Delaware Option of Remaining Partners to Purchase

Description

How to fill out Option Of Remaining Partners To Purchase?

You can dedicate hours online trying to locate the legal document template that meets your federal and state requirements. US Legal Forms provides thousands of legal forms evaluated by experts.

It is easy to obtain or print the Delaware Option of Remaining Partners to Purchase from my service.

If you already possess a US Legal Forms account, you can sign in and click on the Download button. Afterward, you can complete, modify, print, or sign the Delaware Option of Remaining Partners to Purchase. Every legal document template you obtain is yours permanently.

Choose the pricing plan you want, enter your details, and register for a free account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, modify, sign, and print the Delaware Option of Remaining Partners to Purchase. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To get another copy of the purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/area of your choice.

- Review the form description to confirm you have chosen the appropriate document.

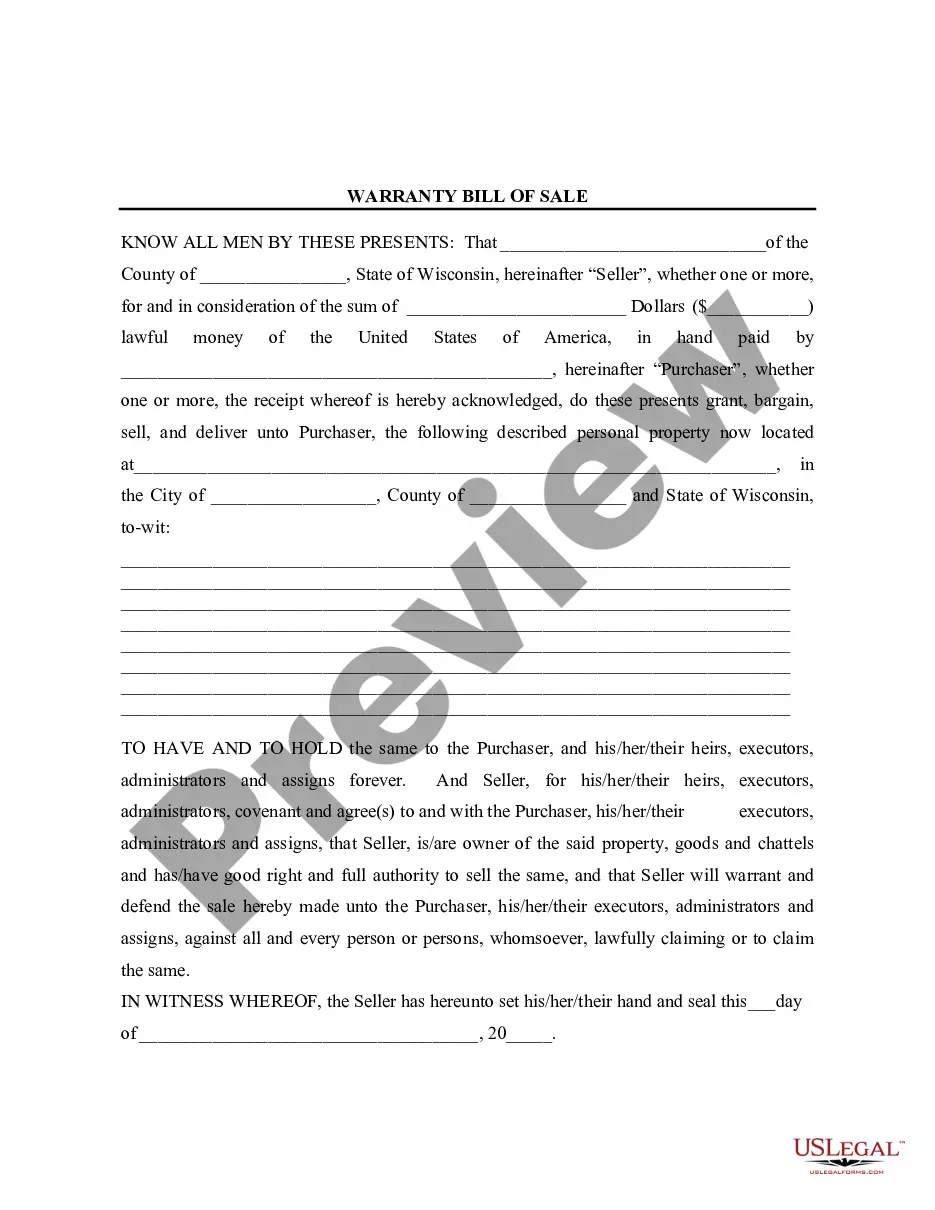

- If available, use the Preview button to review the document template as well.

- To find another version of the form, use the Search field to discover the template that fits your needs and requirements.

- Once you have found the template you desire, click Get now to proceed.

Form popularity

FAQ

Delaware does not require general partnerships to file formal paperwork; however, it is beneficial to document your partnership agreement. For LLCs, filing with the Delaware Secretary of State is necessary, including any changes in membership. Utilizing services like USLegalForms can help ensure compliance with all legal requirements.

Domestic (California) limited partnerships: To cancel the Certificate of Limited Partnership of a California limited partnership (LP), the LP must file a Certificate of Dissolution (Form LP-3) and Certificate of Cancellation (Form LP-4/7).

Description. The Uniform Partnership Act of 1997 (UPA) modernizes the Uniform Partnership Act of 1914, adopted in every state except Louisiana. It establishes a partnership as a separate legal entity, and not merely as an aggregate of individual partners.

Under Section 17-801 of the DRULPA, a Delaware limited partnership will voluntarily dissolve upon the occurrence of certain events, including: (i) at a time specified in the limited partnership agreement; (ii) upon the happening of events specified in the limited partnership agreement; or (iii) the vote of at least two

This is a clear and straightforward process. Surrender your share certificate to the Corporation's transfer agent. Wait for the transfer agent to issue a certificate to a new shareholder, thereby transferring the shares. Waif for the transfer agent to cancel your old certificate.

The following states have adopted the RUPA: Alabama, Alaska, Arizona, Arkansas, California, Colorado, Delaware, District of Columbia, Florida, Hawaii, Idaho, Illinois, Iowa, Kansas, Kentucky, Maine, Maryland, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Dakota, Oklahoma, Oregon,

Steps to Cancel a Delaware LLCConsult the LLC Operating Agreement.Take a Member Vote.Appoint a Manager to Wind up the LLC's Affairs.Payoff Creditors, Current and Forseeable, before paying Members.Pay The Delaware Franchise Tax.Pay the LLC's members.File a Certificate of Cancellation.More items...

One major example of how the UPA and RUPA differ is their treatment of a partnership as an organization. The UPA treats the partnership as an aggregate, while the RUPA treats a partnership as an entity. While this difference may appear to be subtle, it has major implications on the running of a partnership.

It was adopted by all states except for Louisiana, a state which has a history of establishing its own laws. The Uniform Partnership Act of 1997 is a modern form and was later adopted by all states except Louisiana.

A limited partnership must have at least one general partner and at least one limited partner. The principal distinguishing feature of a limited partnership is that the limited partners are not personally liable for the debts and obligations of the partnership. The general partner remains fully liable.