Unless the continuation of a trust is necessary to carry out a material purpose of the trust (such as tax benefits), the trust may be terminated by agreement of all the beneficiaries if none of them is mentally incompetent or underage (e.g., under 21 in some states). However, termination generally cannot take place when it is contrary to the clearly expressed intention of the trustor. In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

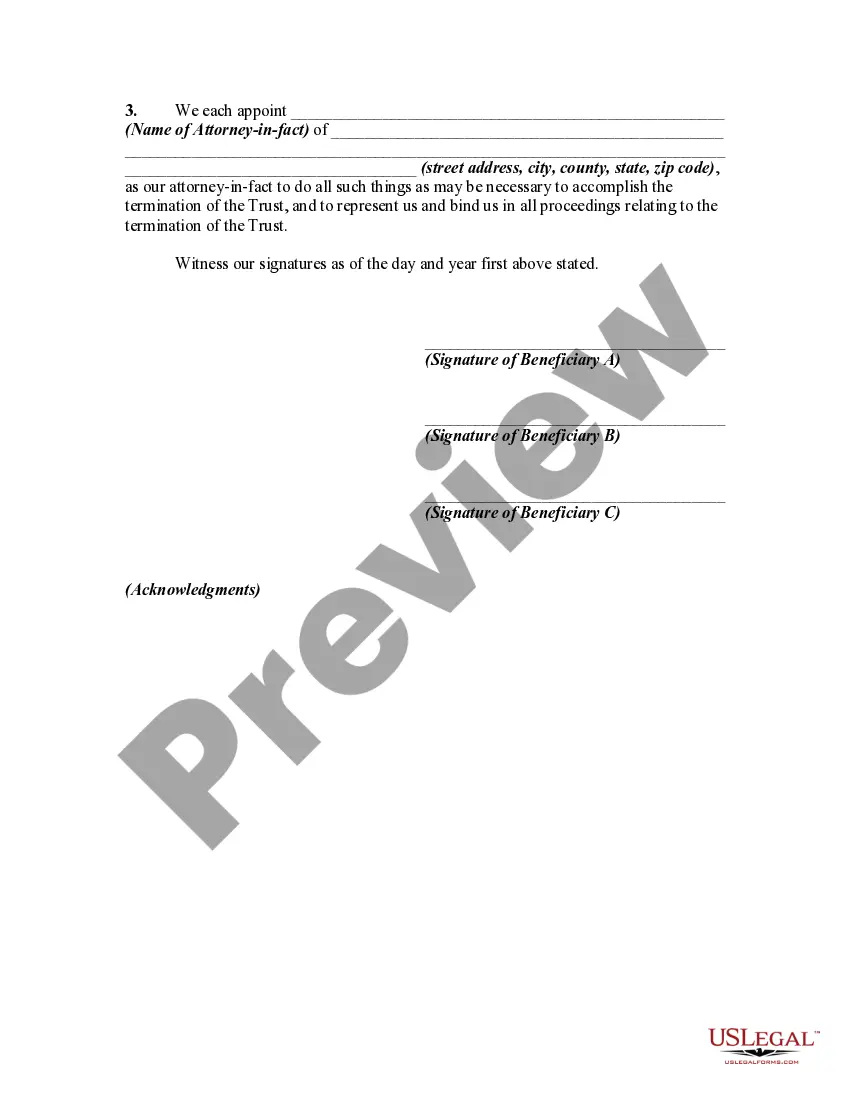

Title: Delaware Agreement Among Beneficiaries to Terminate Trust: Explained in Detail Introduction: The Delaware Agreement Among Beneficiaries to Terminate Trust is a legal document that outlines the specific conditions under which beneficiaries of a trust may come together to terminate the trust agreement. This article aims to provide a comprehensive understanding of this agreement, its purpose, and any variations it may have. Key Points: 1. Definition of the Delaware Agreement Among Beneficiaries to Terminate Trust: The Delaware Agreement Among Beneficiaries to Terminate Trust is a legally binding contract that allows beneficiaries of a trust to terminate the trust before its predetermined expiration date. 2. Objectives of the Agreement: The primary goal of this agreement is to provide beneficiaries with a structured process to collectively terminate a trust and distribute the trust assets in alignment with the beneficiaries' mutual interests and priorities. 3. Conditions for Utilizing the Agreement: — Unanimous Beneficiary Consent: All beneficiaries must agree to terminate the trust. The agreement ensures that every beneficiary's rights and interests are protected. — Compliance with Trust Terms: The trust termination must comply with the terms, conditions, and legal requirements set forth in the original trust agreement. — Approval by Court: In some cases, court approval may be required, depending on the complexity of the trust or specific state laws. 4. Types of Delaware Agreements Among Beneficiaries to Terminate Trust: While the specific types of Delaware agreements may vary, the following are some common variations: — Revocable Trust Termination: This agreement enables beneficiaries to terminate a revocable trust, which grants the settler or granter the right to modify or revoke the trust during their lifetime. — Irrevocable Trust Termination: This agreement focuses on terminating an irrevocable trust, which typically requires more complex processes due to the permanent nature of the trust. 5. Process of Termination: — Identifying Beneficiaries: All beneficiaries must be identified and consulted regarding their interests in the termination of the trust. — Drafting the Agreement: A legally binding agreement is prepared, clearly stating the unanimous consent of all beneficiaries to terminate the trust and the terms for distributing the trust assets. — Court Approval (if required): In cases where court approval is necessary, beneficiaries must seek appropriate legal counsel and comply with all legal procedures. — Distribution of Assets: Once the termination is approved, the trust assets are distributed among the beneficiaries as outlined in the agreement. Conclusion: The Delaware Agreement Among Beneficiaries to Terminate Trust offers beneficiaries the opportunity to efficiently dissolve a trust while ensuring the equitable distribution of assets. Whether it is terminating a revocable or irrevocable trust, beneficiaries must follow specific procedures, seek legal advice when necessary, and ensure compliance with the original trust agreement. The detailed provisions found within this agreement protect the rights and interests of all beneficiaries involved, fostering a smoother trust termination process.