The Delaware Agreement of Shareholders of a Close Corporation with Management by Shareholders is a legal document that outlines the rights, responsibilities, and governance structure of a close corporation in Delaware. This agreement is specifically designed for close corporations where the shareholders themselves take part in the management of the company. Here, the shareholders not only hold ownership stakes but are also involved in day-to-day decision-making and strategic planning. Keywords: Delaware, Agreement of Shareholders, Close Corporation, Management, Shareholders, Rights, Responsibilities, Governance, Ownership, Decision-making, Strategic planning. This type of agreement is crucial for establishing a clear framework for communication, decision-making, profit distribution, and dispute resolution among the shareholders who actively participate in the management of the corporation. The agreement helps ensure that the company operates smoothly and that the interests of all involved parties are protected. Different Types: 1. Shareholders' Rights and Responsibilities: This section of the agreement specifies the specific rights and responsibilities of the shareholders, such as voting rights, financial contributions, and obligations towards the company. It also outlines the limits and powers of the shareholders in terms of making important decisions and appointments within the corporation. 2. Management Structure: This component describes the management structure of the close corporation. It may include details on the roles and responsibilities of the shareholders in managing various aspects of the company, such as finance, marketing, operations, and human resources. 3. Decision-making Process: This part of the agreement outlines the decision-making process within the close corporation. It may define how important decisions are made, whether through consensus, majority vote, or weighted voting. It also specifies the frequency and manner of meetings, including shareholders' meetings and board meetings. 4. Profit Distribution: The agreement may include provisions regarding profit distribution among the shareholders. It may outline the criteria for profit allocation, such as equal or proportionate distribution, or based on certain performance metrics. It may also include details on dividends, bonuses, or reinvestment of profits. 5. Dispute Resolution: This section focuses on resolving conflicts and disputes that may arise among the shareholders. It may include procedures for mediation, arbitration, or litigation in case of disagreements or breaches of the agreement. The goal is to provide a mechanism for resolving disputes swiftly and fairly to ensure the corporation's stability and longevity. In conclusion, the Delaware Agreement of Shareholders of a Close Corporation with Management by Shareholders is a critical legal document that provides a comprehensive framework for the governance and management of a close corporation. It ensures that the rights, responsibilities, and interests of all participating shareholders are clearly defined and protected.

Delaware Agreement of Shareholders of a Close Corporation with Management by Shareholders

