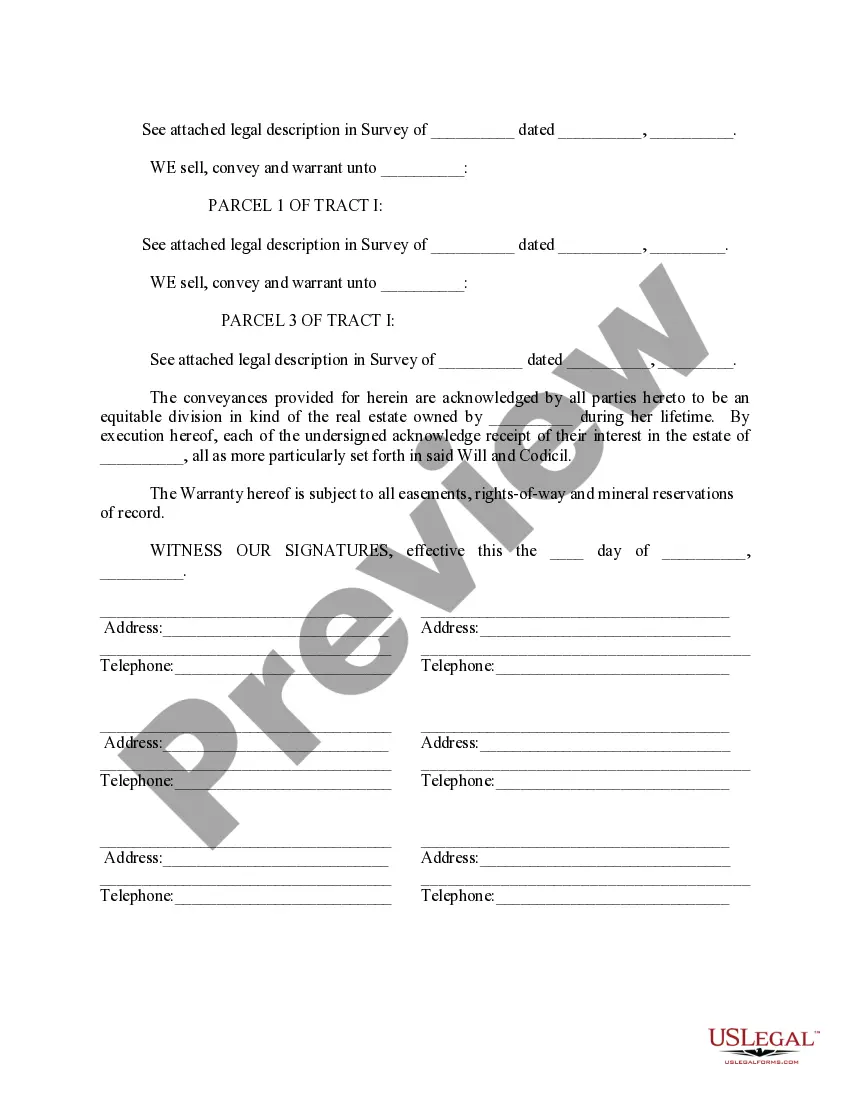

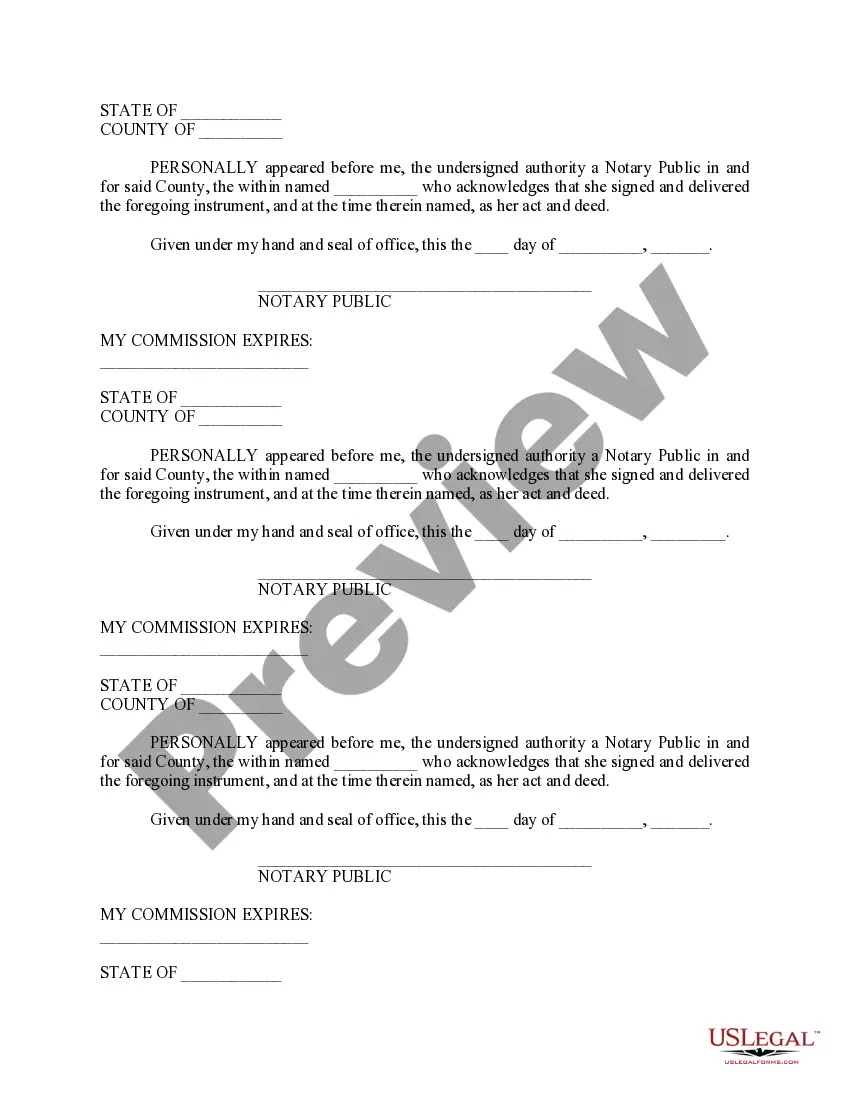

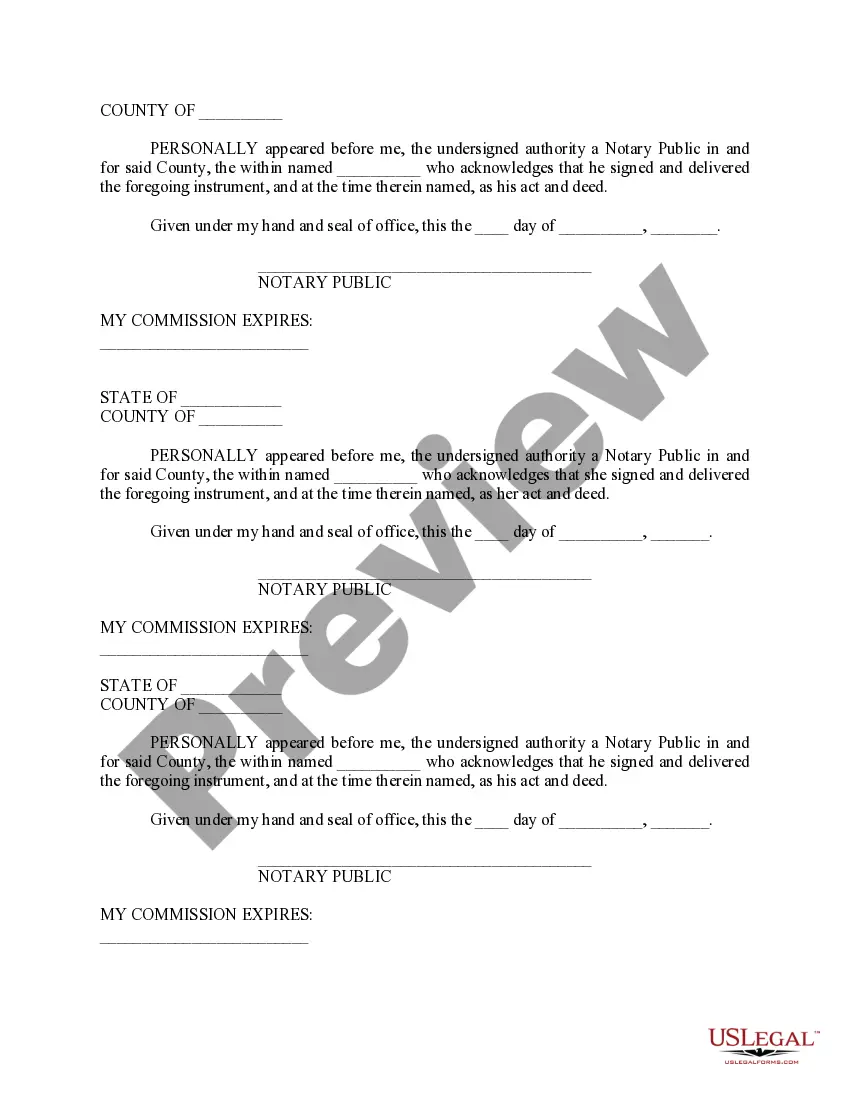

A Delaware Partition Warranty Deed is a legal document used in the state of Delaware to transfer ownership of real property (land or buildings) from one party to another with a guarantee that the property is free from any defects or encumbrances. It provides a warranty or promise to the buyer that the seller has full legal authority to sell the property and that there are no undisclosed claims, liens, or pending lawsuits against the property. The parties involved in a Delaware Partition Warranty Deed include the granter (seller) and the grantee (buyer). The granter is responsible for executing the deed and transferring ownership, while the grantee is the recipient of the property. The deed must be properly signed and notarized to be legally valid. In Delaware, there are two main types of Partition Warranty Deeds: 1. General Warranty Deed: This type of deed provides the highest level of guarantees to the grantee. The granter warrants that they have clear title to the property and will defend against any future claims by third parties. It offers the most protection to the buyer in terms of ownership rights. 