Delaware Pledge of Shares of Stock is a legal agreement that allows shareholders to secure a loan by pledging their shares of stock as collateral. This document is commonly used in Delaware, a state renowned for its favorable corporate laws and business-friendly environment. The Delaware Pledge of Shares of Stock creates a lien on the shares, providing security to the lender against default on the loan. It outlines the terms and conditions of the pledge arrangement, including the number and type of shares pledged, the loan amount, interest rate, repayment terms, and default provisions. The pledge agreement ensures that the lender has the right to take ownership of the pledged shares if the borrower fails to meet the repayment obligations. This means that the lender can sell the shares to recover the outstanding debt if necessary. In Delaware, two prominent types of Pledge of Shares of Stock exist — the legal and beneficial pledge. The legal pledge involves a transfer of legal title of the shares to the lender, while the beneficial pledge allows the borrower to retain legal title but grants the lender the right to manage and sell the shares in case of default. Delaware's legal framework offers considerable flexibility in structuring Pledge of Shares of Stock agreements. For instance, shareholders can pledge a portion or all of their shares, including common or preferred stock, voting or non-voting shares. The Delaware Pledge of Shares of Stock provides protection to both the borrower and the lender. It allows shareholders to obtain financing without relinquishing control over their shares. Simultaneously, lenders gain assurance that they will be able to recover their investment if the borrower defaults on the loan. This type of pledge has become popular among entrepreneurs, venture capitalists, and investors, as it serves as a valuable tool for raising capital, acquiring business loans, and securing personal financial obligations. Overall, the Delaware Pledge of Shares of Stock is a versatile legal instrument enabling shareholders to leverage their stock holdings while providing lenders with an added layer of security. By pledging their shares, shareholders can access funds for various purposes, including working capital, expansion initiatives, and personal investments, bolstering entrepreneurship and business growth in Delaware's vibrant corporate landscape.

