Delaware Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

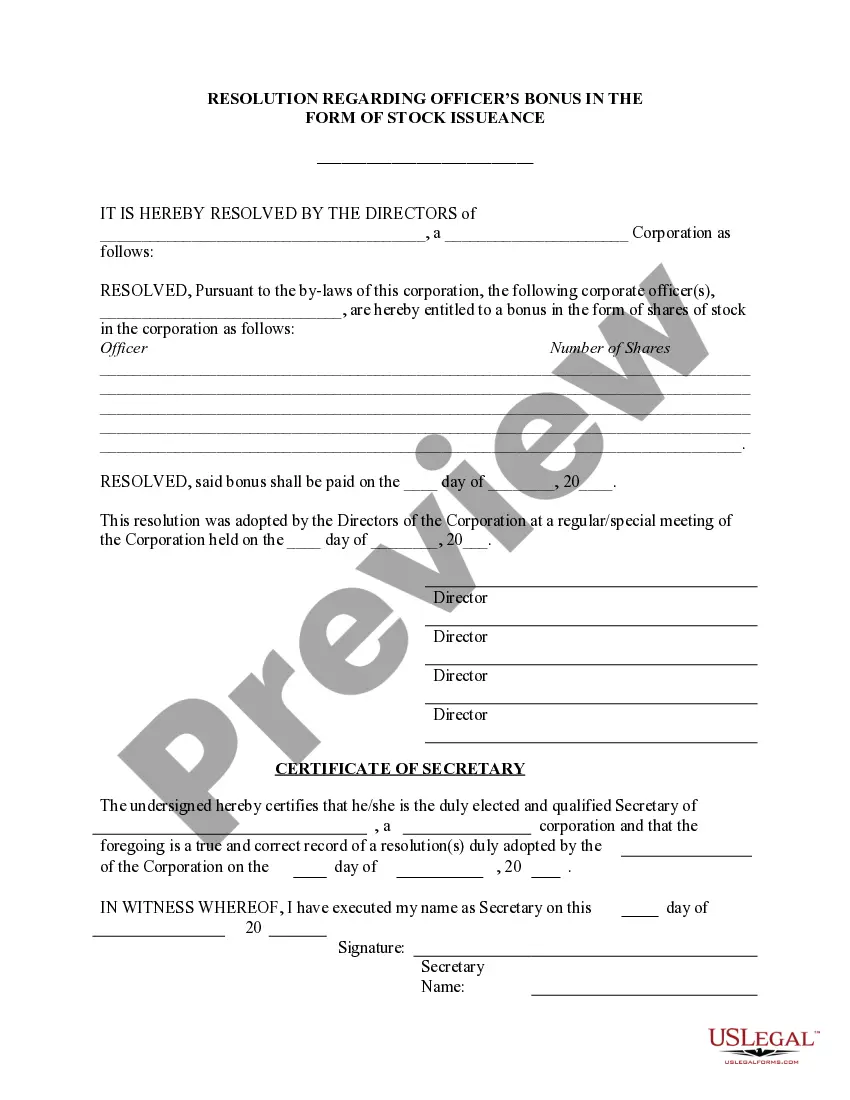

Selecting the appropriate legal document format can present challenges. Understandably, numerous templates are accessible online, but how can you locate the legal document you need.

Utilize the US Legal Forms website. This service provides thousands of templates, including the Delaware Revocable Trust for Asset Protection, suitable for both business and personal purposes.

All forms are verified by professionals to meet federal and state regulations.

Once you are convinced that the form is suitable, click the Purchase now button to acquire the document. Choose the pricing plan you wish and input the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document format to your device. Complete, edit, print, and sign the obtained Delaware Revocable Trust for Asset Protection. US Legal Forms is the largest repository of legal templates where you can access various document layouts. Take advantage of the service to download professionally prepared documents that comply with state requirements.

- If you are already registered, Log In to your account and click the Download button to secure the Delaware Revocable Trust for Asset Protection.

- Leverage your account to review the legal documents you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, follow these straightforward guidelines.

- First, ensure you have selected the appropriate document for your city/region. You can explore the form using the Review option and inspect the form overview to confirm it meets your needs.

- If the form does not fulfill your requirements, utilize the Search feature to find the correct document.

