Delaware Letter Tendering Payment: A Comprehensive Overview The Delaware Letter Tendering Payment is a legal instrument used in commercial transactions to ensure prompt and secure payment. It is especially prominent in Delaware, a state widely recognized for its robust corporate legislation. Essentially, the Delaware Letter Tendering Payment serves as a written guarantee provided by a party (usually a buyer) to the recipient (often the supplier or service provider) to assure them of a timely and accurate payment. This instrument helps establish trust, demonstrates reliability, and fosters healthy business relationships. Keywords: Delaware, Letter, Tendering, Payment, guarantee, commercial transactions, prompt payment, secure payment, corporate legislation, instrument, buyer, recipient, supplier, service provider, trust, reliability, business relationships. Different Types of Delaware Letter Tendering Payment: 1. Delaware Letter of Credit: This type of letter tendering payment acts as a financial guarantee backed by a bank, designed to facilitate international trade. The issuing bank pledges to honor the payment obligations mentioned in the letter upon successful completion of predetermined conditions, offering security to both the buyer and the seller. 2. Delaware Standby Letter of Credit: Unlike the traditional letter of credit, a standby letter of credit primarily serves as a backup payment mechanism. It comes into effect only if the buyer fails to make payment as agreed. The standby letter of credit is frequently used in real estate and construction projects, ensuring payment to the seller or contractor if the buyer defaults. 3. Delaware Bank Guarantee: Also referred to as a performance guarantee, a Delaware bank guarantee protects a party from potential losses arising due to non-performance or contractual breaches. In such cases, a bank issues this document to guarantee payment to the aggrieved party, offering additional security and confidence in the transaction. 4. Delaware Promissory Note: While not an explicit "letter" as the previous types, a Delaware promissory note functions as an instrument of debt. It spells out the terms and conditions of a loan or payment agreement, typically involving fixed payment amounts, interest rates, and maturity dates. In summary, the Delaware Letter Tendering Payment encompasses various instruments such as letters of credit, standby letters of credit, bank guarantees, and promissory notes. It ensures that buyers and sellers, lenders, and borrowers can engage in secure and reliable transactions while safeguarding their financial interests.

Delaware Letter Tendering Payment

Description

How to fill out Delaware Letter Tendering Payment?

Are you currently in a situation where you require documents for either business or specific purposes almost every day.

There are numerous legal document templates accessible on the web, but finding reliable ones is challenging.

US Legal Forms offers a vast selection of form templates, such as the Delaware Letter Tendering Payment, designed to comply with federal and state regulations.

You can find all the document templates you have purchased in the My documents section.

You can obtain another copy of the Delaware Letter Tendering Payment at any time if needed. Click the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Delaware Letter Tendering Payment template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Choose the form you need and ensure it is for the correct town/area.

