A Delaware Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a legal document that outlines the sale of a retail store owned by a sole proprietor in the state of Delaware. This agreement includes the terms and conditions of the sale, including the price of the store and the additional cost of the goods and fixtures. The agreement can be customized to include different variations based on the unique circumstances of the transaction. Some types of Delaware Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage are: 1. Standard Agreement: This is the most common type of agreement that covers the sale of a retail store with goods and fixtures at their invoice cost plus a certain percentage. It includes details such as the purchase price, payment terms, inventory assessment, and transfer of ownership. 2. Wholesale Agreement: This type of agreement is applicable when the sole proprietorship operates as a wholesale business. It includes specific provisions related to bulk sales, trade discounts, and transfer of supplier contracts. 3. Franchise Agreement: If the retail store being sold is a franchise, a separate agreement might be required to address the franchisor-franchisee relationship and any additional obligations or restrictions imposed by the franchisor. 4. Asset Purchase Agreement: In some cases, a buyer may prefer to purchase only specific assets of a retail store rather than the entire business. This type of agreement identifies the assets being sold, including goods and fixtures, and specifies their invoice cost plus a percentage. 5. Seller Financing Agreement: When the buyer is unable to secure traditional financing, a seller financing agreement can be used. This type of agreement outlines the terms of a loan extended by the seller to the buyer, often including interest rates, repayment schedules, and collateral. 6. Leaseback Agreement: In situations where the seller wants to retain ownership of the property but sell the retail store business and assets, a leaseback agreement can be employed. This allows the seller to lease the premises to the buyer while continuing to operate the business. In summary, a Delaware Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage is a comprehensive legal document that facilitates the sale of a retail store, including its goods and fixtures, in Delaware. The specific type of agreement can vary based on the nature of the business and the preferences of the parties involved.

Delaware Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage

Description

How to fill out Delaware Agreement For Sale Of Retail Store By Sole Proprietorship With Goods And Fixtures At Invoice Cost Plus Percentage?

If you have to full, down load, or print legitimate record themes, use US Legal Forms, the biggest variety of legitimate types, that can be found on the web. Take advantage of the site`s easy and practical research to get the paperwork you will need. Numerous themes for company and specific uses are sorted by groups and states, or keywords. Use US Legal Forms to get the Delaware Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage with a number of clicks.

Should you be previously a US Legal Forms client, log in for your profile and click the Download switch to find the Delaware Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage. Also you can gain access to types you in the past downloaded inside the My Forms tab of your own profile.

If you use US Legal Forms the very first time, follow the instructions under:

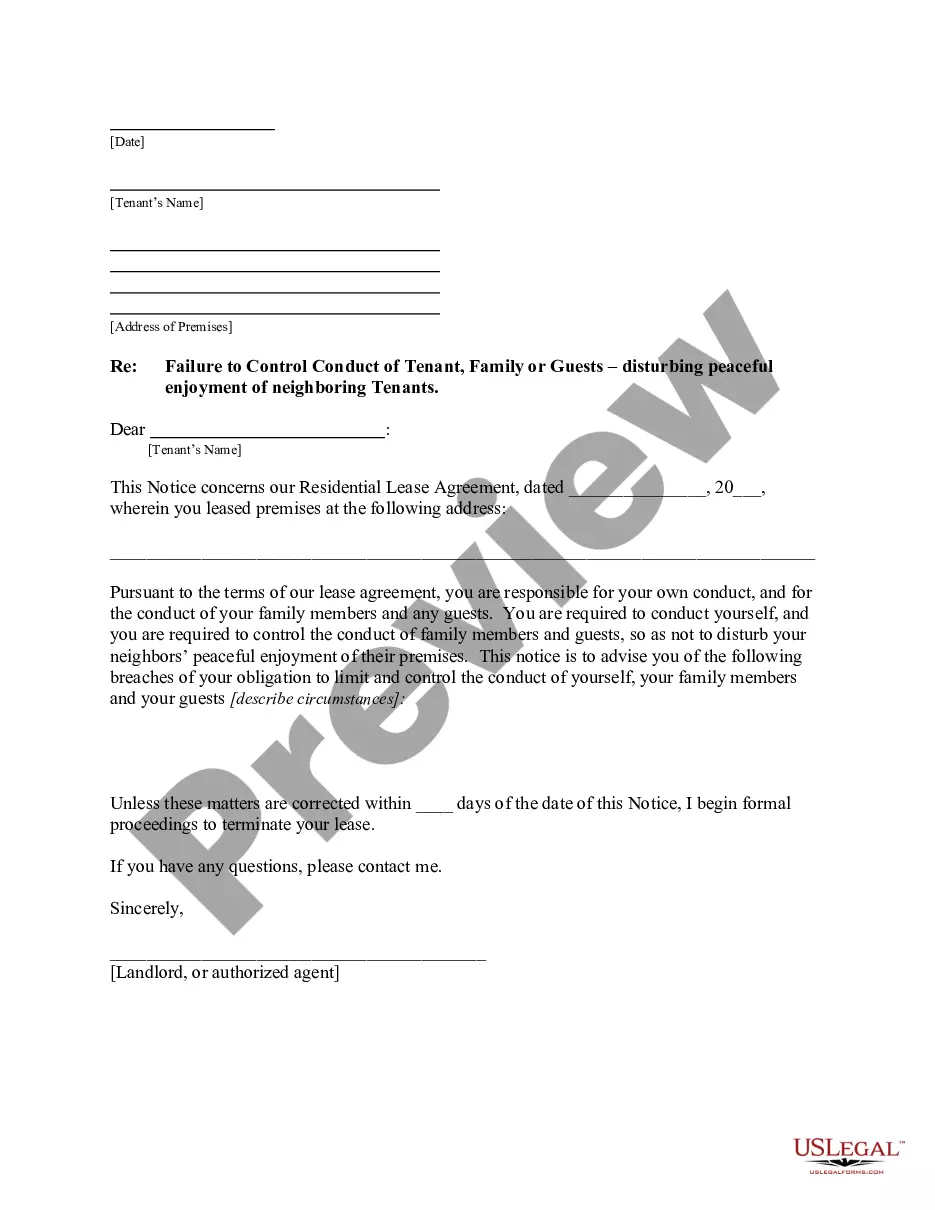

- Step 1. Be sure you have selected the shape for your proper metropolis/country.

- Step 2. Make use of the Preview method to check out the form`s articles. Never forget to learn the explanation.

- Step 3. Should you be not satisfied with all the type, take advantage of the Research field near the top of the screen to get other models from the legitimate type web template.

- Step 4. When you have discovered the shape you will need, click the Purchase now switch. Opt for the rates prepare you like and add your references to sign up for the profile.

- Step 5. Process the transaction. You should use your charge card or PayPal profile to complete the transaction.

- Step 6. Find the structure from the legitimate type and down load it in your device.

- Step 7. Comprehensive, change and print or indicator the Delaware Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage.

Every single legitimate record web template you purchase is yours for a long time. You possess acces to each type you downloaded in your acccount. Click on the My Forms segment and pick a type to print or down load again.

Remain competitive and down load, and print the Delaware Agreement for Sale of Retail Store by Sole Proprietorship with Goods and Fixtures at Invoice Cost Plus Percentage with US Legal Forms. There are millions of professional and status-certain types you can use to your company or specific requirements.