Delaware Financing Statement: Exploring its Purpose, Types, and Relevance Keywords: Delaware Financing Statement, UCC-1 form, secured transactions, collateral, public record, perfection, priority, debtor, creditor, UCC, personal property. Description: The Delaware Financing Statement is a crucial document filed with the Delaware Secretary of State under the Uniform Commercial Code (UCC). This statement serves as a public record, providing notice of a creditor's security interest in specific collateral of a debtor. By filing this statement, the creditor establishes their claim to the collateral, notifying other potential creditors of their interest. It is typically referred to as a UCC-1 form in Delaware. Types of Delaware Financing Statements: 1. General Delaware Financing Statement: This is the most common type of UCC-1 filing wherein the secured party files a comprehensive statement to establish their security interest in all present and future personal property collateral of the debtor. It covers a broad range of collateral, offering extensive protection to the creditor. 2. Specific Delaware Financing Statement: In contrast to a general statement, a specific financing statement is filed to cover a specific piece or category of collateral. Creditors may use this type when their interest is limited to a particular asset — for instance, a specific vehicle or equipment. 3. Amended Delaware Financing Statement: In cases where amendments, corrections, or changes are required to be made to the original financing statement, an amended statement is filed. This ensures that the most accurate information is reflected in the public record, avoiding any discrepancies or confusion. The Delaware Financing Statement is vital in securing the priority position of the creditor's claim over the collateral. It establishes a legal relationship between debtors and creditors, protecting the creditor's rights in case of default or insolvency. By perfecting their security interest through this statement, creditors establish a legally recognized priority over other potential claimants. This document contains critical information, including the names and addresses of both the debtor and creditor, a description of the collateral, and any other relevant terms or conditions of the security agreement. It is essential to ensure accuracy and completeness when filling out the Delaware Financing Statement to avoid jeopardizing the creditor's rights. In conclusion, the Delaware Financing Statement serves as a powerful tool for creditors to protect their interests in both tangible and intangible personal property. By filing the appropriate UCC-1 form, creditors establish their security interest and gain priority in the event of debtor default, insolvency, or competing claims. It secures transparency and fairness in secured transactions while providing notice to other interested parties that a creditor has a legitimate claim against the debtor's collateral.

Delaware Financing Statement

Description

How to fill out Delaware Financing Statement?

Are you in a circumstance where you require documents for both organizational or personal use on a daily basis.

There is a plethora of legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of form templates, including the Delaware Financing Statement, which are created to meet state and federal regulations.

If you find the right document, click Get now.

Select the pricing plan you prefer, fill out the necessary information to establish your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Delaware Financing Statement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