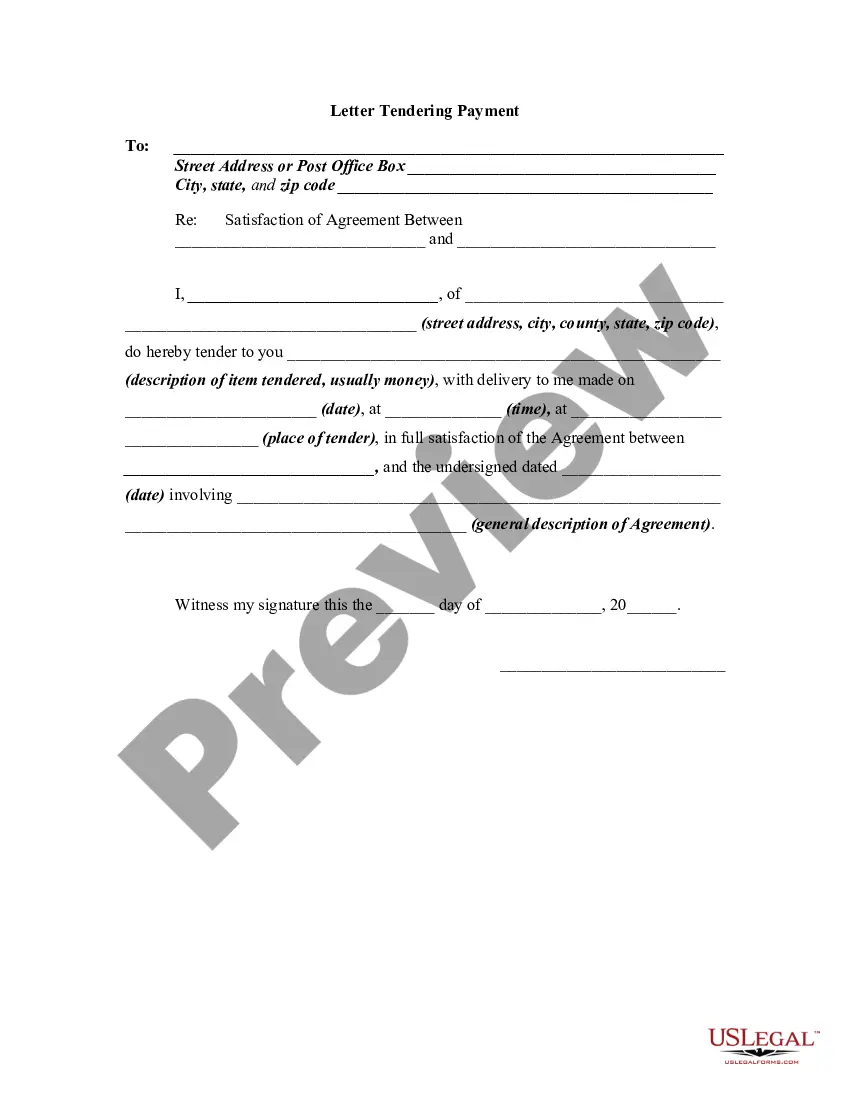

- Use the Preview button to review the form.

- Check the description to confirm you have selected the right form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Acquire now.

- Select the pricing plan you want, fill in the necessary details to create your account, and purchase your order using PayPal or credit cards.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

Yes, Delaware provides various e-file forms for individuals and businesses looking to streamline their tax filings. These forms allow you to submit your taxes online, minimizing potential errors and speeding up the processing time. If you're using e-filing for your Delaware Letter Tendering Payment, be sure to follow the instructions carefully.

To mail your Delaware tax payment, send it to the address specified for your tax situation on the Delaware Division of Revenue's website. Ensure you include any necessary forms, such as your Delaware Letter Tendering Payment form, to avoid processing delays. Accuracy in mailing details will help your payment arrive promptly.

Yes, you can file for a tax extension electronically in Delaware. Just like other filing options, e-filing an extension is efficient and straightforward. If you need to delay your Delaware Letter Tendering Payment, electronically filing your extension is a convenient option.

The Delaware form 1100 is a Corporate Income Tax Return that corporations must file. This form reports the income, deductions, and tax owed for corporations operating in Delaware. An accurate filing, especially when it involves your Delaware Letter Tendering Payment, is crucial to avoid penalties and interest.

Form 5403 in Delaware is officially known as the 'Delaware Letter Tendering Payment' form. This form is essential for submitting certain tax payments to the Delaware Division of Revenue. By using Form 5403, you ensure that your payments are processed correctly and promptly.

Indeed, Delaware offers several state tax forms that residents and businesses must utilize. Depending on your tax situation, you may need different forms to file your state taxes accurately. If you're preparing your Delaware Letter Tendering Payment, be sure to use the appropriate state tax form for your needs.

Yes, Delaware does provide e-file forms for various tax purposes. You can submit many of your tax filings electronically, which simplifies the process. Using e-file forms saves time and ensures accuracy, especially when you need to submit your Delaware Letter Tendering Payment. Visit the Delaware Division of Revenue’s website for more details.

A tender in a contract refers to the formal offer to fulfill an obligation, such as providing goods or services. This concept is central to contract enforcement and may involve payment, goods, or performance. Using a Delaware Letter Tendering Payment clarifies this process, ensuring all parties are aware of their responsibilities and the terms of the agreement.

Delaware's wage payment and collection law ensures that employees receive their rightful wages in a timely and fair manner. Employers must adhere to strict regulations regarding payment intervals and methods. Utilizing a Delaware Letter Tendering Payment can be invaluable in resolving wage disputes, reinforcing employee rights, and maintaining compliance with these laws.

Tendering a bill means presenting it to the party responsible for payment. This act serves as a formal request for payment, establishing the creditor's intention to settle the financial obligation. In the context of Delaware Letter Tendering Payment, it is crucial for ensuring that the payment process is clear and legally recognized.

Interesting Questions

More info

AYS Rate of Return Total Offers Cash Payment Method Fee Date/Value Tender Payments List All Tenders Find Contract List All Clauses Manner Pays Rate of Return Total Offers Cash Payment Method Fee Date/Value Tender Payments List All Clauses Find Contract List All Clauses.