The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

Delaware Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules Fraudulently Transferred Property

Description

How to fill out Complaint Objecting To Discharge In Bankruptcy Proceedings For Concealment By Debtor And Omitting From Schedules Fraudulently Transferred Property?

If you have to complete, acquire, or produce legal document templates, use US Legal Forms, the greatest collection of legal types, which can be found on-line. Take advantage of the site`s simple and easy handy research to find the paperwork you want. Different templates for enterprise and individual functions are categorized by groups and says, or keywords and phrases. Use US Legal Forms to find the Delaware Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules in just a handful of click throughs.

Should you be currently a US Legal Forms consumer, log in for your bank account and then click the Obtain switch to get the Delaware Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules. You can even access types you in the past saved in the My Forms tab of the bank account.

If you are using US Legal Forms the first time, refer to the instructions below:

- Step 1. Ensure you have selected the shape for your right town/nation.

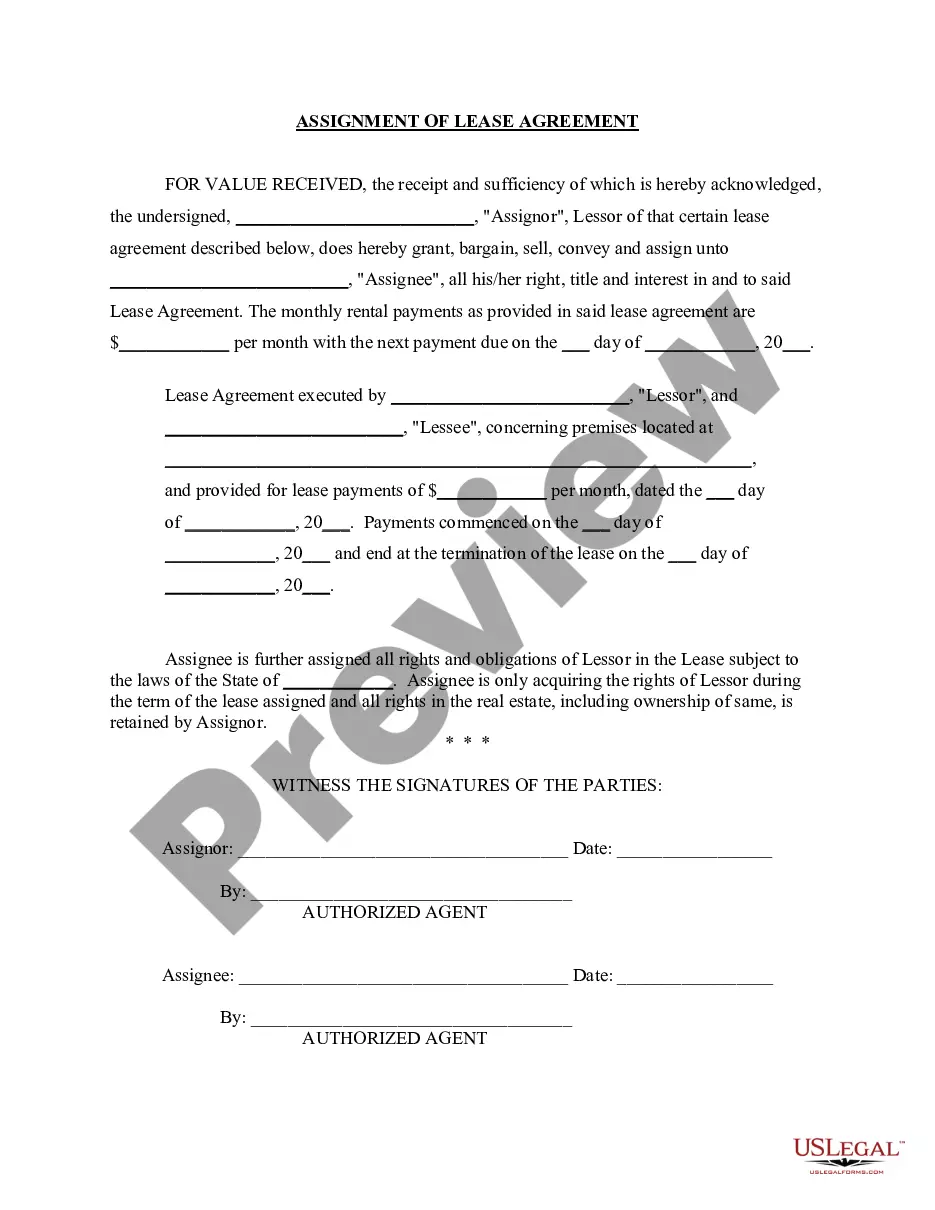

- Step 2. Use the Preview choice to look through the form`s articles. Never forget about to read through the explanation.

- Step 3. Should you be not satisfied with the kind, use the Search field on top of the monitor to get other types in the legal kind web template.

- Step 4. When you have discovered the shape you want, go through the Acquire now switch. Select the costs prepare you favor and include your references to register on an bank account.

- Step 5. Method the transaction. You should use your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Find the structure in the legal kind and acquire it on your own device.

- Step 7. Total, change and produce or signal the Delaware Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules.

Every single legal document web template you acquire is yours eternally. You may have acces to each and every kind you saved with your acccount. Click the My Forms section and select a kind to produce or acquire yet again.

Remain competitive and acquire, and produce the Delaware Complaint Objecting to Discharge in Bankruptcy Proceedings for Concealment by Debtor and Omitting from Schedules with US Legal Forms. There are millions of skilled and express-certain types you can use for your personal enterprise or individual requires.

Form popularity

FAQ

A trustee's or creditor's objection to the debtor being released from personal liability for certain dischargeable debts. Common reasons include allegations that the debt to be discharged was incurred by false pretenses or that debt arose because of the debtor's fraud while acting as a fiduciary.

Another exception to Discharge is for fraud while acting in a fiduciary capacity, embezzlement, or larceny. Domestic obligations are not dischargeable in Bankruptcy. Damages resulting from the willful and malicious injury by the debtor of another person or his property, are also not dischargeable in Bankruptcy.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

Section 523(a)(2)(A) of the Bankruptcy Code provides an exception from the discharge of any debt for money, property or services, to the extent such debt was obtained by false pretenses, a false representation, or actual fraud.

Dischargeability concerns whether any given claim can be discharged in the bankruptcy. When a claim is non-dischargable, it will survive the bankruptcy process intact. Related Term: Non-dischargeable Debt.

Debts not discharged Some debts are not dischargeable in bankruptcy. See 11 U.S.C. 523 for the list of non dischargeable debts. Non dischargeable debts are unaltered by the bankruptcy discharge and remain just as valid as they were before the bankruptcy. The debtor's personal liability continues.

Except as otherwise provided in subdivision (d), a complaint to determine the dischargeability of a debt under §523(c) shall be filed no later than 60 days after the first date set for the meeting of creditors under §341(a).