Delaware Non-Disclosure Agreement for Merger or Acquisition

Description

How to fill out Non-Disclosure Agreement For Merger Or Acquisition?

Selecting the appropriate legal document template can be challenging. It goes without saying that there are numerous options available online, but how can you acquire the legal form you need.

Make use of the US Legal Forms website. The platform offers thousands of templates, including the Delaware Non-Disclosure Agreement for Merger or Acquisition, which can be utilized for both business and personal purposes.

All documents are reviewed by experts and comply with federal and state regulations.

If the form does not meet your requirements, utilize the Search field to find the suitable form. Once you are sure the form is correct, proceed to click the Buy now button to obtain it. Select your preferred pricing plan and enter the required information. Create your account and complete your purchase using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, modify, and print and sign the acquired Delaware Non-Disclosure Agreement for Merger or Acquisition. US Legal Forms is indeed the largest collection of legal forms where you can find numerous document templates. Use the service to acquire professionally crafted papers that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Download button to access the Delaware Non-Disclosure Agreement for Merger or Acquisition.

- Access your account to browse through the legal forms you have purchased previously.

- Navigate to the My documents section of your account to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your state/region.

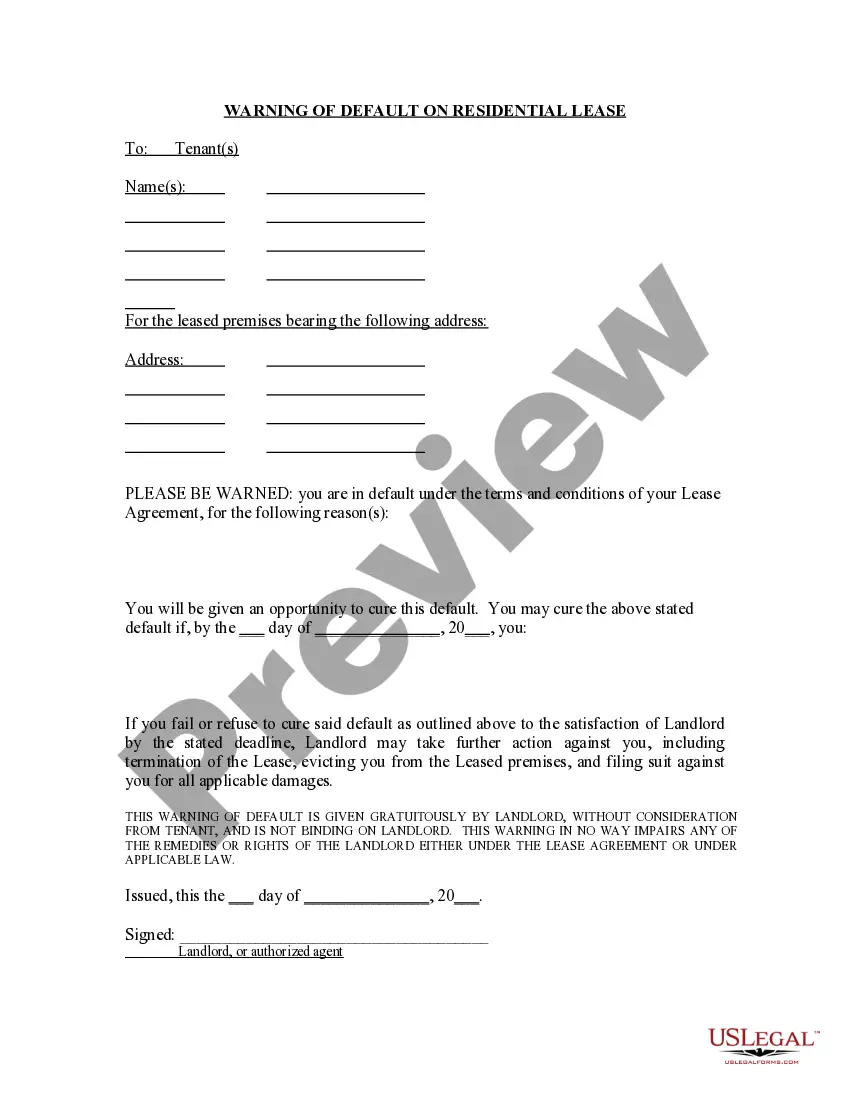

- You can examine the form using the Review option and read its description to confirm it suits your needs.

Form popularity

FAQ

Filling out a Delaware Non-Disclosure Agreement for Merger or Acquisition involves several key steps. First, identify the parties involved and provide their names and addresses. Next, specify the confidential information you wish to protect, ensuring the language is clear and precise. Lastly, include the duration of the confidentiality obligation, along with any other relevant terms. For a seamless process, consider using the uslegalforms platform, which offers templates and guidance tailored to your needs.

Obtaining a non-disclosure agreement is straightforward. You can draft one yourself, use a template, or consult a legal professional for assistance. Platforms like US Legal Forms offer ready-made Delaware Non-Disclosure Agreements for Merger or Acquisition, saving you time and ensuring compliance with legal standards. It is essential to choose a reliable source to ensure your agreement is effective and comprehensive.

Yes, you can create your own non-disclosure agreement. However, it is important to ensure that the document covers all necessary terms and conditions specific to your situation. A well-crafted Delaware Non-Disclosure Agreement for Merger or Acquisition can protect your confidential information effectively. You may want to consider using online resources or templates to help guide you through the process.

Determining the best state law for an NDA often depends on your business needs and the specific circumstances of your agreement. Delaware is considered favorable due to its well-established legal framework for corporate agreements and confidentiality. Utilizing a Delaware Non-Disclosure Agreement for Merger or Acquisition can provide you with robust protection and legal clarity when engaging in significant business transactions.

Delaware does have self-defense laws that permit individuals to protect themselves under certain circumstances. While this pertains primarily to personal safety, it's essential to understand the context of legal protection in business as well. When it comes to your business dealings, a Delaware Non-Disclosure Agreement for Merger or Acquisition can shield your organization from breaches and ensure your information remains safeguarded.

The rules governing an NDA typically include the definition of confidential information, the obligations of the receiving party, and the duration of confidentiality. Additionally, it often outlines the permitted disclosures and any consequences for breach. Crafting a detailed Delaware Non-Disclosure Agreement for Merger or Acquisition can help you establish a strong legal framework for your confidentiality needs.

An NDA, or Non-Disclosure Agreement, focuses on the protection of sensitive information disclosed between parties. In contrast, an MNDA, or Mutual Non-Disclosure Agreement, involves reciprocal confidentiality where both parties share and protect their information equally. Choosing a Delaware Non-Disclosure Agreement for Merger or Acquisition ensures clarity in protecting your specific interests.

An NDA for merger or acquisition is a legal document that ensures that parties involved do not disclose proprietary information to outsiders. This agreement is crucial during negotiations, ensuring that trade secrets and financial data remain confidential. Engaging in a Delaware Non-Disclosure Agreement for Merger or Acquisition allows businesses to explore opportunities while protecting their interests.

In Delaware, the law regarding Non-Disclosure Agreements reflects a balance between protecting business interests and ensuring fairness. Delaware courts generally uphold NDAs as long as they are reasonable in scope and purpose. A properly structured Delaware Non-Disclosure Agreement for Merger or Acquisition aligns with state regulations, safeguarding sensitive information.

Yes, Non-Disclosure Agreements (NDAs) are generally enforceable in the United States, provided they meet specific legal criteria. The enforceability can vary depending on state laws. A well-drafted Delaware Non-Disclosure Agreement for Merger or Acquisition helps ensure that confidential information remains protected, promoting trust between parties involved.