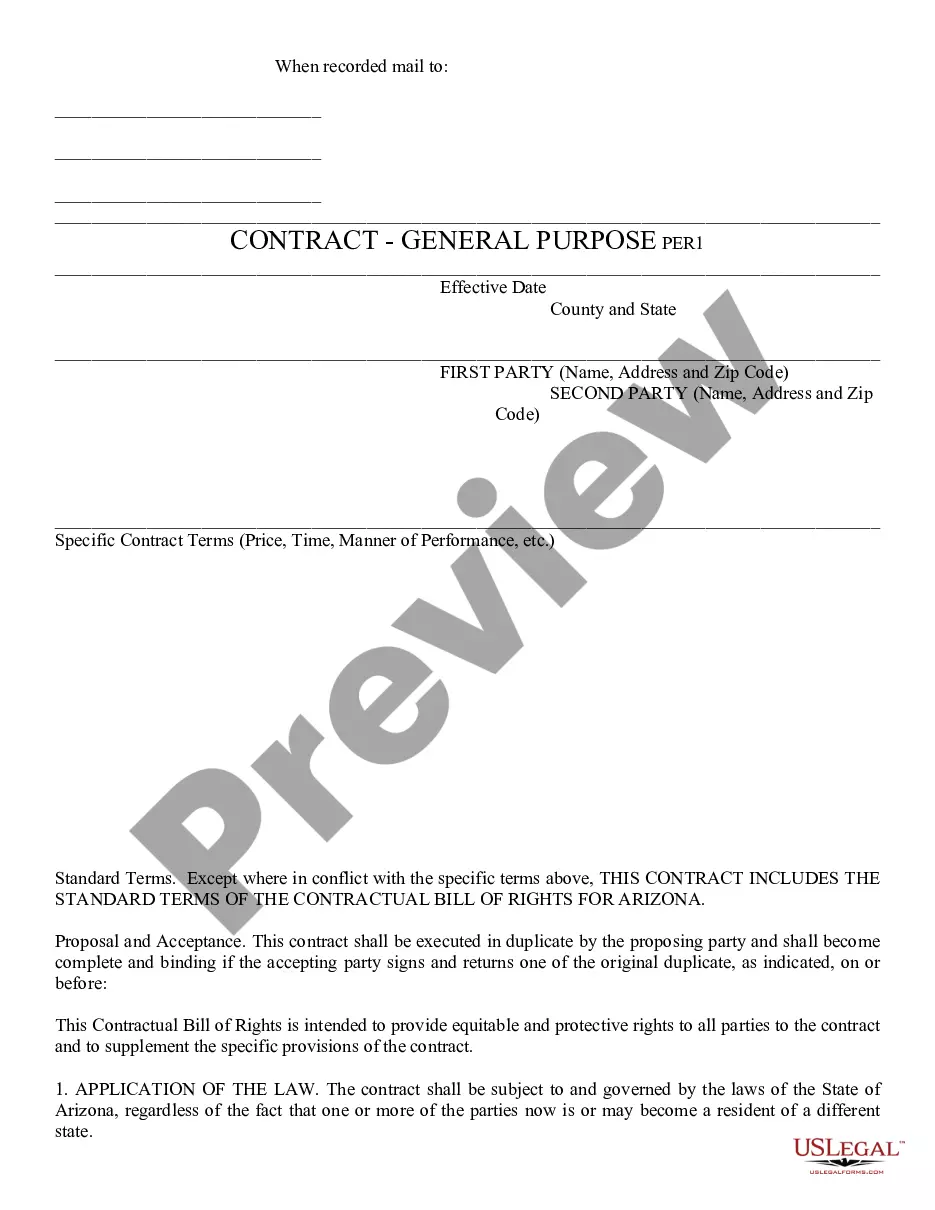

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Agreement between Mortgage Brokers to Find Acceptable Lender for Client

Description

How to fill out Agreement Between Mortgage Brokers To Find Acceptable Lender For Client?

If you wish to total, acquire, or print lawful file themes, use US Legal Forms, the largest selection of lawful forms, which can be found on the web. Utilize the site`s easy and practical search to discover the files you need. A variety of themes for company and person uses are categorized by classes and claims, or keywords. Use US Legal Forms to discover the Delaware Agreement between Mortgage Brokers to Find Acceptable Lender for Client with a few mouse clicks.

Should you be already a US Legal Forms customer, log in for your accounts and then click the Obtain option to get the Delaware Agreement between Mortgage Brokers to Find Acceptable Lender for Client. You may also accessibility forms you in the past acquired from the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the form to the correct metropolis/region.

