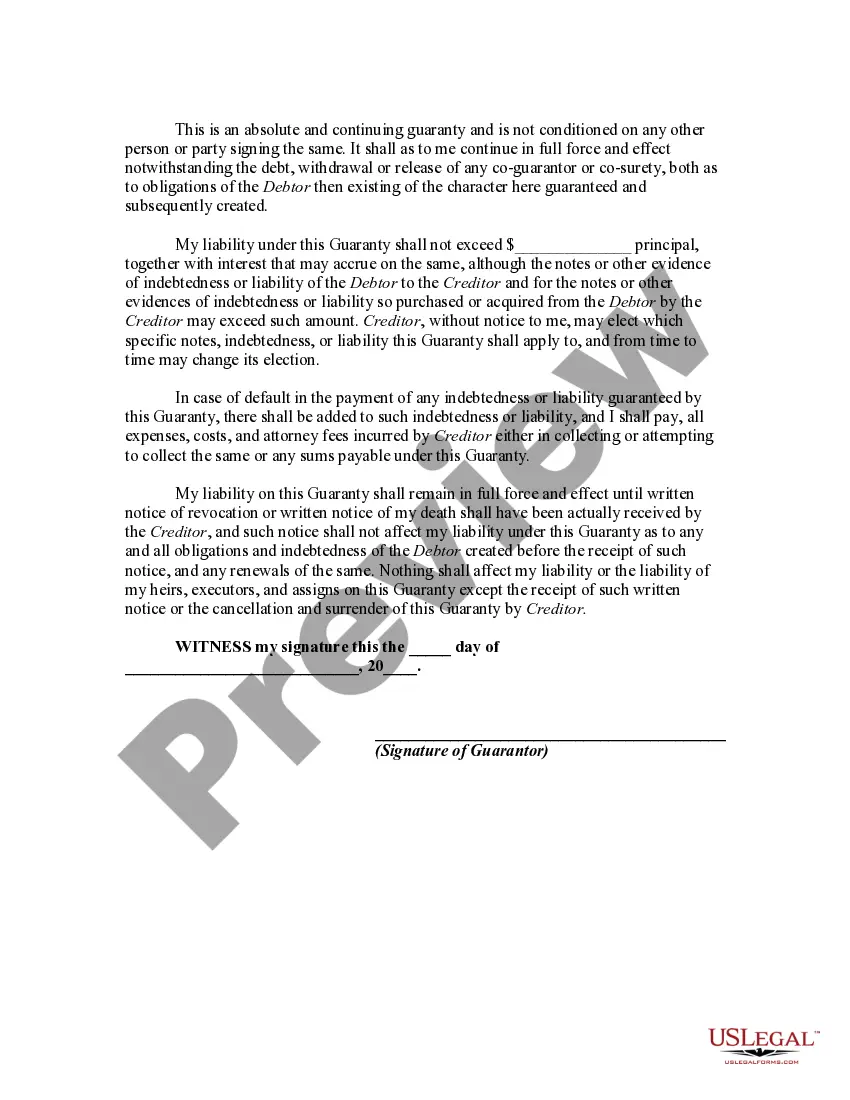

A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

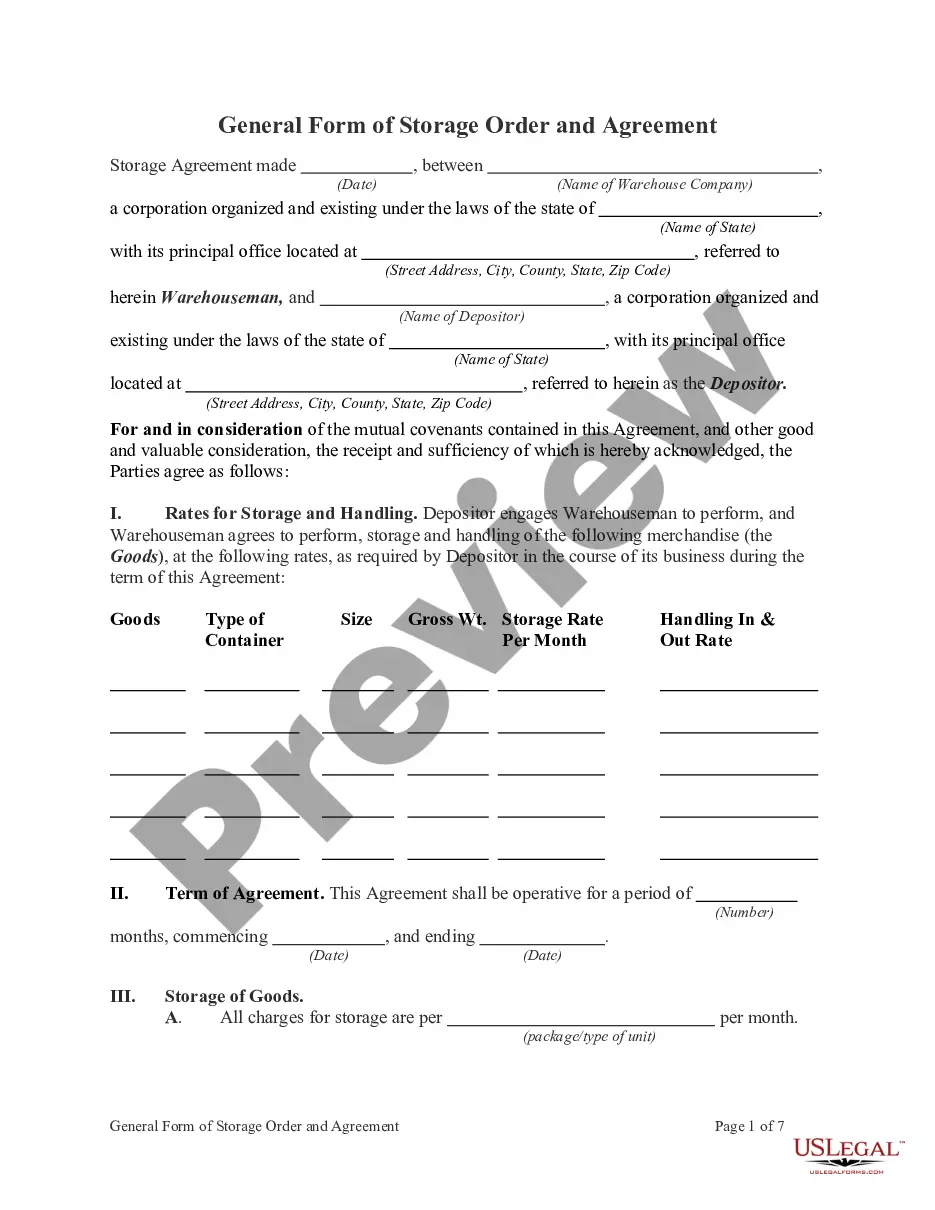

Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

Are you faced with a situation where you require documentation for either business or personal purposes almost every day.

There are numerous legitimate document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms provides thousands of form templates, including the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, which can be tailored to comply with federal and state regulations.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability at any time, if needed. Just click on the desired form to download or print the document template.

- If you are already familiar with the US Legal Forms site and possess an account, simply Log In.

- Then, you can download the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it corresponds to the correct state/area.

- Utilize the Review button to examine the form.

- Read the description to confirm you have chosen the correct form.

- If the form does not meet your requirements, use the Search field to find a form that fits your needs and criteria.

- Once you have the correct form, click Buy now.

- Choose the pricing plan you want, fill in the necessary details to create your account, and purchase an order using your PayPal or credit card.

Form popularity

FAQ

A guarantee of indebtedness is a promise made by a third party to repay a debt if the primary borrower fails to do so. This is particularly relevant in the context of Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, where the guarantor takes on a crucial role in financial agreements. This provides reassurance to lenders and enhances the borrower's ability to secure financing.

In a credit agreement, Indebtedness typically refers to all the amounts that you owe under the terms of that agreement. This may include loans, interest payments, and any other financial commitments. Understanding the implications of Indebtedness is crucial, especially when dealing with Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. It helps you manage your obligations effectively.

To protect themselves, a guarantor should understand the terms of the guarantee and assess the debtor's creditworthiness. Implementing strategies, such as securing the guarantee with collateral or limiting it through terms, is beneficial. Utilizing resources from platforms like uslegalforms can provide templates and guidance for constructing a Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability that minimizes risk.

