This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Installment Promissory Note with Acceleration Clause and Collection Fees

Description

How to fill out Installment Promissory Note With Acceleration Clause And Collection Fees?

If you need to total, obtain, or print out sanctioned documents templates, utilize US Legal Forms, the premier collection of legal forms, available online.

Take advantage of the site`s straightforward and efficient search feature to locate the documents you require.

A selection of templates for business and personal uses is categorized by types and provisions, or terms and phrases.

Step 4. Once you have found the form you want, click on the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Delaware Installment Promissory Note with Acceleration Clause and Collection Fees with just a few clicks.

- If you are currently a US Legal Forms subscriber, Log In to your account and click the Download button to acquire the Delaware Installment Promissory Note with Acceleration Clause and Collection Fees.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Utilize the Preview option to review the form`s content. Don`t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

To demand a payment on a Delaware Installment Promissory Note with Acceleration Clause and Collection Fees, begin by reviewing the note to confirm the terms and due dates. Write a formal demand letter to the borrower, clearly stating the amount owed, the specifics of the note, and the terms of the acceleration clause if applicable. It’s important to maintain a professional tone and keep a record of all communications. For additional assistance, uslegalforms provides templates that can simplify creating your demand letter.

Yes, a lender can demand repayment of a promissory note, particularly if it includes an acceleration clause. In the case of a Delaware Installment Promissory Note with Acceleration Clause and Collection Fees, the lender has the right to demand full payment if the borrower defaults. This ability helps protect the lender’s interests and ensures swift recovery of funds, reinforcing the importance of clear communication throughout the lending process.

Legally enforcing a promissory note involves several steps, including reviewing the terms of the Delaware Installment Promissory Note with Acceleration Clause and Collection Fees. First, the lender must ensure that they have provided all required notices and documentation regarding missed payments. If the borrower still does not comply, the lender may need to pursue legal action, such as filing a lawsuit, to recover the outstanding balance.

To accelerate a promissory note, the lender must provide written notice to the borrower, indicating that the note will be accelerated due to default or other agreed-upon conditions. This notice initiates the process of demanding full repayment of the Delaware Installment Promissory Note with Acceleration Clause and Collection Fees. It is vital to ensure that you comply with the terms outlined in the note and applicable state laws to enforce this right effectively.

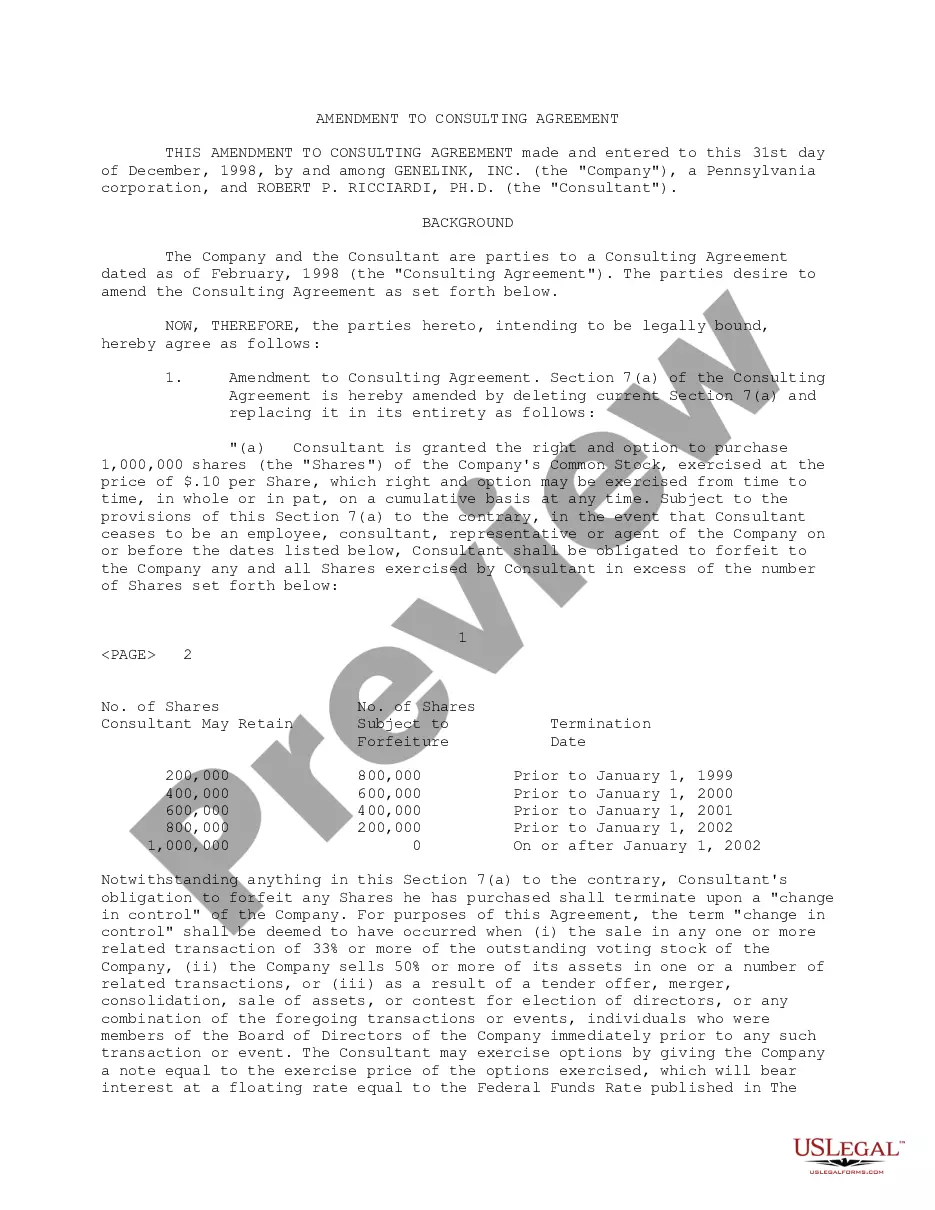

Promissory notes come in various forms, including secured and unsecured notes, demand notes, and installment notes. Each type serves different purposes depending on the needs of the lender and borrower. A Delaware Installment Promissory Note with Acceleration Clause and Collection Fees is a specific type that includes detailed provisions for repayment and fees, making it essential for those seeking structured payment plans.

Yes, a promissory note can go to collections if the borrower fails to make payments as agreed. In such cases, the lender may engage a collection agency to retrieve the owed amount, often incurring additional fees. Understanding how a Delaware Installment Promissory Note with Acceleration Clause and Collection Fees functions can help both parties navigate potential collections more effectively.

Legal requirements for a promissory note include having a written document, signatures from all parties, and clear repayment terms. Each jurisdiction may have additional stipulations, so it is essential to review local laws. For those in Delaware, a properly drafted installment promissory note with an acceleration clause and collection fees follows the state's legal framework.

Conditions for a promissory note usually involve terms that specify the payment schedule, interest rates, and consequences for default. It is vital that these terms are explicitly stated to avoid misunderstandings. A Delaware Installment Promissory Note with Acceleration Clause and Collection Fees should clearly outline these conditions to protect both parties.

A promissory note becomes legally binding when it fulfills certain criteria, including a clear offer, acceptance, and mutual consent from both parties. Additionally, consideration, or something of value exchanged, must be present. In the context of a Delaware Installment Promissory Note with Acceleration Clause and Collection Fees, adherence to these legal standards ensures enforceability.