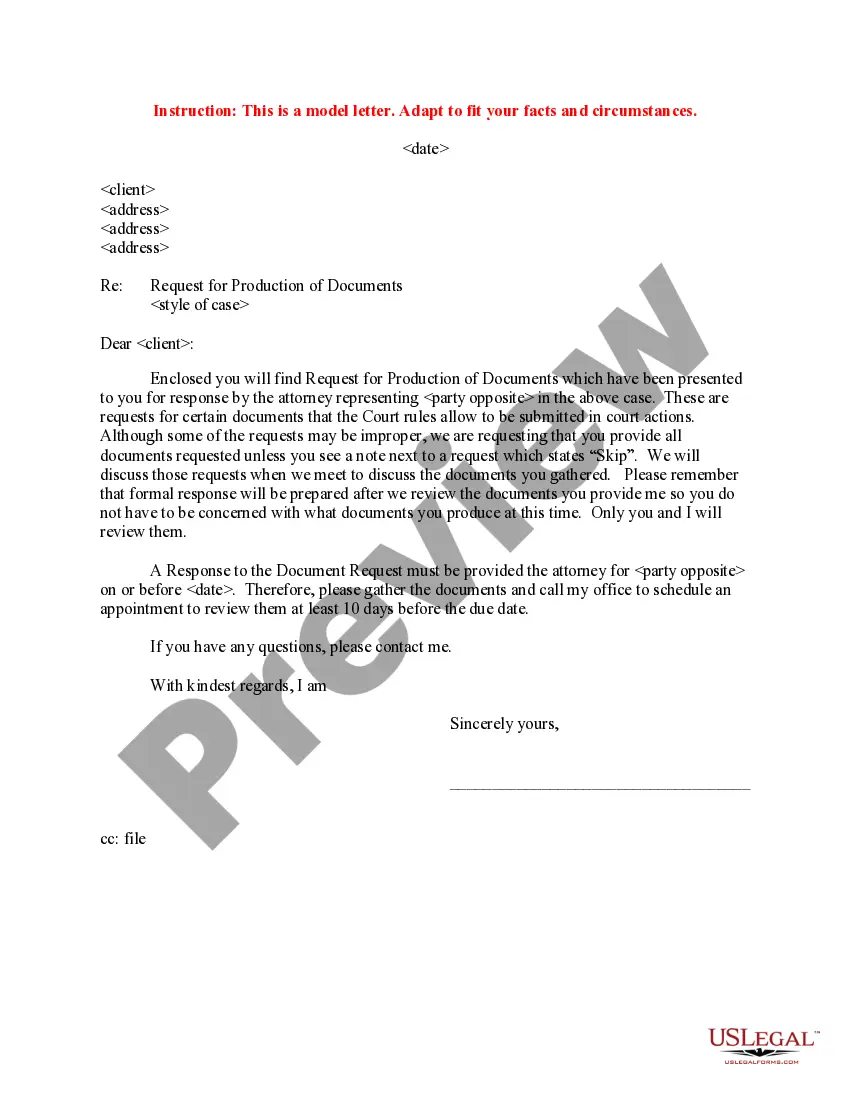

Should you use US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for that proper area/nation.

- Step 2. Use the Review solution to look through the form`s articles. Never forget to learn the description.

- Step 3. In case you are not satisfied with all the type, utilize the Search field near the top of the display screen to find other types of the authorized type format.

- Step 4. Once you have found the form you want, go through the Acquire now button. Pick the pricing program you choose and include your qualifications to sign up for an account.

- Step 5. Method the deal. You may use your bank card or PayPal account to perform the deal.

- Step 6. Find the format of the authorized type and download it on your own device.

- Step 7. Comprehensive, edit and printing or sign the Delaware Plan of Liquidation and Dissolution of a Corporation.

Every single authorized papers format you purchase is the one you have permanently. You possess acces to each type you acquired inside your acccount. Click the My Forms portion and decide on a type to printing or download again.

Remain competitive and download, and printing the Delaware Plan of Liquidation and Dissolution of a Corporation with US Legal Forms. There are thousands of expert and state-certain types you can use for your business or individual requires.