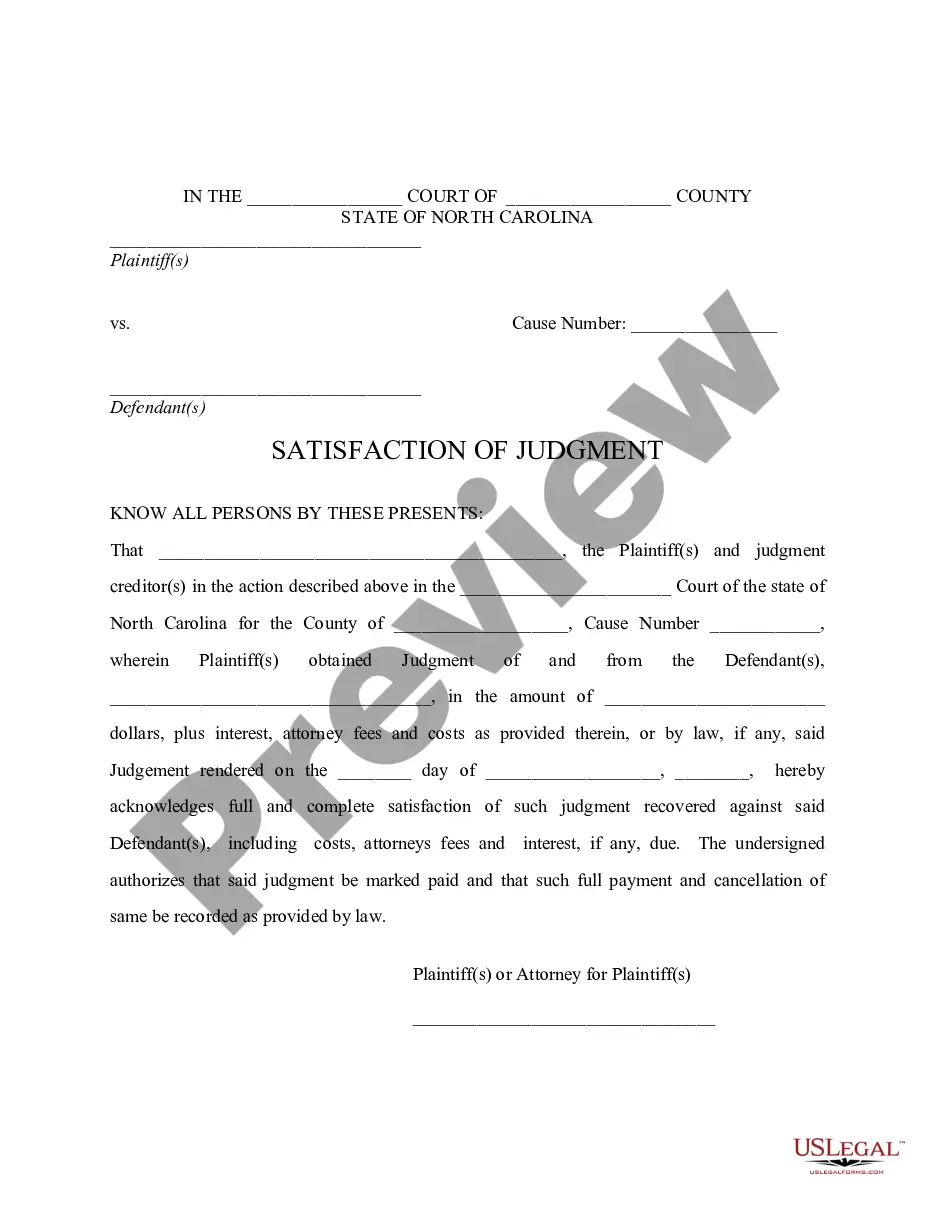

- Utilize the Preview button to review the form.

- Check the summary to guarantee you have selected the correct document.

- If the form does not meet your needs, use the Search field to find the form that aligns with your requirements.

Form popularity

FAQ

To file a financing statement in Delaware, you need to go through the Delaware Division of Corporations. You can file online or submit a paper form to ensure proper processing. It's crucial to follow the correct procedure to maintain your financing statement's legal validity. If you're unsure about the filing process, US Legal Forms offers easy access to forms and guidance tailored for Delaware Financing Statements.

1 Financing Statement in Delaware is a legal document that a secured party files to perfect a security interest in collateral. This statement provides public notice of the secured party's interest in the specified assets. By filing a Delaware Financing Statement, you protect your claim against third parties. This process is essential for businesses and individuals to secure their loans and other financial agreements.

To properly fill out a UCC-1 form, provide clear information about the debtor, including their name and address. Then, describe the collateral that is being secured in detail. Ensure that you follow all Delaware guidelines to create a valid Delaware Financing Statement, which can help avoid complications during future transactions.

The UCC, or Uniform Commercial Code, is a set of laws that governs commercial transactions in the United States. It aims to streamline and harmonize business regulations across states, making it easier for businesses to operate. In the context of a Delaware Financing Statement, the UCC outlines how secured transactions are handled, protecting both lenders and borrowers.

Filing a financing statement serves to publicly announce the secured party’s rights to specific collateral in the event of default. It creates a legal claim that protects the lender’s interests, ensuring they can recover the collateral if necessary. Thus, understanding how a Delaware Financing Statement works is vital for both lenders and borrowers.

To clear a UCC-1 Financing Statement, you need to file a UCC-3 termination statement. This is a form used to remove the financing statement from the public record. You must ensure that the termination is filed in the correct state where the original financing statement was submitted, hence the importance of understanding the Delaware Financing Statement process.

The financing statement can be located in the public records at the Delaware Secretary of State’s Office. You can also find it online through statewide databases that provide access to these documents. Using tools like US Legal Forms can ease your search, helping you navigate the necessary resources for locating a Delaware financing statement efficiently.

A financing statement typically consists of the debtor's name, the secured party's name, and a description of the collateral. It has a straightforward structure to ensure clarity and ease of understanding. When you create a Delaware financing statement through US Legal Forms, you can count on a professional layout that adheres to all legal requirements.

Yes, a financing statement is considered a public document. This means that anyone can access it to verify the security interests in a debtor’s assets. By filing a Delaware financing statement, you promote transparency and protect your interests, as potential buyers or lenders can clearly see any existing claims.

In Delaware, UCC financing statements are filed with the Delaware Secretary of State’s Office. This centralized location allows for easy access and verification of financing statements by all interested parties. Utilizing services like US Legal Forms can help you with the filing process, ensuring you complete it accurately and efficiently.