Delaware Pledge of Shares of Stock

Description

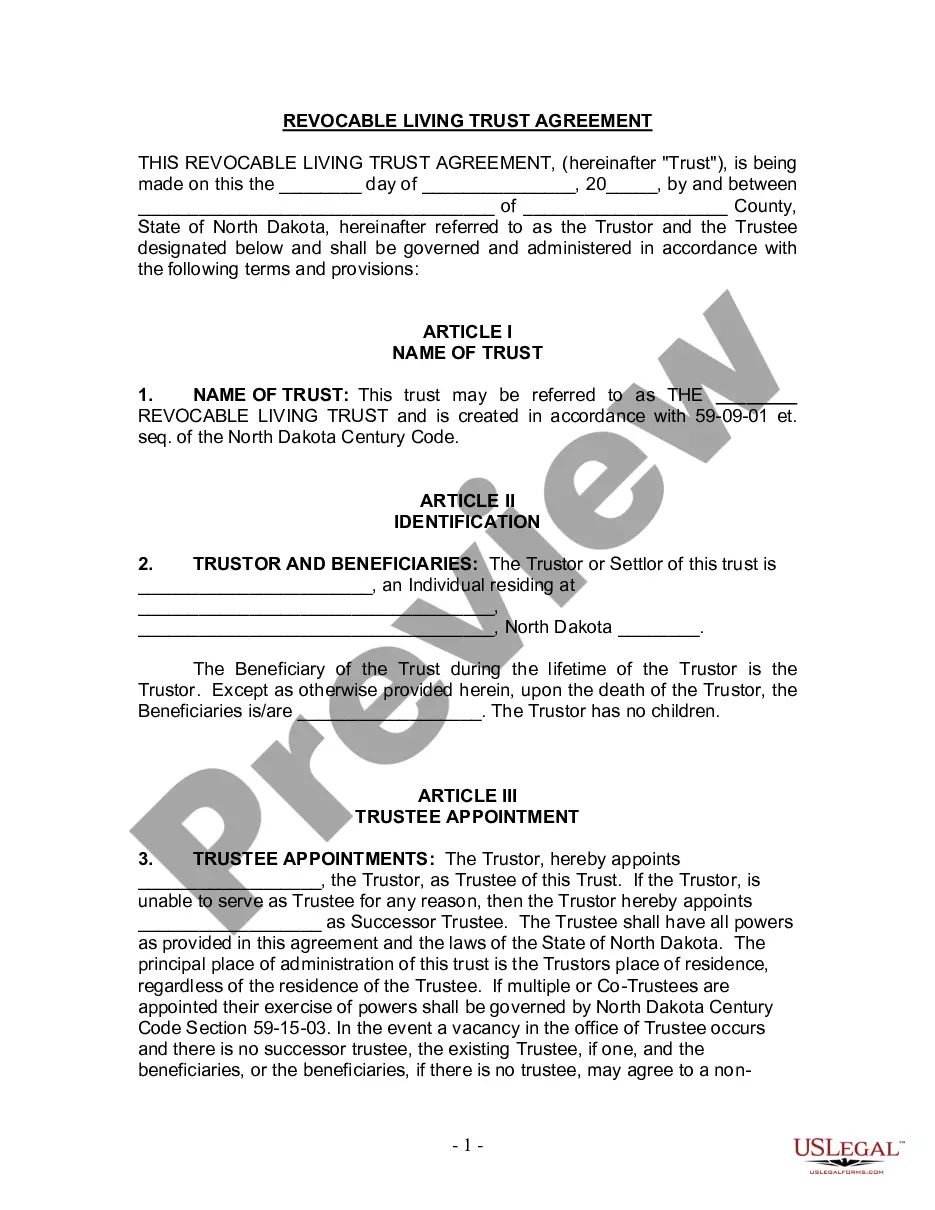

How to fill out Delaware Pledge Of Shares Of Stock?

If you need to acquire, download, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search option to find the documents you need. Various templates for business and personal purposes are categorized by types and states, or keywords.

Use US Legal Forms to obtain the Delaware Pledge of Shares of Stock with just a few clicks.

Every legal document template you purchase is yours indefinitely. You will have access to every form you downloaded in your account. Just select the My documents section and choose a form to print or download again.

Complete and download, and print the Delaware Pledge of Shares of Stock using US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to access the Delaware Pledge of Shares of Stock.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to review the form's content. Remember to check the outline.

- Step 3. If you are not satisfied with the type, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have identified the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it onto your device.

- Step 7. Complete, modify, and print or sign the Delaware Pledge of Shares of Stock.

Form popularity

FAQ

Disadvantage: Shareholder Risks When a borrower who pledged stock defaults on a loan, the lender can sell the shares. If the pledge involves a substantial number of shares, the sale can depress the stock price and therefore disadvantage other shareholders.

Can I sell pledged stocks? Shares on Margin Pledge in case sold would attract penalty. Thus it is advised to first un-pledge the shares kept on margin pledge before initiating a sell transaction and it would take 1 day for getting the shares un-pledge.

A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged. Pledged assets can include cash, stocks, bonds, and other equity or securities.

Visit the holdings page on Console . In the holdings table, hover the cursor on the stock you want to pledge and click on 'options' and select pledge for margins . Once you do, you will get a pop-up, which will show how much margins you will be eligible for.

The customer needs to select the shares and their quantity to be pledged and submit the online request. Once the request is submitted, the customer receives an email from the clearing corporation. The customer then needs to authorise the pledge request to be able to activate it.

This is a clear and straightforward process. Surrender your share certificate to the Corporation's transfer agent. Wait for the transfer agent to issue a certificate to a new shareholder, thereby transferring the shares. Waif for the transfer agent to cancel your old certificate.

Pledging simply means taking loans against the shares that one holds. Shares are considered a type of asset. They act as a collateral against loans. Any individual or institution that holds shares can pledge them.

Pledging of shares is an arrangement in which the promoters of a company use their shares as collateral to fulfil their financial requirements. Pledging of shares is common for companies that have high shares owned by investors.

Pledging simply means taking loans against the shares that one holds. Shares are considered a type of asset. They act as a collateral against loans. Any individual or institution that holds shares can pledge them.

In simple words, pledging of shares means taking loans against the shares that one holds. Shares are considered assets. Pledging of shares is a way for the promoters of a company to get loans to meet their business or personal requirements by keeping their shares as collateral to lenders.

Interesting Questions

More info

SPRINGDALE, NY (February 13th, 2017) — At Shareholders' Meeting this afternoon, the Shareholders adopted a pledge to “stand committed as a community to the shared long-term interests of all Shareholders, including our community's small businesses and retirees,” and approved the new Pledge for the Shareholder's Membership. This new pledge is part of the Shareholders' Program's vision for our entire community, and it reflects the new share-sharing economy of our future. The Pledge to “Stand Commitmented as a Community to the Shared Long-Term Interests of All Shareholders” and the new Pledge will be the focus of a series of shareholder events, which are scheduled to begin in the coming weeks. About Shareholders' Meeting Today's Shareholders' Meeting is the first in a series of shareholder events planned by Shareholders' Fund, the sponsor of the Shareholders' Program.