Description

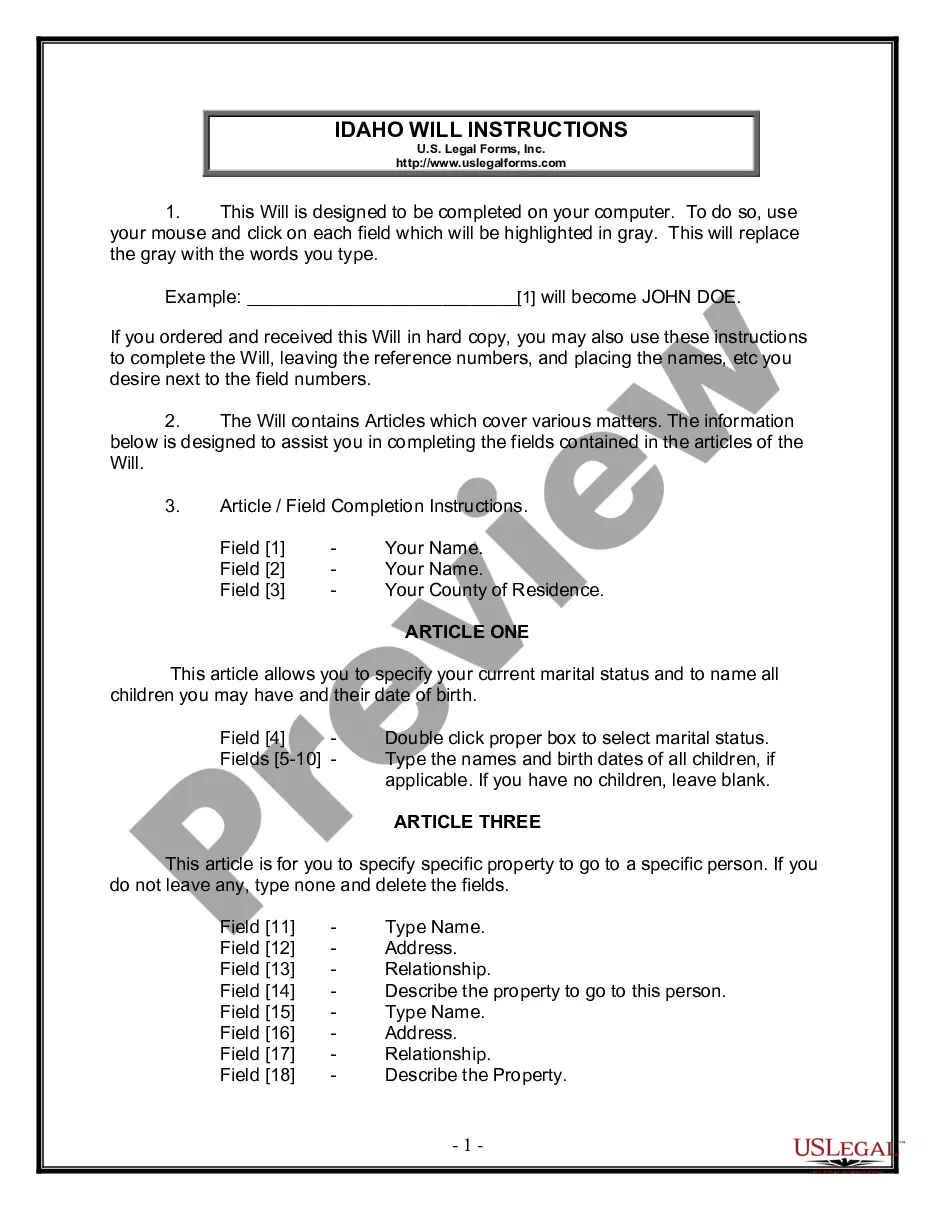

How to fill out Delaware Agreement Of Shareholders Of A Close Corporation With Management By Shareholders?

Are you in the placement where you require documents for either organization or individual purposes virtually every day? There are tons of legitimate file themes accessible on the Internet, but getting kinds you can depend on is not easy. US Legal Forms offers thousands of develop themes, like the Delaware Agreement of Shareholders of a Close Corporation with Management by Shareholders, that happen to be written to meet state and federal requirements.

Should you be previously knowledgeable about US Legal Forms web site and possess a merchant account, simply log in. Following that, you are able to obtain the Delaware Agreement of Shareholders of a Close Corporation with Management by Shareholders design.

Should you not offer an bank account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is for the proper town/area.

- Utilize the Review key to examine the shape.

- Look at the information to ensure that you have selected the proper develop.

- In the event the develop is not what you are searching for, utilize the Look for area to obtain the develop that suits you and requirements.

- If you find the proper develop, click Acquire now.

- Opt for the pricing prepare you need, complete the required details to generate your bank account, and pay for an order using your PayPal or Visa or Mastercard.

- Decide on a convenient data file structure and obtain your backup.

Discover all the file themes you may have bought in the My Forms menu. You can aquire a more backup of Delaware Agreement of Shareholders of a Close Corporation with Management by Shareholders any time, if necessary. Just click the essential develop to obtain or print out the file design.

Use US Legal Forms, probably the most considerable assortment of legitimate types, to save lots of time and steer clear of blunders. The services offers professionally produced legitimate file themes which can be used for an array of purposes. Make a merchant account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

Issuer 251(g) Merger Event means a merger of an Issuer pursuant to which such Issuer becomes a wholly-owned subsidiary of a holding company; provided that such merger satisfies each of the following conditions: (a) Persons that ?beneficially owned? (within the meaning of Section 13(d) of the Exchange Act and the rules ...

Delaware General Corporation Law Section 220 permits a stockholder (who complies with the ?form and manner? requirements of making a demand) to access corporate books and records for a ?proper purpose??which, most commonly, is to investigate suspected corporate wrongdoing (such as potential fiduciary breaches by ...

Section 225 - Contested election of directors; proceedings to determine validity (a) Upon application of any stockholder or director, or any officer whose title to office is contested, the Court of Chancery may hear and determine the validity of any election, appointment, removal or resignation of any director or ...

(a) Every corporation may at any meeting of its board of directors or governing body sell, lease or exchange all or substantially all of its property and assets, including its goodwill and its corporate franchises, upon such terms and conditions and for such consideration, which may consist in whole or in part of money ...

(a) Whenever stockholders are required or permitted to take any action at a meeting, a notice of the meeting in the form of a writing or electronic transmission shall be given which shall state the place, if any, date and hour of the meeting, the means of remote communications, if any, by which stockholders and proxy ...

(a) Any 2 or more corporations of this State may merge into a single surviving corporation, which may be any 1 of the constituent corporations or may consolidate into a new resulting corporation formed by the consolidation, pursuant to an agreement of merger or consolidation, as the case may be, complying and approved ...

How does Delaware law define a controlling stockholder? Typically, a stockholder is ?controlling? if the stockholder owns more than 50% of the voting power in a corporation or ?exercises control over the business affairs of the corporation.? Kahn v.

Section 228 rules that unless otherwise described in a company's certificate of incorporation, shareholders have the right to proceed with any action that would typically be done at a meeting of shareholders, but are not required to have a meeting, give prior notice or hold a vote.