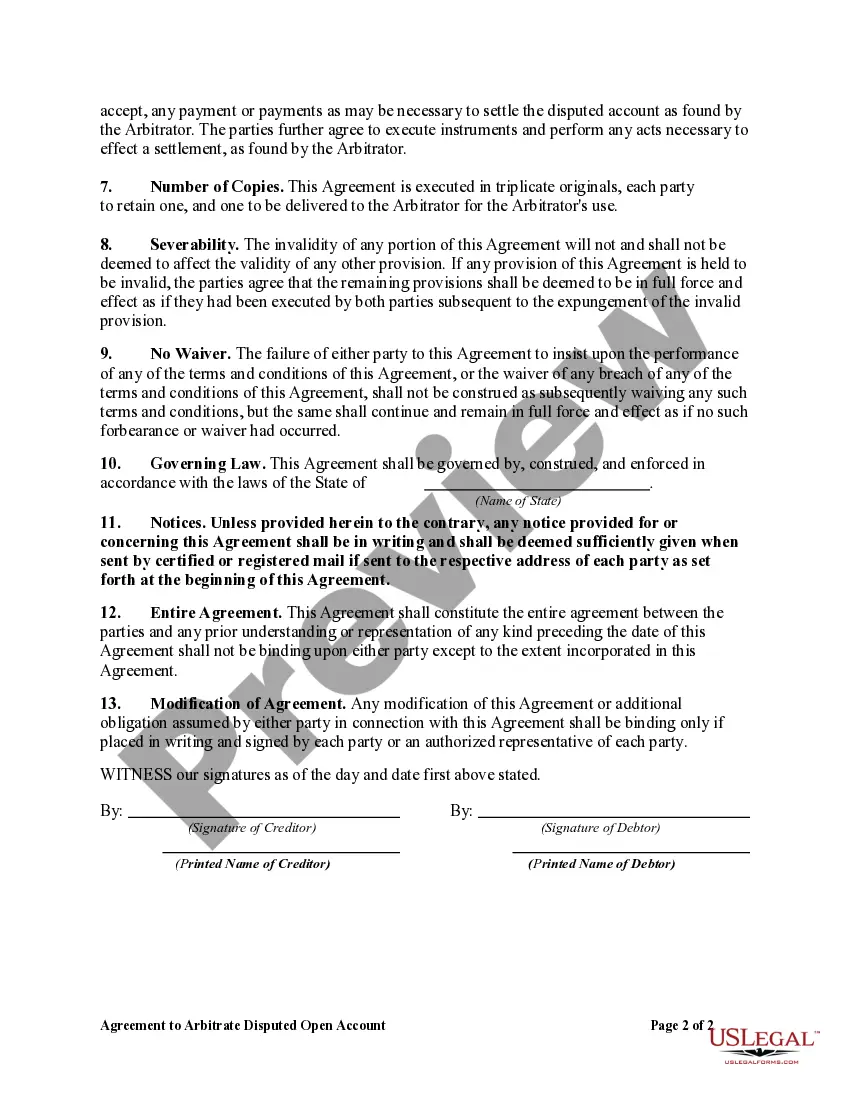

Delaware Agreement to Arbitrate Disputed Open Account

Description

How to fill out Agreement To Arbitrate Disputed Open Account?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a selection of legal document templates you can download or create.

By using the website, you can access thousands of forms for commercial and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Delaware Agreement to Arbitrate Disputed Open Account in just a few moments.

If the form does not meet your requirements, utilize the Search field at the top of the page to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, select the pricing plan you prefer and provide your information to create an account.

- If you have an account, Log In and download the Delaware Agreement to Arbitrate Disputed Open Account from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously saved forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click on the Preview option to review the form’s content.

Form popularity

FAQ

Delaware's arbitration law governs how arbitration agreements are enforced and outlines procedures for arbitration. The law supports the enforcement of agreements such as the Delaware Agreement to Arbitrate Disputed Open Account, providing a framework for resolving disputes efficiently. It emphasizes the importance of adhering to the terms laid out in your arbitration agreement, ensuring that parties have a clear legal pathway when entering arbitration.

The five steps of arbitration typically include: first, selecting an arbitrator based on the agreement's requirements; second, exchanging relevant documents and information among parties; third, conducting a hearing where both sides present their cases; fourth, allowing the arbitrator to deliberate and make a decision; and finally, receiving the arbitrator's award, which should comply with the Delaware Agreement to Arbitrate Disputed Open Account.

Writing an arbitration agreement requires clarity and specificity to ensure all parties understand their obligations. Start with a title such as 'Delaware Agreement to Arbitrate Disputed Open Account,' followed by clauses regarding the scope of disputes covered, the arbitration process, and governing laws. Your agreement should also address how arbitrators are selected and the rules that will govern arbitration, ensuring it aligns with Delaware statutes.

Applying for arbitration under the Delaware Agreement to Arbitrate Disputed Open Account involves preparing an application that adheres to the terms outlined in your arbitration agreement. Typically, this includes identifying the parties involved, describing the dispute, and selecting an arbitrator if required by the agreement. Once completed, file your application with the designated arbitration organization and inform the other party of your application.

To file a motion for arbitration under the Delaware Agreement to Arbitrate Disputed Open Account, you need to draft a written motion outlining your request for arbitration. Include all relevant details, such as the nature of the dispute and the agreement to arbitrate. Submit the motion to the appropriate court, alongside any necessary filing fees, and ensure that all parties receive proper notification of the motion.

Challenging an arbitration agreement involves demonstrating that the terms of the Delaware Agreement to Arbitrate Disputed Open Account are unenforceable or that there were issues during its formation. You may need to prove factors such as fraud, duress, or lack of mutual consent. Legal assistance can be crucial in navigating this challenge and presenting your case effectively.

Filing arbitration in Delaware begins with reviewing the Delaware Agreement to Arbitrate Disputed Open Account to confirm the applicable procedures. Next, you will need to submit a written request for arbitration to the chosen arbitration provider or organization. Ensure to include all necessary documentation and any required fees to initiate the process effectively.

Bypassing an arbitration agreement, such as the Delaware Agreement to Arbitrate Disputed Open Account, is often difficult. Courts generally uphold such agreements, so it’s essential to fully understand the implications before attempting to circumvent them. However, specific conditions or legal loopholes may allow for some exceptions, but this typically requires professional legal guidance.

Fighting an arbitration decision is possible, but it can be quite challenging. Under normal circumstances, arbitration awards are final and binding, as outlined in the Delaware Agreement to Arbitrate Disputed Open Account. You may have grounds to contest the decision if you can prove significant flaws in the arbitration process, such as bias or misconduct.

To invoke an arbitration agreement, you need to notify the other party in writing about your intention to initiate arbitration. This is often done in accordance with the terms set out in the Delaware Agreement to Arbitrate Disputed Open Account. Providing clear communication helps facilitate the process and ensures all parties are aware of the arbitration proceedings.