This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor

Description

How to fill out Contract For Cultivation Of Soil Between Landowner And Self-Employed Independent Contractor?

Selecting the appropriate legal document template can be quite a challenge.

Clearly, there is a multitude of designs accessible online, but how do you find the legal form you require.

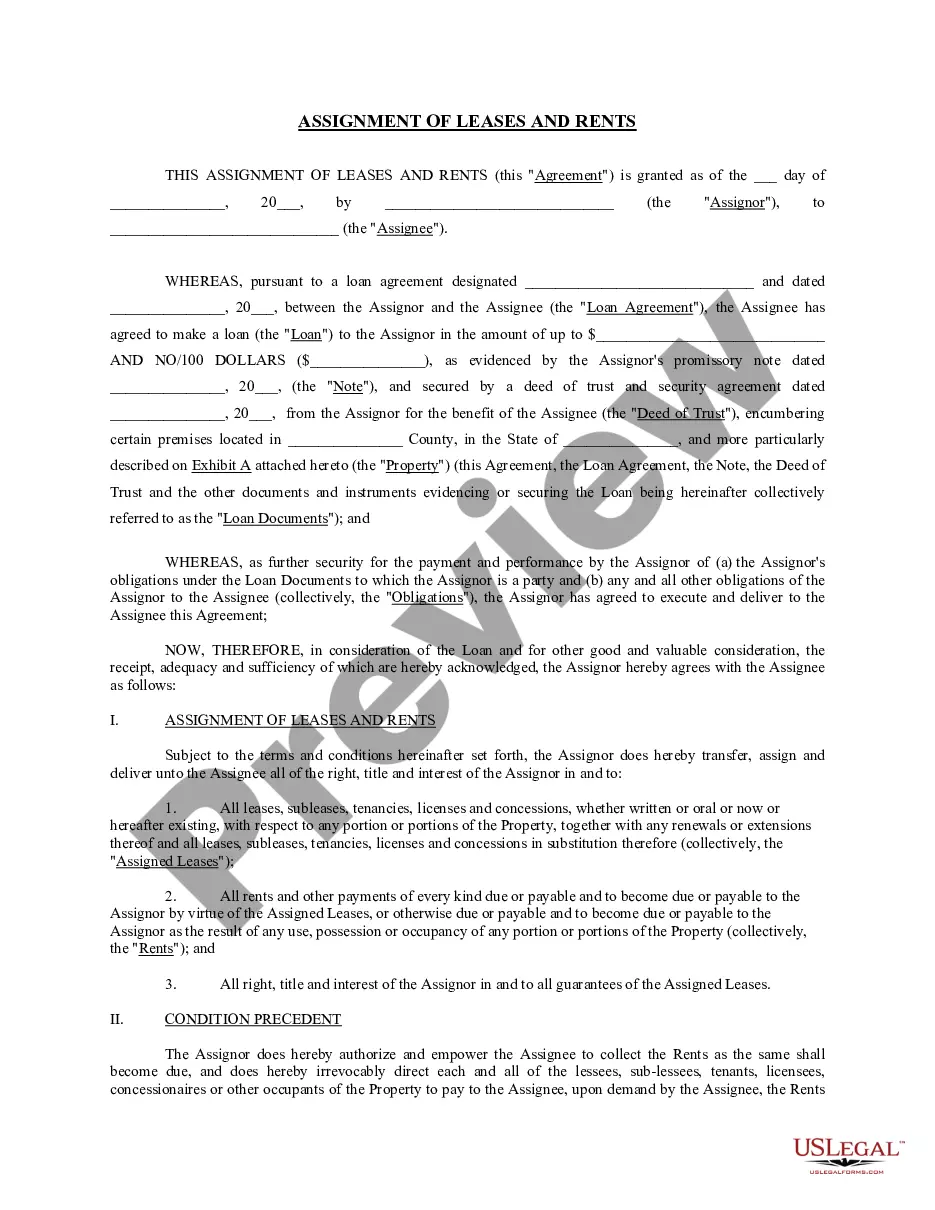

Utilize the US Legal Forms website. The platform offers thousands of designs, such as the Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, which can be utilized for business and personal purposes.

You can review the form using the Review button and read the form description to ensure this is the best fit for you.

- All the forms are verified by experts and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor.

- Use your account to track the legal forms you have purchased previously.

- Visit the My documents tab in your account and obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, make sure you have chosen the correct form for your area/region.

Form popularity

FAQ

A general contractor license is often required for extensive construction or renovation projects, including those involving structural changes or significant electrical and plumbing work. If you plan to enter into a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, understanding the scope of work can help clarify whether a general contractor license is needed. Ensure you adhere to state regulations to legally operate your business.

A contractor typically manages larger projects and hires subcontractors for various tasks, while a handyman tends to handle smaller, more straightforward jobs. If you engage in a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, you may need to determine whether to hire a contractor or a handyman based on the complexity of the work involved. Understanding this distinction can help you choose the right professional for your needs.

Yes, independent contractors in Delaware typically need a business license to operate legally. This license helps ensure that you meet local regulations and tax obligations. If you are entering a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, securing a business license can enhance your credibility and protect your interests. It's a wise move to handle this early on.

Yes, Delaware does require a contractor's license for various types of construction work. The requirements may vary based on the specific trade or project. If you're considering engaging in agreements like a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, it's important to consult local laws to ensure compliance. Having a license protects you and your clients.

In Delaware, whether or not you need a contractor license depends on the type of work you are doing. For certain construction and contracting jobs, you must obtain a license. If your work involves a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, checking local regulations is essential. Always make sure you comply with state laws to avoid any legal issues.

An example of an independent contractor could be a horticulturist who specializes in soil cultivation for landowners looking to enhance their properties. In this scenario, the horticulturist would enter into a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, allowing them to complete specific tasks related to soil management. This setup enables landowners to benefit from specialized skills without the long-term commitment of hiring full-time staff.

An independent contractor in Delaware is an individual or business that provides services under a contract while maintaining control over how those services are delivered. They are distinct from employees, as they are not subject to the same regulations and do not receive employee benefits. When engaging in a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, it's important to define the terms to establish a clear working relationship.

The independent contractor agreement in Delaware outlines the relationship between the landowner and the self-employed independent contractor. This document details the responsibilities, payment terms, and project scope, ensuring both parties understand their obligations. It plays a crucial role in a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor by providing legal clarity and protecting the interests of both parties involved.

An independent contractor is sometimes referred to as a freelancer, self-employed individual, or gig worker. This term emphasizes their autonomy and the nature of their work relationship. In the context of a Delaware Contract for Cultivation of Soil Between Landowner and Self-Employed Independent Contractor, the contractor takes on specific tasks independently, reflecting their expertise and skills without the constraints of a traditional employer-employee relationship.