Delaware Lease of Business Premises — Real Estate Rental is a legally binding agreement between a landlord and a tenant for leasing commercial property in the state of Delaware. This comprehensive contract outlines the terms, conditions, and responsibilities of both parties involved in the rental transaction. Keywords: Delaware Lease of Business Premises, Real Estate Rental, landlord, tenant, commercial property, terms, conditions, responsibilities, rental transaction. There are several types of Delaware Lease of Business Premises — Real Estate Rentals, including: 1. Gross Lease: In a gross lease, the tenant pays a fixed rental amount, and the landlord is responsible for all operating expenses related to the property, such as property taxes, insurance, and maintenance fees. 2. Net Lease: In a net lease, the tenant pays a base rent and additional expenses, such as property taxes, insurance, utilities, and maintenance costs. Net leases can be single-net, double-net, or triple-net, depending on the level of expenses passed onto the tenant. 3. Modified Gross Lease: A modified gross lease is a combination of both gross and net leases. The tenant pays a fixed rental amount, but usually, the tenant is responsible for some expenses, such as utilities or janitorial services. 4. Percentage Lease: A percentage lease is commonly used in retail spaces. The tenant pays a base rent plus a percentage of their sales revenue. This type of lease allows the landlord to benefit from the tenant's success. 5. Ground Lease: A ground lease is a type of long-term lease where the tenant leases the land and usually constructs their own building on the property. The tenant is responsible for the construction, maintenance, and operating costs while paying rent for the land. 6. Sublease: A sublease occurs when a tenant leases a part or all of their leased space to another party. The original tenant remains responsible for the lease terms with the landlord, while the subtenant pays rent to the original tenant. These different types of Delaware Lease of Business Premises — Real Estate Rentals offer flexibility in terms of cost sharing, property maintenance, and revenue generation, allowing tenants and landlords to choose the most suitable rental arrangement for their business needs.

