Subject: Delaware Company Stock Transfer — Downloadable Sample Letter to Client Dear [Client's Name], We hope this letter finds you in good health and high spirits. We are reaching out to provide you with guidance regarding stock transfer procedures for Delaware companies. In this email, we will outline the necessary steps involved in facilitating a stock transfer, ensuring a seamless transition of shares ownership within the Delaware corporate framework. Delaware, known for its business-friendly environment and well-established legal system, is a popular choice for incorporating many companies. The state offers significant advantages in terms of corporate governance and shareholder protection, making it a preferred jurisdiction for businesses of all sizes. When it comes to stock transfer, it is essential to adhere to the legal and procedural requirements meticulously. Following are the key steps involved in the process: 1. Confirm the Transferor and Transferee Information: — Obtain the complete legal name, address, and contact details of both the transferor (current shareholder) and the transferee (the new potential shareholder). — Ensure the accuracy of the information to avoid any difficulties during the transfer process. 2. Verify the Corporate Documentation: — Verify the company's bylaws, operating agreement, or shareholders' agreement to identify specific provisions related to stock transfer restrictions, consent requirements, or preemptive rights. — Review the stock certificates or other evidence of ownership to ensure they are valid and properly executed. 3. Prepare the Stock Transfer Agreement: — Draft a stock transfer agreement that outlines the transfer terms and conditions. — Include the details of the shares being transferred, transferor and transferee information, purchase price (if applicable), and any other relevant provisions. — Seek legal counsel to ensure compliance with Delaware corporate laws and regulations. 4. Obtain Board of Directors' Approval (if Required): — If the company's governing documents or Delaware law require board approval for stock transfers, arrange a board meeting or obtain written consent from directors. — Document the board's approval or consent within the stock transfer agreement. 5. Update Shareholder Records: — Once the stock transfer agreement is executed, update the company's shareholder records and stock transfer ledger. — Issue new stock certificates to the transferee or update electronic records accordingly. Please note that this letter contains general guidance, and each stock transfer may have unique circumstances or requirements. Therefore, we strongly recommend seeking legal advice from a qualified attorney to ensure compliance and adherence to Delaware corporate laws specific to your company's situation. Attached to this email, you will find a downloadable sample letter to assist you in commencing the stock transfer process. This template can serve as a reference point, but it's important to tailor it to your specific requirements and consult with your legal counsel. We are always here to assist you in navigating Delaware's corporate landscape. Should you have any questions or need further clarification, please do not hesitate to contact our expert team. Wishing you continued success and prosperity. Sincerely, [Your Name] [Your Title/Organization] [Contact Information] ------------------------------ Types of Delaware Sample Letters to Clients concerning Stock Transfer: 1. Standard Sample Letter: — A generally applicable letter that covers the fundamental aspects and procedures involved in stock transfers for Delaware companies. It serves as a comprehensive guide for clients dealing with stock transfers without any specific complexities or unique circumstances. 2. Sample Letter for Restrictive Stock Transfer: — A specialized letter addressing stock transfers with additional complexities, such as restrictions on certain shareholders' ability to transfer their stock or the requirement of prior approval from the company's board of directors. 3. Sample Letter for Preemptive Rights Exercise: — A specific type of stock transfer letter focusing on situations where existing shareholders have preemptive rights, allowing them to purchase additional shares before offering them to external parties. 4. Sample Letter for Stock Transfer in LCS: — A tailored letter specifically designed for clients with Delaware limited liability companies (LCS) but seeking to transfer ownership interests instead of traditional stock shares. This letter takes into account the unique characteristics and legal requirements associated with LCS. 5. Sample Letter for Cross-Border Stock Transfer: — A specialized letter addressing stock transfers involving international parties or moving shares across borders while considering the additional legal and regulatory implications associated with such transactions. Please note that stock transfer requirements and procedures might differ based on individual circumstances, company structure, and legal agreements. It is always advisable to consult legal professionals well-versed in Delaware corporate law to ensure compliance and accuracy.

Delaware Sample Letter to Client concerning Stock Transfer

Description

How to fill out Delaware Sample Letter To Client Concerning Stock Transfer?

Choosing the best legitimate record template can be a have difficulties. Needless to say, there are plenty of layouts available online, but how do you obtain the legitimate form you require? Take advantage of the US Legal Forms internet site. The support offers thousands of layouts, like the Delaware Sample Letter to Client concerning Stock Transfer, which you can use for enterprise and personal requires. Each of the types are examined by specialists and fulfill federal and state needs.

If you are previously authorized, log in to the accounts and click the Down load key to have the Delaware Sample Letter to Client concerning Stock Transfer. Make use of accounts to appear through the legitimate types you may have bought formerly. Go to the My Forms tab of the accounts and obtain an additional copy of your record you require.

If you are a new consumer of US Legal Forms, allow me to share simple directions for you to comply with:

- Initially, be sure you have selected the right form to your area/region. You may look over the shape making use of the Preview key and study the shape information to make sure it will be the right one for you.

- When the form fails to fulfill your requirements, utilize the Seach area to find the appropriate form.

- When you are sure that the shape is acceptable, click on the Get now key to have the form.

- Choose the pricing plan you would like and enter in the essential information and facts. Build your accounts and buy an order with your PayPal accounts or bank card.

