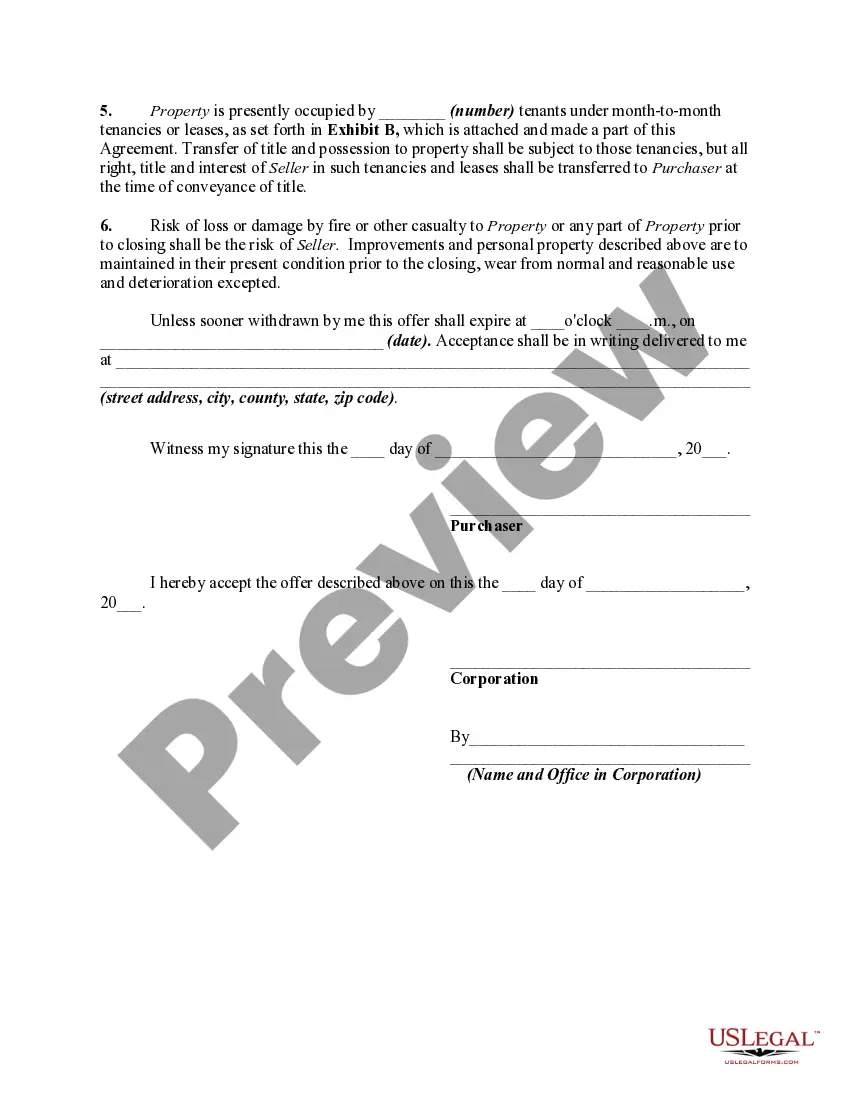

A contract is based upon an agreement. An agreement arises when one person, the offeror, makes an offer and the person to whom is made, the offeree, accepts. There must be both an offer and an acceptance. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Offer to Purchase Commercial Property

Description

How to fill out Offer To Purchase Commercial Property?

You can spend hours online attempting to locate the sanctioned document format that meets the state and federal requirements you seek.

US Legal Forms offers thousands of legal templates that are examined by experts.

You can acquire or print the Delaware Offer to Purchase Commercial Property from their service.

To find another version of the template, utilize the Search field to locate the format that fulfills your needs and requirements.

- If you own a US Legal Forms account, you can Log In and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Delaware Offer to Purchase Commercial Property.

- Every legal document format you buy is yours indefinitely.

- To obtain another copy of any purchased template, go to the My documents tab and click on the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document format for your desired region/area.

- Review the template description to confirm you have picked the appropriate template.

Form popularity

FAQ

In Delaware, a seller can back out of a contract under specific circumstances stated in the agreement. This may involve contingencies that must be fulfilled or disclosed issues with the property. It’s important for both buyers and sellers to fully understand their rights and obligations to avoid disputes. Seeking guidance from platforms like uslegalforms may assist you in navigating these complexities.

To obtain a sale and purchase agreement you'll need to contact your lawyer or conveyancer or a licenced real estate professional. You can also purchase printed and digital sale and purchase agreement forms online.

How to Fill Out a Residential Purchase AgreementPlace the name(s) of the seller(s) on the contract.Write the date of the offer on the agreement.Add the purchase price to the contract.Include a request for the seller to provide a clear title and deed for the property.More items...

How to Write an LOI in Commercial Real EstateStructure it like a letter.Write the opening paragraph.State the parties involved.Draft a property description.Outline the terms of the offer.Include disclaimers.Conclude with a closing statement.

How to Fill Out a Residential Purchase AgreementPlace the name(s) of the seller(s) on the contract.Write the date of the offer on the agreement.Add the purchase price to the contract.Include a request for the seller to provide a clear title and deed for the property.More items...

Fill out the name of the buyer(s), the address of the subject property and the assessor's parcel number for the dwelling. The purchase price is presented both numerically and spelled out. The agreement refers to the buyer and seller as parties, a term which does not include the real estate broker.

The LOI should be in writing; it should be signed by the parties; it should state all needed terms of a property sale agreement or lease, like price or rent, party names and descriptions of the property and the interest conveyed and finally, it should state clearly that the parties may (or will) prepare a final written

The most important sections include:Offer & closing dates.Legal names of the buyer(s) & seller(s)Property address, frontage, and legal description.Offer price & deposit amount.Irrevocable date for when the offer is good until.Chattels & fixtures included and not included in the sale.Rental items included in the sale.More items...

Writing a real estate purchase agreement.Identify the address of the property being purchased, including all required legal descriptions.Identify the names and addresses of both the buyer and the seller.Detail the price of the property and the terms of the purchase.Set the closing date and closing costs.More items...

The Letter of Intent should include the names of the parties negotiating, such as the name of the Tenant and the Property Owner/Landlord, and a list of industry standard list items. You should also include items that are important to your business when leasing commercial real estate.