- Step 2. Take advantage of the Review method to look over the form`s information. Never forget to read through the information.

- Step 3. Should you be unhappy using the type, use the Search industry near the top of the monitor to find other types of the lawful type format.

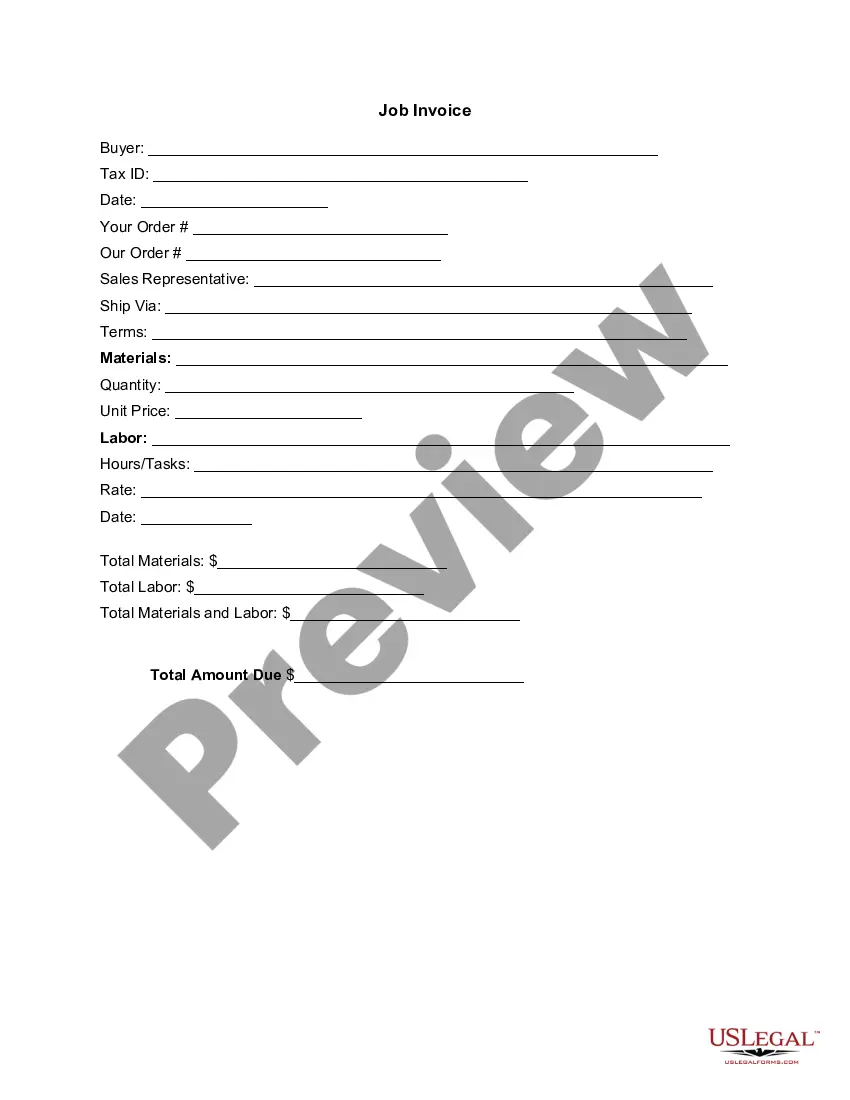

- Step 4. Once you have located the form you need, go through the Buy now option. Opt for the pricing plan you favor and add your accreditations to register to have an accounts.

- Step 5. Method the purchase. You can utilize your bank card or PayPal accounts to complete the purchase.

- Step 6. Find the file format of the lawful type and acquire it on your own product.

- Step 7. Comprehensive, modify and print or signal the Delaware Agreement between Mortgage Brokers to Find Acceptable Lender for Client.

Every lawful file format you buy is yours for a long time. You possess acces to each type you acquired inside your acccount. Go through the My Forms portion and decide on a type to print or acquire again.

Compete and acquire, and print the Delaware Agreement between Mortgage Brokers to Find Acceptable Lender for Client with US Legal Forms. There are thousands of skilled and condition-certain forms you may use to your company or person needs.

Form popularity

FAQ

A lender is a financial institution that makes loans directly to you. A broker does not lend money. A broker finds a lender. A broker may work with many lenders.

When borrowers work with a loan officer, they deal directly with the institution that will lend them money. When borrowers work with a mortgage broker, they work with a third party. The broker merely facilitates the process between the borrower and the lender.