Delaware Lease of Business Premises - Real Estate Rental

Description

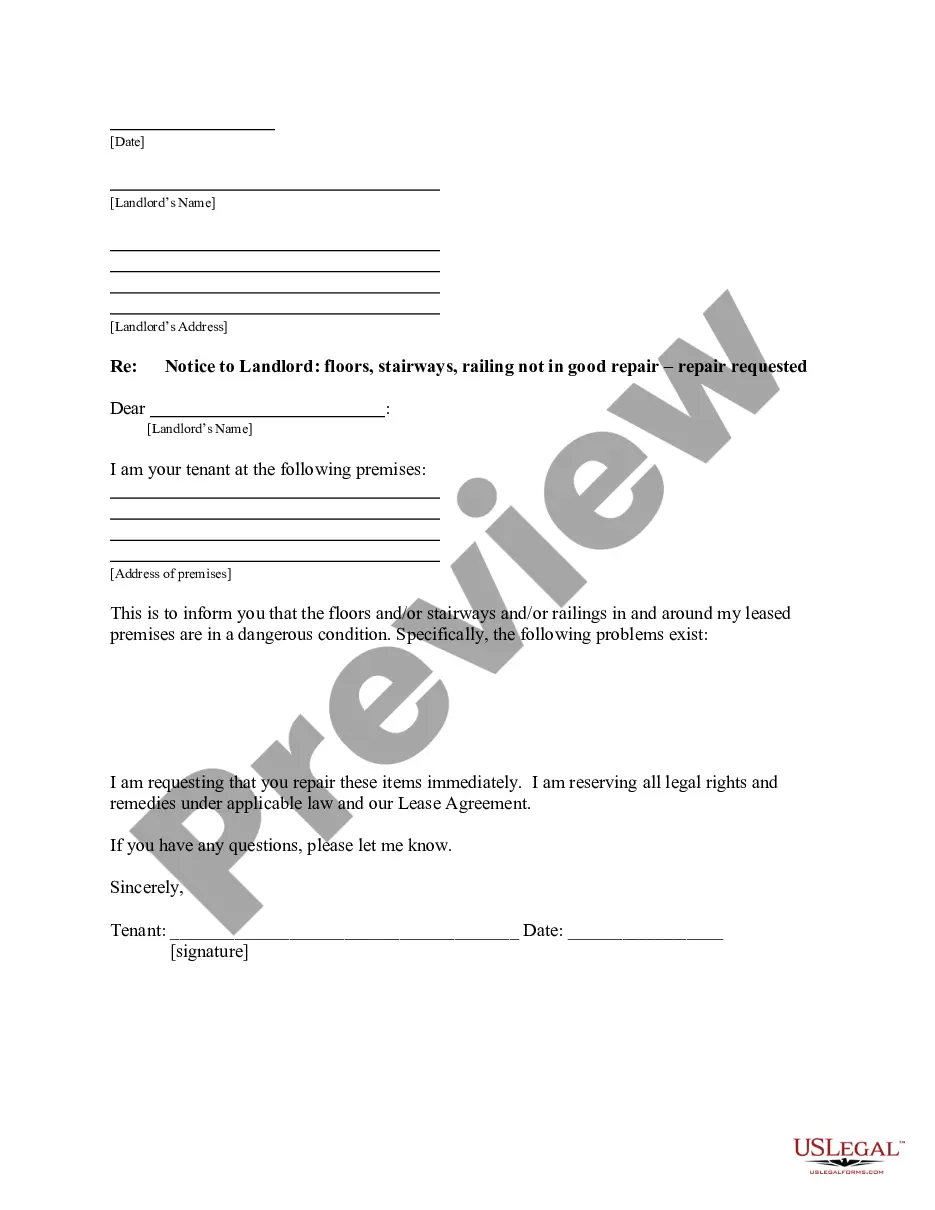

How to fill out Lease Of Business Premises - Real Estate Rental?

Selecting the appropriate legal document format can be quite a challenge.

Certainly, there are numerous templates available online, but how do you find the specific document you require.

Utilize the US Legal Forms platform. The service offers thousands of templates, including the Delaware Lease of Business Premises - Real Estate Rental, which you can employ for both business and personal needs.

If the document does not meet your requirements, utilize the Search field to find the correct document. When you are confident that the form is appropriate, click on the Get now button to obtain the document. Choose the pricing plan you desire and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document to your device. Complete, modify, then print and sign the obtained Delaware Lease of Business Premises - Real Estate Rental. US Legal Forms is the largest repository of legal documents where you can find numerous document templates. Utilize the service to download professionally-crafted documents that adhere to state requirements.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are already a member, sign in to your account and click on the Acquire button to obtain the Delaware Lease of Business Premises - Real Estate Rental.

- Use your account to look through the legal forms you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have selected the correct document for your city/region. You can browse the form using the Preview button and read the form description to verify it is suitable for you.

Form popularity

FAQ

Delaware is generally considered a landlord-friendly state due to its straightforward eviction processes, but it also offers rights to tenants regarding property condition and rentals. Balancing these perspectives is essential when engaging in a Delaware Lease of Business Premises - Real Estate Rental. Potential tenants should familiarize themselves with their rights to ensure a fair agreement.

Yes, you can assign a commercial lease, provided that the landlord approves and the lease does not have prohibitions against assignments. This gives tenants flexibility in managing their business spaces. If you're navigating a Delaware Lease of Business Premises - Real Estate Rental, consider checking the lease terms and potential implications.

The most typical lease used in a residential rental is often a standard residential lease agreement, which outlines terms, duration, rental payment methods, and maintenance responsibilities. For those exploring the Delaware Lease of Business Premises - Real Estate Rental environment, understanding these terms can provide useful insight into different leasing strategies.

The assignment and assumption of a commercial lease involves transferring the lease interest from the original tenant to the new tenant, along with an understanding of the obligations outlined in the lease. This is vital for a smooth transition in any Delaware Lease of Business Premises - Real Estate Rental, as it protects both parties' interests.

To assign a commercial lease, the tenant must obtain permission from the landlord and draft an assignment agreement that includes all relevant terms. This ensures that the new tenant understands their responsibilities. Using a secure platform like uslegalforms can simplify this process when managing a Delaware Lease of Business Premises - Real Estate Rental.

A commercial assignment refers to the legal transfer of a tenant's rights and obligations under a commercial lease to another party. This remains a critical process in the context of a Delaware Lease of Business Premises - Real Estate Rental, especially for businesses looking to transition ownership or location without breaking their lease.

A lease is a contract between the landlord and the tenant, granting the tenant the right to occupy and use the property. An assignment, on the other hand, transfers the tenant's interest in the lease to another party, while the original tenant may still bear responsibility. Knowing these differences can help when negotiating a Delaware Lease of Business Premises - Real Estate Rental.

Section 5514 of the Delaware landlord/tenant code outlines the obligations of landlords and tenants regarding the maintenance and condition of leased property. This section emphasizes the right to a habitable space for tenants. Understanding this is crucial when dealing with a Delaware Lease of Business Premises - Real Estate Rental.