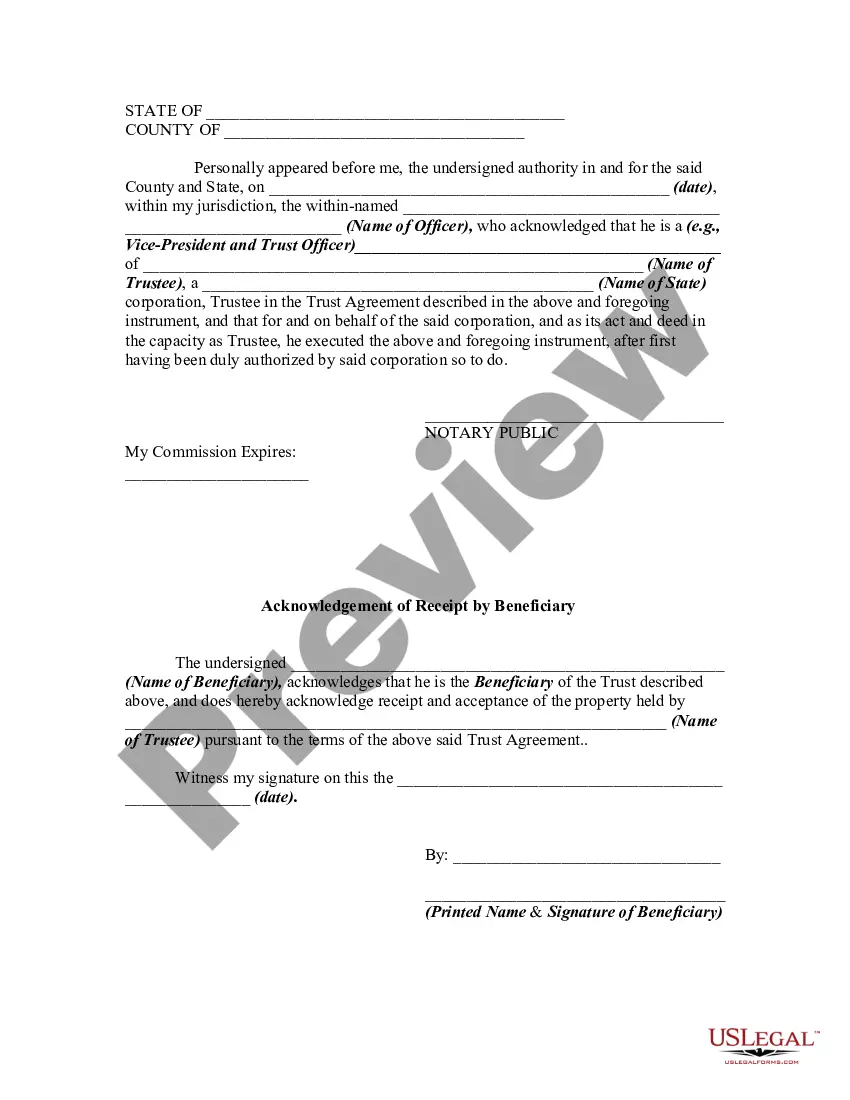

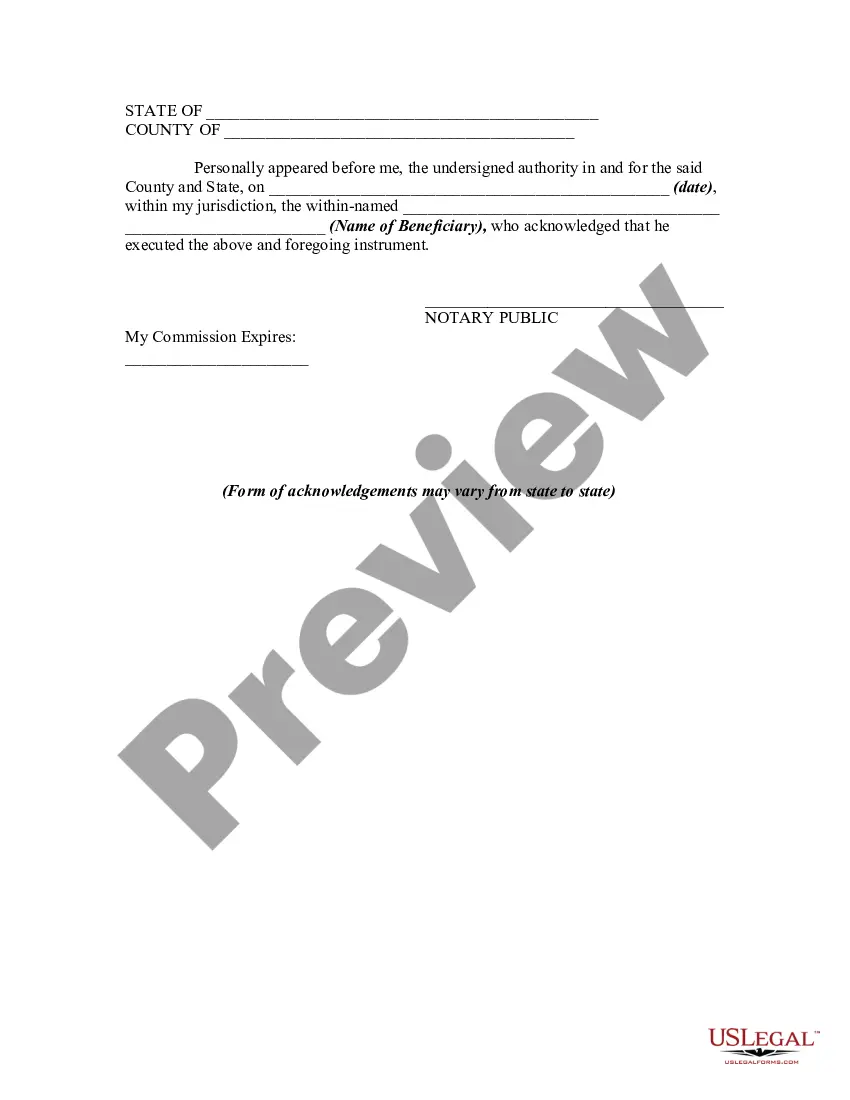

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that outlines the transfer of assets or trust property from a trustee to a beneficiary in the state of Delaware. This document serves as proof of the beneficiary's receipt of the assets and signifies the trustee's release of their control and responsibility over the assets. In Delaware, there are different types of releases and receipts that can be executed depending on the specific circumstances. They include: 1. Full Release: A Full Release is used when the trustee is completely transferring all assets and property held in the trust to the beneficiary. This document signifies the trustee's full discharge of their duties and responsibilities. 2. Partial Release: A Partial Release is utilized when only a portion of the trust assets or property is being transferred to the beneficiary. This may occur when the trust is being distributed in stages or if certain assets are being allocated to specific beneficiaries. 3. Conditional Release: A Conditional Release refers to situations where the transfer of assets to the beneficiary is subject to certain conditions being met. These conditions can be specified in the trust agreement, such as the beneficiary reaching a certain age or achieving certain milestones. 4. Revocable Release: A Revocable Release grants the trustee the ability to revoke or modify the release of assets to the beneficiary if certain circumstances occur. This offers flexibility in cases where unforeseen events or changes in circumstances may warrant the modification of the release. 5. Final Release: A Final Release occurs when the entire trust administration process has been completed, and all assets have been distributed to the beneficiaries. This signifies the formal conclusion of the trust and the trustee's release of their fiduciary duties. When executing a Delaware Release by Trustee to Beneficiary and Receipt from Beneficiary, it is essential to include relevant details such as the names and contact information of both the trustee and beneficiary, a comprehensive description of the assets being transferred, any conditions or restrictions associated with the release, and the date of execution. This document should be signed and acknowledged by both parties and should adhere to the laws and regulations of the state of Delaware. Executing a Release by Trustee to Beneficiary and Receipt from Beneficiary ensures a transparent and legal transfer of assets and provides a clear record of the beneficiary's receipt. It is advisable to consult with an attorney specializing in trust and estate planning to ensure compliance with Delaware laws and to draft a document that accurately reflects the