2. Special Warranty Deed: A special warranty deed, also known as a limited warranty deed, guarantees only that the granter has not caused any defects in the title during the time they owned the property. It does not provide the same level of protection as a general warranty deed as it does not cover any potential defects or claims that existed before the granter's ownership. Both types of Delaware Partition Warranty Deeds are used when transferring property ownership. However, it is recommended for buyers to opt for a general warranty deed as it provides the highest level of protection against any potential title issues or disputes. When executing a Delaware Partition Warranty Deed, it is crucial to consult with a qualified attorney or a real estate professional familiar with Delaware real estate laws to ensure the process is conducted correctly and that all requirements are met. Additionally, conducting a thorough title search and obtaining title insurance can further protect the buyer's interests and provide peace of mind.

Delaware Partition Warranty Deed

Description

How to fill out Delaware Partition Warranty Deed?

Have you been in a place in which you require paperwork for sometimes company or individual uses almost every day? There are plenty of legal document themes available on the Internet, but getting versions you can trust is not effortless. US Legal Forms provides thousands of type themes, such as the Delaware Partition Warranty Deed, that are created to fulfill state and federal requirements.

Should you be previously familiar with US Legal Forms website and have a free account, merely log in. After that, you may down load the Delaware Partition Warranty Deed format.

Unless you provide an account and would like to start using US Legal Forms, follow these steps:

- Get the type you want and make sure it is to the proper town/state.

- Make use of the Review switch to review the form.

- See the outline to actually have chosen the correct type.

- In case the type is not what you are seeking, take advantage of the Search industry to find the type that suits you and requirements.

- If you discover the proper type, click on Get now.

- Opt for the pricing program you would like, fill out the specified details to produce your bank account, and pay for the order with your PayPal or bank card.

- Choose a practical data file structure and down load your copy.

Discover each of the document themes you have bought in the My Forms menu. You can aquire a further copy of Delaware Partition Warranty Deed whenever, if needed. Just click on the needed type to down load or print out the document format.

Use US Legal Forms, one of the most extensive collection of legal varieties, in order to save efforts and prevent mistakes. The services provides skillfully manufactured legal document themes that can be used for a variety of uses. Make a free account on US Legal Forms and commence producing your lifestyle a little easier.