The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

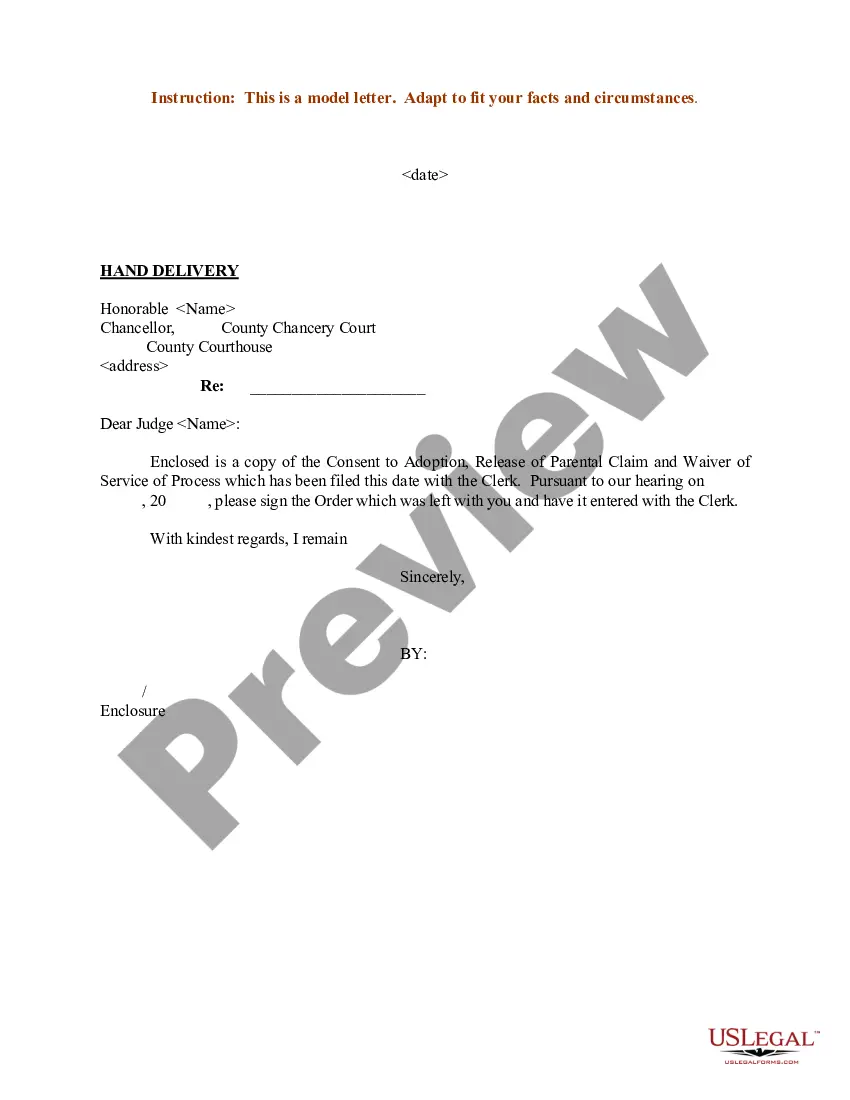

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

US Legal Forms - among the largest repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account in just a few minutes.

If you have a monthly subscription, Log In and retrieve the Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account from the US Legal Forms database. The Download button will appear on each form you review.

If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your desired pricing plan and provide your credentials to set up an account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the transaction. Choose the format and download the form to your device. Edit. Complete, modify, and print and sign the downloaded Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account.

Every template you add to your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you need.

Access the Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements and criteria.

- You can access all previously downloaded forms in the My documents section of your account.

- To use US Legal Forms for the first time, follow these simple steps to get started.

- Verify that you have chosen the correct form for your city/county.

- Click the Review button to examine the form's details.

- Check the form summary to ensure you have selected the correct document.

- If the form does not suit your needs, utilize the Search field at the top of the screen to find the one that does.

Form popularity

FAQ

One downside of naming a Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account is the potential tax implications. A trust may face higher tax rates compared to individuals, resulting in decreased benefits for your heirs. Additionally, the process can become more complex, requiring careful administration to comply with IRS rules. On a positive note, utilizing a trust can provide control over distribution and protect assets, so consider consulting with professionals to find the best path.

Indeed, a trust can serve as a beneficiary of a retirement account, and this can allow flexibility in how funds are distributed. When utilizing a Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you can define precise terms for beneficiaries while potentially optimizing tax outcomes. This method aligns well with estate planning strategies.

Generally, you do not transfer a retirement account directly into an irrevocable trust. However, naming the Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account is an excellent alternative. This strategy enables you to enjoy the advantages of trust management while keeping the account intact.

Several assets are typically not suitable for inclusion in an irrevocable trust. For instance, personal assets like primary residences and certain retirement accounts might be better held outside of the trust. If you are considering a Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, it's crucial to evaluate your entire asset portfolio.

Yes, an irrevocable trust can be named as the beneficiary of an IRA. Doing so allows for strategic distribution of the IRA’s assets according to the trust's terms. By choosing a Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you can ensure your heirs benefit from your retirement savings while adhering to tax rules.

You generally cannot place retirement accounts directly into an irrevocable trust. However, by naming the Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, you can effectively manage those assets without transferring them into the trust. This approach protects your retirement savings while offering control over distributions.

Naming a trust as a beneficiary of an IRA can complicate things significantly. The IRS rules may impose restrictions and tax implications that could diminish the trust's benefits. Instead, consider a Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, which can offer smoother management and potential tax advantages.

Naming a Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account can provide several advantages. This choice can help with estate planning, ensuring that your assets are distributed according to your wishes. Additionally, it might offer protection from creditors and facilitate smoother management of your assets for beneficiaries. Consider consulting a professional to discuss how this option can benefit you.

Filling out a beneficiary designation is a straightforward process. You will need to provide the name of your Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, along with its identification details. Make sure to specify the percentage of the account that your trust will receive. Confirm the information for accuracy before submitting the form.

Yes, a trust can be the beneficiary of a retirement account, but it must be set up carefully. Selecting a Delaware Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account grants unique tax advantages if executed properly. Trusts might provide benefits such as asset protection and control over distributions for heirs. For clarity and compliance, using tools and guidance from platforms like uslegalforms can help you craft a well-structured plan.