intentions of the granter and the trustee.Delaware Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that outlines the transfer of assets or trust property from a trustee to a beneficiary in the state of Delaware. This document serves as proof of the beneficiary's receipt of the assets and signifies the trustee's release of their control and responsibility over the assets. In Delaware, there are different types of releases and receipts that can be executed depending on the specific circumstances. They include: 1. Full Release: A Full Release is used when the trustee is completely transferring all assets and property held in the trust to the beneficiary. This document signifies the trustee's full discharge of their duties and responsibilities. 2. Partial Release: A Partial Release is utilized when only a portion of the trust assets or property is being transferred to the beneficiary. This may occur when the trust is being distributed in stages or if certain assets are being allocated to specific beneficiaries. 3. Conditional Release: A Conditional Release refers to situations where the transfer of assets to the beneficiary is subject to certain conditions being met. These conditions can be specified in the trust agreement, such as the beneficiary reaching a certain age or achieving certain milestones. 4. Revocable Release: A Revocable Release grants the trustee the ability to revoke or modify the release of assets to the beneficiary if certain circumstances occur. This offers flexibility in cases where unforeseen events or changes in circumstances may warrant the modification of the release. 5. Final Release: A Final Release occurs when the entire trust administration process has been completed, and all assets have been distributed to the beneficiaries. This signifies the formal conclusion of the trust and the trustee's release of their fiduciary duties. When executing a Delaware Release by Trustee to Beneficiary and Receipt from Beneficiary, it is essential to include relevant details such as the names and contact information of both the trustee and beneficiary, a comprehensive description of the assets being transferred, any conditions or restrictions associated with the release, and the date of execution. This document should be signed and acknowledged by both parties and should adhere to the laws and regulations of the state of Delaware. Executing a Release by Trustee to Beneficiary and Receipt from Beneficiary ensures a transparent and legal transfer of assets and provides a clear record of the beneficiary's receipt. It is advisable to consult with an attorney specializing in trust and estate planning to ensure compliance with Delaware laws and to draft a document that accurately reflects the intentions of the granter and the trustee.