Delaware Lease to Own for Commercial Property

Description

How to fill out Lease To Own For Commercial Property?

You can invest hours online searching for the legal document template that meets the federal and state requirements you will require.

US Legal Forms offers a vast array of legal documents that can be reviewed by professionals.

It is easy to obtain or print the Delaware Lease to Own for Commercial Property from our service.

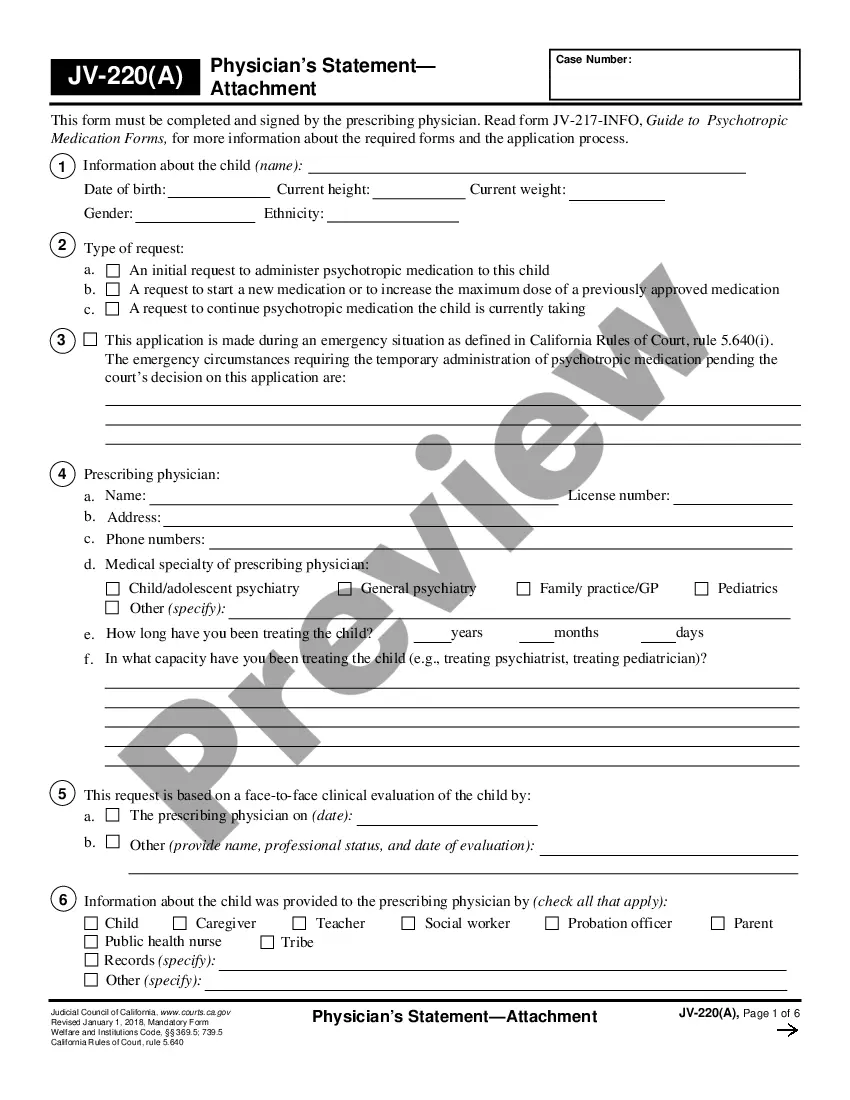

If available, utilize the Preview button to look through the document format as well.

- If you already have a US Legal Forms account, you can sign in and then click the Download button.

- Afterward, you can complete, edit, print, or sign the Delaware Lease to Own for Commercial Property.

- Every legal document template you obtain is yours permanently.

- To retrieve another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document format for the region/area of your choice.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

Key Takeaways. A lease is a legal, binding contract outlining the terms under which one party agrees to rent property owned by another party. It guarantees the tenant or lessee use of the property and guarantees the property owner or landlord regular payments for a specified period in exchange.

In order for a lease agreement to be valid, both parties must sign the contract. Depending on your state's laws, if a property manager is representing an owner, the owner may or may not be listed on the lease agreement.

Delaware does not currently enforce or prohibit rent control policies. As it stands, landlords are free to charge what they want in rental prices. Rental increases. Landlords must provide 60 days' notice before raising rental prices, and the tenant has 15 days to accept or refuse.

A lease is an implied or written agreement specifying the conditions under which a lessor accepts to let out a property to be used by a lessee. The agreement promises the lessee use of the property for an agreed length of time while the owner is assured consistent payment over the agreed period.

Tenant Rights to Withhold Rent in DelawareTenants may withhold rent or exercise the right to "repair and deduct" if a landlord fails to take care of important repairs, such as a broken heater. For specifics, see Delaware Tenant Rights to Withhold Rent or "Repair and Deduct".

Document everything in writing. Keep a written record of everything that is agreed on, and be careful to use the right terms in the agreement.Consult an attorney.Use separate agreements.Keep the term short.Take a security deposit.Pay like an owner.Factor in repair costs.Don't give large rent credits.More items...?

How to create a lease agreementCollect each party's information.Include specifics about your property.Consider all of the property's utilities and services.Know the terms of your lease.Set the monthly rent amount and due date.Calculate any additional fees.Determine a payment method.Consider your rights and obligations.More items...

No, lease agreements do not need to be notarized in Delaware. Some states require residential leases to be notarized based on the duration of the lease, but Delaware is not one of them. If the lease meets the requirements to be binding, it does not need to be notarized.

If there is a rental agreement, the tenant can terminate the lease before it expires in specific situations under the law. There is a requirement that there be 30 days' written notice that starts on the first day of the month the day after the notice was given.

Landlords Cannot Discriminate When Selecting A Tenant It is illegal for a landlord to turn down a potential tenant based on any personal attributes of an applicant. This includes age, gender and race. These personal attributes also cannot be used as a way of charging different rental rates either.