- Opt for the file formatting and acquire the legitimate record template to the product.

- Full, change and print out and sign the obtained Delaware Sample Letter to Client concerning Stock Transfer.

US Legal Forms is the biggest collection of legitimate types in which you can find different record layouts. Take advantage of the service to acquire professionally-produced papers that comply with state needs.

Form popularity

FAQ

Don't use correction fluid or stick labels on the form. 1 Consideration money. ... 2 Full name of Undertaking. ... 3 Full description of Security. ... 4 Number or amount of Shares, Stock or other security. ... 5 Name(s) and address of registered holder(s) ... 6 Signature(s) ... 7 Name(s) and address of person(s) receiving the shares.

Your stock transfer form must include the following: The company name and registration number. The number and class (type) of shares being transferred. The amount paid, or due to be paid, for the shares (if applicable)

Giving stocks to family members involves several steps. First, you need to consider the number of shares you want to give. Next, contact your brokerage firm to begin the transfer, which likely requires filling out a gift transfer form and providing the recipient's brokerage account information.

Fill out the recipient/new shareholders name, address, Tax ID/ Social Security number and phone number. Certificate Issuance: Designate the total number of shares to be transferred to the new shareholder and any special instructions you wish to be included.

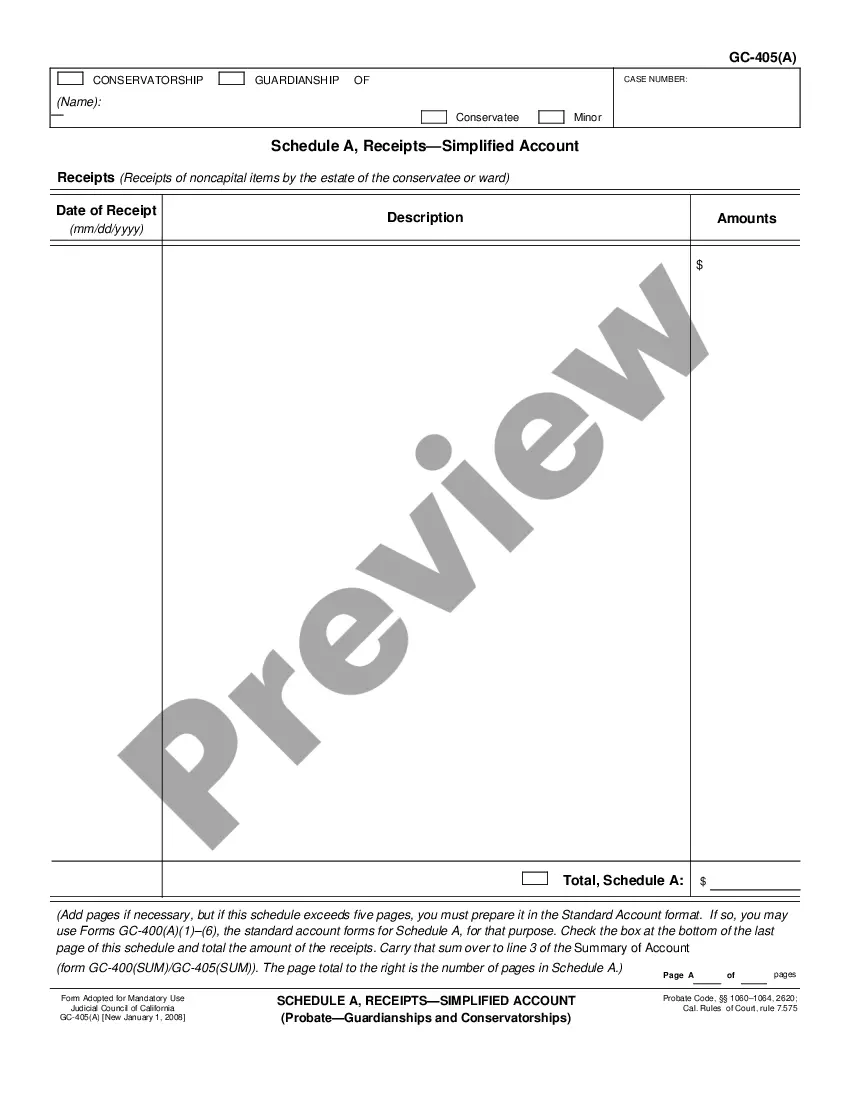

In the Stock Transfer Ledger, the names of the shareholders can be listed along with important information such as their places of residence, the time that they gained ownership within the corporation, the number of shares issued, the amount paid for the shares, and the stock certificate number that was distributed (if ...

This is to inform you that I,???????.. , the Shareholder of ???????..shares in your Company, request you to transfer my ???????? Equity Shares held in the Company for a total consideration of Rs ????????

Consideration refers to the value of what is paid for the stocks and shares. You need to state the amount if the person buying the shares pays cash. If there is zero consideration, this must be recorded. Consideration can also include other stocks or satisfaction of a debt.

A stock transfer form is a legal document that is used to transfer the ownership of stocks, also known as shares, from one person or entity to another. Stock transfer forms include essential information about the transactions such as the identities of the parties involved and the amount of stock being transferred.