A guarantee is indeed seen as a form of indebtedness, representing a contingent liability for the guarantor. This aspect is crucial when looking at the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, as it establishes the responsibilities involved. Properly addressing this can lead to better financial management and risk assessment.

Yes, a guarantee can be recognized as financial debt as it binds the guarantor to fulfill a repayment obligation if the primary debtor defaults. This underlines the importance of understanding the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability for those entering into such agreements. Awareness of this aspect helps in assessing risk and liability.

An unlimited continuing guaranty is a commitment from a guarantor to cover all obligations of the debtor without a cap on the amount. This type of guaranty provides more security for creditors and enhances the agreement under Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Therefore, understanding its implications can protect your interests.

An unconditional guarantee is a promise where the guarantor agrees to fulfill the obligations without any conditions or prerequisites. This type of guarantee often appears in the context of the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. An unconditional guarantee offers maximum security for lenders, knowing that repayment is assured regardless of the borrower's financial health. It is essential to understand the implications of such guarantees in any financial agreement.

A limited guarantor is a party that agrees to cover only a portion of another party's obligations, rather than the total amount. This type of guarantee often appears in contexts governed by the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. By providing a limited guarantee, the guarantor minimizes their risk, while still offering some assurance to lenders. This approach can foster better lending relationships and ensure both parties’ interests are protected.

The three types of liabilities typically include current liabilities, long-term liabilities, and contingent liabilities. Current liabilities are obligations due within a year, while long-term liabilities extend beyond that period. Contingent liabilities arise from uncertain future events but still require attention, especially in light of the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Understanding these classifications can help businesses better organize their financial responsibilities.

A guaranty of liabilities involves a party agreeing to fulfill the financial responsibilities of another if that party fails to do so. In the framework of the Delaware Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, this guarantee provides lenders with security against default. This arrangement helps businesses secure needed financing while managing their risk exposure. Knowing how these guarantees work can empower you in your financial dealings.