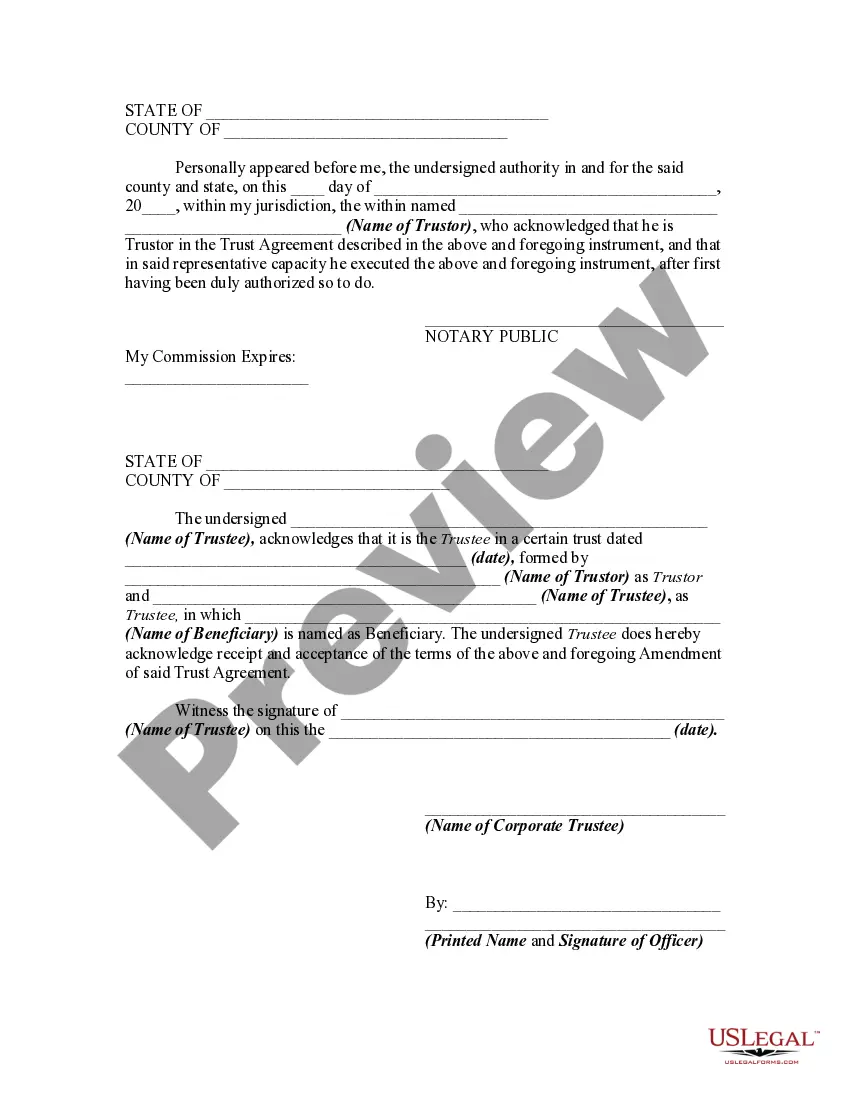

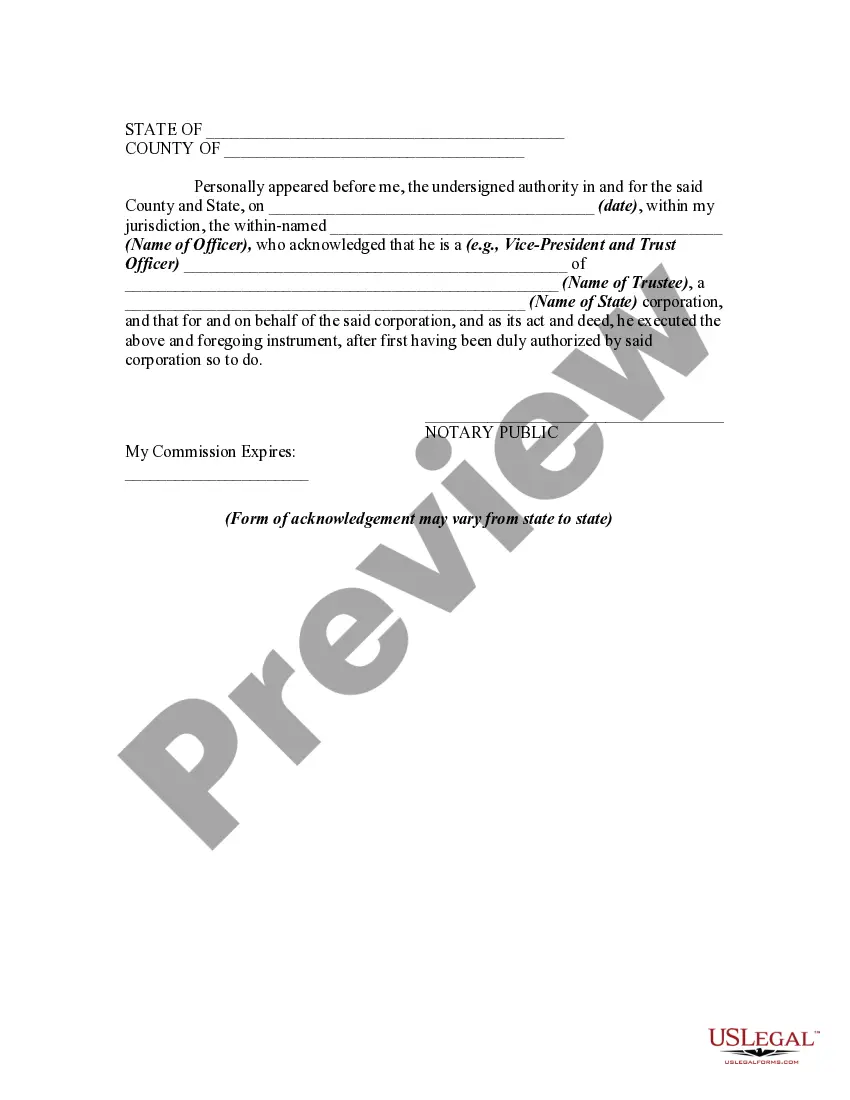

A well drafted trust instrument will generally prescribe the method and manner of amending the trust agreement. A trustor may reserve the power to withdraw property from the trust. This form is a sample of a trustor amending the trust agreement in order to withdraw property from the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Delaware Amendment to Trust Agreement is a legal document that allows for changes or modifications to be made to an existing inter vivos trust. This amendment is specifically used when the creator (also known as the granter or settler) of the trust wants to withdraw property from the trust and requires the consent of the trustee. The inter vivos trust, commonly known as a living trust, is created during the granter's lifetime and holds assets that will be distributed to beneficiaries according to the terms specified in the trust agreement. However, circumstances may arise where the granter wishes to remove certain property from the trust, either to sell it, transfer it to another trust, or for any other valid reason. To initiate this change, the granter must draft a Delaware Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust, specifying the details of the property to be removed and the desired amendments to the original trust agreement. This document should be prepared in accordance with the laws and regulations of the state of Delaware. The consent of the trustee is a crucial aspect of this process, as the trustee is responsible for managing and safeguarding the assets held in the trust. The trustee's approval is typically required before any modifications can be made to the trust agreement. The consent signifies that the trustee is aware of and agrees with the granter's decision to withdraw property from the trust. It is important to note that there may be different types or variations of Delaware Amendments to Trust Agreements in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee. These variations can depend on the specific requirements of the granter, the nature of the property being withdrawn, and the terms outlined in the original trust agreement. Some potential variations of Delaware Amendments to Trust Agreements in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee may include: 1. Partial Property Withdrawal Amendment: This type of amendment allows the granter to withdraw only a portion of the property held in the trust, keeping the remaining assets intact. 2. Property Transfer to Another Trust Amendment: In this scenario, the granter wants to transfer the property from the existing trust to another trust, either due to changes in estate planning purposes or for other designated reasons. 3. Property Sale Amendment: If the granter intends to sell the property held within the trust, this type of amendment outlines the terms and conditions of the sale and ensures proper consent from the trustee. 4. Amendment to Trust Administration: This type of amendment may be required when changes to the administrative provisions of the trust are necessary, possibly due to a change in circumstances or updated legal requirements. When undertaking a Delaware Amendment to Trust Agreement in Order to Withdraw Property from Inter Vivos Trust and Consent of Trustee, it is essential to consult with an experienced attorney to ensure compliance with all legal formalities and to accurately reflect the intentions of the granter.