Form popularity

FAQ

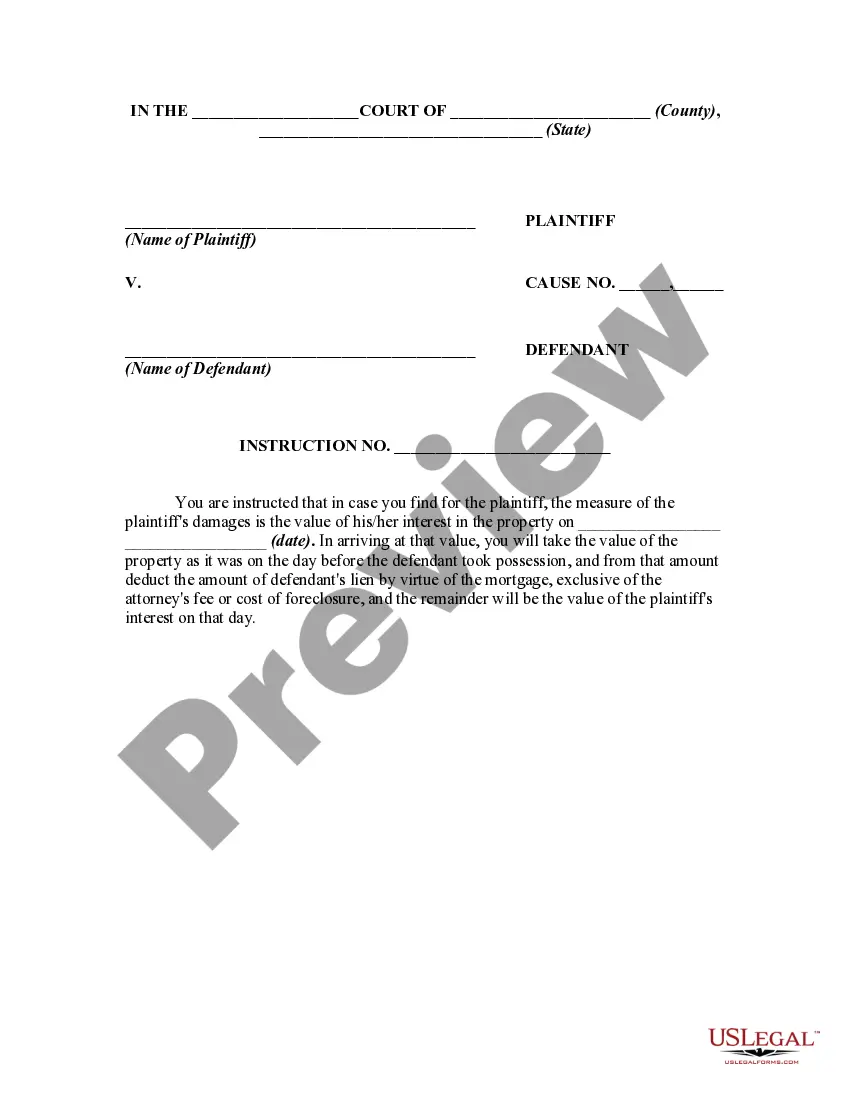

When considering asset protection, a Delaware asset protection trust stands out as one of the most effective options. This trust not only offers significant protection from creditors but also allows you flexibility in managing your assets. Additionally, a Delaware Revocable Trust for Asset Protection can complement this strategy, ensuring a smooth transfer of your assets while providing peace of mind. For personalized guidance, consider exploring the resources available through uslegalforms, which can help you set up the right trust for your needs.

While a Delaware Revocable Trust for Asset Protection is versatile, certain assets are best kept outside of it. For instance, retirement accounts, such as 401(k)s or IRAs, often have specific tax advantages that may be lost when placed in a trust. Additionally, any assets that you do not want to be included in your estate, like life insurance proceeds, should be handled separately. It's essential to consult with a knowledgeable advisor to determine the best strategies for your personal situation.

A Delaware asset protection trust is a legal arrangement designed to shield your assets from creditors while allowing you to maintain control. By placing your assets in this type of trust, you can achieve a higher level of security against potential lawsuits and claims. This trust takes advantage of Delaware's favorable laws, making it an attractive option for those prioritizing asset protection. A Delaware Revocable Trust for Asset Protection can further enhance these benefits while keeping your assets flexible.

A Delaware Revocable Trust for Asset Protection offers several benefits for safeguarding your assets. It allows you to manage and control your assets while enabling a smooth transition upon your passing. Because the trust remains revocable, you can modify its terms, ensuring your assets are distributed according to your wishes without going through public probate. This privacy feature is particularly valuable for individuals seeking to protect their estate from unnecessary public scrutiny.

One of the biggest mistakes parents make when establishing a trust fund is failing to clearly articulate their intentions in the trust document. This often leads to confusion among beneficiaries and can cause disputes later on. To avoid this pitfall, it is crucial to detail specific terms and conditions within the Delaware Revocable Trust for Asset Protection, ensuring that your wishes are clearly communicated. Consider consulting with US Legal Forms for guidance in this important process.

Writing a Delaware Revocable Trust for Asset Protection requires careful planning and consideration of your assets. Begin by outlining your objectives and determining which assets you want to protect. Then, draft a trust agreement that specifies how you want the trust to operate and who will manage it. To ensure legal sufficiency, utilizing resources like US Legal Forms can help you to create a robust and compliant trust.

Distributing assets from a Delaware Revocable Trust for Asset Protection is straightforward, as you have full control until your passing. Upon your death, the trustee you appoint will follow the instructions detailed in the trust document to distribute the assets to your designated beneficiaries. This process can save time and avoid probate, providing peace of mind for you and your loved ones. US Legal Forms offers templates to assist you in detailing these distributions.

To establish a Delaware Revocable Trust for Asset Protection, you must meet specific criteria. Generally, you need to be a resident of Delaware or own property there. Additionally, you should designate a trustee who will manage the trust and ensure that it operates according to your wishes. It's advisable to work with professionals to ensure all legal requirements are met correctly.

Setting up a Delaware Revocable Trust for Asset Protection involves several steps. First, you need to decide which assets to include in the trust. Next, you should create a trust document that outlines the terms and conditions of the trust. Finally, it's essential to have proper legal assistance to ensure that your trust complies with state laws and fully protects your assets, which is where US Legal Forms can be very helpful.

The Delaware Revocable Trust for Asset Protection is often considered the best option for safeguarding your assets. This structure allows you flexibility in managing your assets while providing a layer of protection from creditors. By choosing a revocable trust, you can maintain control over your assets during your lifetime while ensuring they are protected for your beneficiaries. Additionally, working with US Legal Forms can streamline the process of establishing your trust.