This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

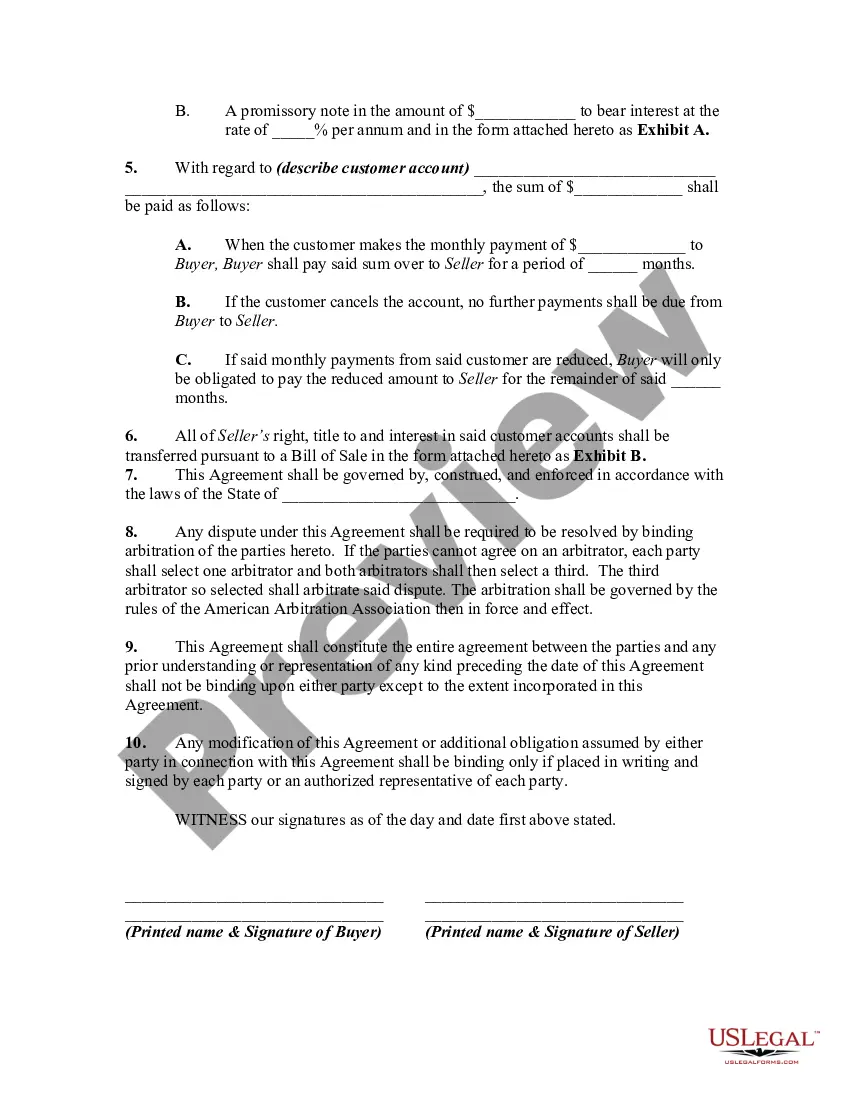

Delaware Agreement to Sell and Purchase Customer Accounts

Description

How to fill out Agreement To Sell And Purchase Customer Accounts?

You can allocate hours online searching for the legal template that meets the state and federal requirements you need.

US Legal Forms offers a multitude of legal documents that can be reviewed by professionals.

You can download or print the Delaware Agreement to Sell and Purchase Customer Accounts from their services.

If available, use the Review button to browse through the template as well.

- If you have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Delaware Agreement to Sell and Purchase Customer Accounts.

- Every legal template you purchase is yours forever.

- To acquire another copy of the downloaded form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct template for the region/state of your choice.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

A purchase and sale agreement, also known as a purchase and sale contract, P&S agreement, or PSA, is a legally-binding document that establishes the terms and conditions related to a real estate transaction. It defines what requirements the buyer must meet as well as purchase price, limitations, and contingencies.

You may be able to terminate your Sales and Purchase Agreement (SPA) if there is a specific clause that allows you to do so. Do note that you might still have to pay for your housing loan if you cancel your SPA too late!

Among the terms typically included in the agreement are the purchase price, the closing date, the amount of earnest money that the buyer must submit as a deposit, and the list of items that are and are not included in the sale.

An accounts receivable purchase agreement is a contract between a buyer and seller. The seller sells receivables to get cash up front, and the buyer has the right to collect the receivables from the original customer.

A purchase agreement is a legally binding contract between a buyer and seller. These agreements usually relate to the buying and selling of goods instead of services, and they can cover transactions for just about any type of product.

A Business Purchase Agreement is a contract used to transfer the ownership of a business from a seller to a buyer. It includes the terms of the sale, what is or is not included in the sale price, and optional clauses and warranties to protect both the seller and the purchaser after the transaction has been completed.

A purchase agreement is a type of contract that outlines terms and conditions related to the sale of goods. As a legally binding contract between buyer and seller, the agreements typically relate to buying and selling goods rather than services. They cover transactions for nearly any type of product.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

What Should I Include in a Sales Contract?Identification of the Parties.Description of the Services and/or Goods.Payment Plan.Delivery.Inspection Period.Warranties.Miscellaneous Provisions.