Generally, a debtor may demand a receipt for payment of an obligation. No particular form is necessary for a valid receipt. However, a receipt should recite all facts necessary to substantiate the tender and acceptance of payment.

Delaware Receipt for Payment of Salary or Wages

Description

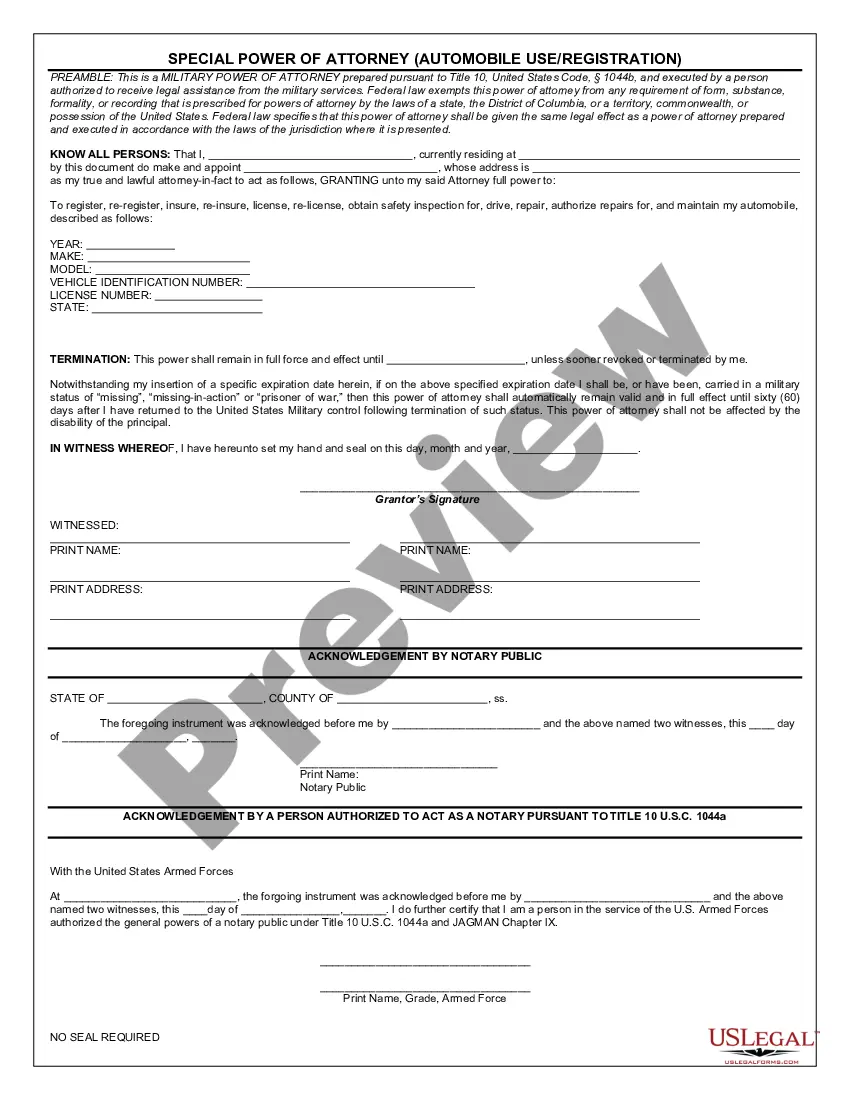

How to fill out Receipt For Payment Of Salary Or Wages?

Have you found yourself in a circumstance where you require documents for both business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating forms you can trust is challenging.

US Legal Forms offers an extensive collection of form templates, such as the Delaware Receipt for Payment of Salary or Wages, designed to comply with state and federal requirements.

Utilize US Legal Forms, one of the most extensive selections of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Delaware Receipt for Payment of Salary or Wages template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct region/state.

- Utilize the Preview button to review the form.

- Examine the details to confirm that you have selected the correct form.

- If the form is not what you require, use the Lookup field to find the form that fits your needs and specifications.

- Once you locate the appropriate form, click Purchase now.

- Select the pricing plan you desire, complete the necessary information to create your account, and finalize the transaction with your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Delaware Receipt for Payment of Salary or Wages at any time, if needed. Click the desired form to download or print the document template.

Form popularity

FAQ

When estimating how much you would take home from a $100,000 salary in Delaware, various factors come into play, including tax brackets and deductions. After considering state and federal taxes, you might expect to retain around $75,000 to $80,000. Using tools like the Delaware Receipt for Payment of Salary or Wages can help you understand your specific tax situation and net earnings better.

Whether you need to file a tax return in Delaware depends on your income sources and residency status. If you earn income in Delaware, you generally must file a state tax return. To assist with filing and managing these details, consider using the Delaware Receipt for Payment of Salary or Wages, which helps clarify your earnings and tax liability.

Yes, Delaware imposes a gross receipts tax on businesses for the privilege of doing business in the state. This tax varies depending on the industry and does not apply to all types of transactions. For businesses needing help understanding their obligations, resources like the Delaware Receipt for Payment of Salary or Wages can provide valuable insights into payroll compliance and tax responsibilities.

Delaware is often considered a tax-friendly state, especially for businesses. The lack of a state sales tax and favorable corporate tax rates attract many enterprises. When exploring options related to employment, users can benefit from services like Delaware Receipt for Payment of Salary or Wages, which ensures compliance with state regulations and streamlines payroll processes.

The standard deduction for Delaware state income tax is an important factor in calculating your tax liability. For individuals, it typically varies based on filing status, so make sure to verify the current thresholds on the official Delaware Division of Revenue's website. If you receive a Delaware Receipt for Payment of Salary or Wages, it helps you better understand income calculations. To simplify your financial management, consider using our platform for all your tax-related documents.

To contact Delaware gross receipts tax, you can visit the Delaware Division of Revenue's website for detailed information. They provide resources on how to reach their office via phone or email. Remember, having your Delaware Receipt for Payment of Salary or Wages handy can help with your inquiries. This document may also assist you in understanding tax obligations tied to your wages.

To file your Delaware gross receipts tax online, visit the Delaware Division of Revenue website and use their e-filing system. You'll need to provide information about your business and revenue. Having your Delaware Receipt for Payment of Salary or Wages ready will facilitate this process, ensuring all financial details are accurately reported.

Yes, Delaware has an earned income tax credit, which is available to eligible individuals and families. This credit is designed to support low to moderate-income earners, effectively reducing their tax burden. When calculating your taxes, always consider the Delaware Receipt for Payment of Salary or Wages as it may allow you to claim this credit efficiently.

Delaware offers several personal tax credits that residents can claim on their tax returns. These credits can help reduce tax liability, providing valuable financial relief. Understanding how the Delaware Receipt for Payment of Salary or Wages fits into your overall tax strategy can help maximize these benefits.

Yes, you can file your Delaware state taxes online through the Delaware Division of Revenue website. The online system is user-friendly and ensures that your information is submitted accurately. When preparing to file, having your Delaware Receipt for Payment of Salary or Wages handy can aid in accurately reporting income and expenses.