When you're looking to buy a home, there are many people who can help you along the way. Two of the most important allies a homebuyer can have are a real estate agent, to help you find the right property, and a lender, to help you finance the purchase.

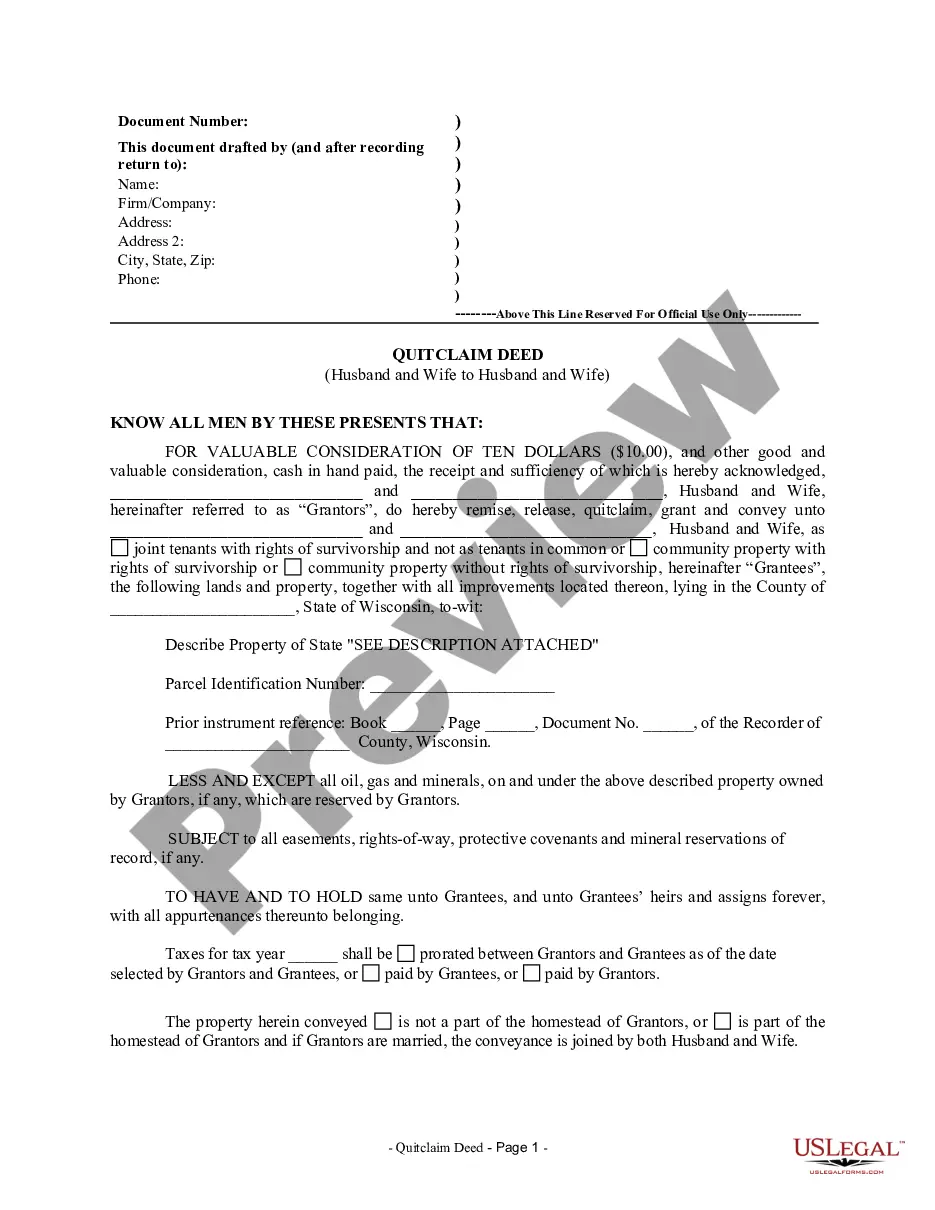

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Finance Brokers are the Agent of the Borrower Not the Lender - Elliott May.

In real estate, the most common example of fiduciary duty is the relationship between the real estate agent and their client. But other parties, including the escrow agent and any attorneys involved in the transaction, also have a fiduciary duty to the individuals they represent.

The main difference between a mortgage broker and lender is a broker doesn't lend you money. Instead, a mortgage broker helps you find the most suitable lender for your home purchase. A mortgage lender then provides the loan to you to buy the property.

A mortgage broker agreement is a contract that outlines the terms of service and compensation, typically between a bank and a mortgage company or brokerage. Both parties sign this document before any work begins, ensuring that expectations are clear from the beginning.