Delaware Sample Letter for Explanation of Insurance Rate Increase

Description

How to fill out Sample Letter For Explanation Of Insurance Rate Increase?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal template designs that you can download or create.

By utilizing the website, you can access thousands of forms for both business and personal use, categorized by regions, states, or keywords. You can find the most recent versions of forms such as the Delaware Sample Letter for Explanation of Insurance Rate Increase in moments.

If you already have a subscription, Log In to download the Delaware Sample Letter for Explanation of Insurance Rate Increase from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously obtained forms in the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Find the format and download the form to your device.Make edits. Fill, modify, print, and sign the received Delaware Sample Letter for Explanation of Insurance Rate Increase. Every template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Delaware Sample Letter for Explanation of Insurance Rate Increase with US Legal Forms, the most extensive collection of legal document templates. Utilize a wide range of professional and state-specific templates that meet your business or personal needs and requirements.

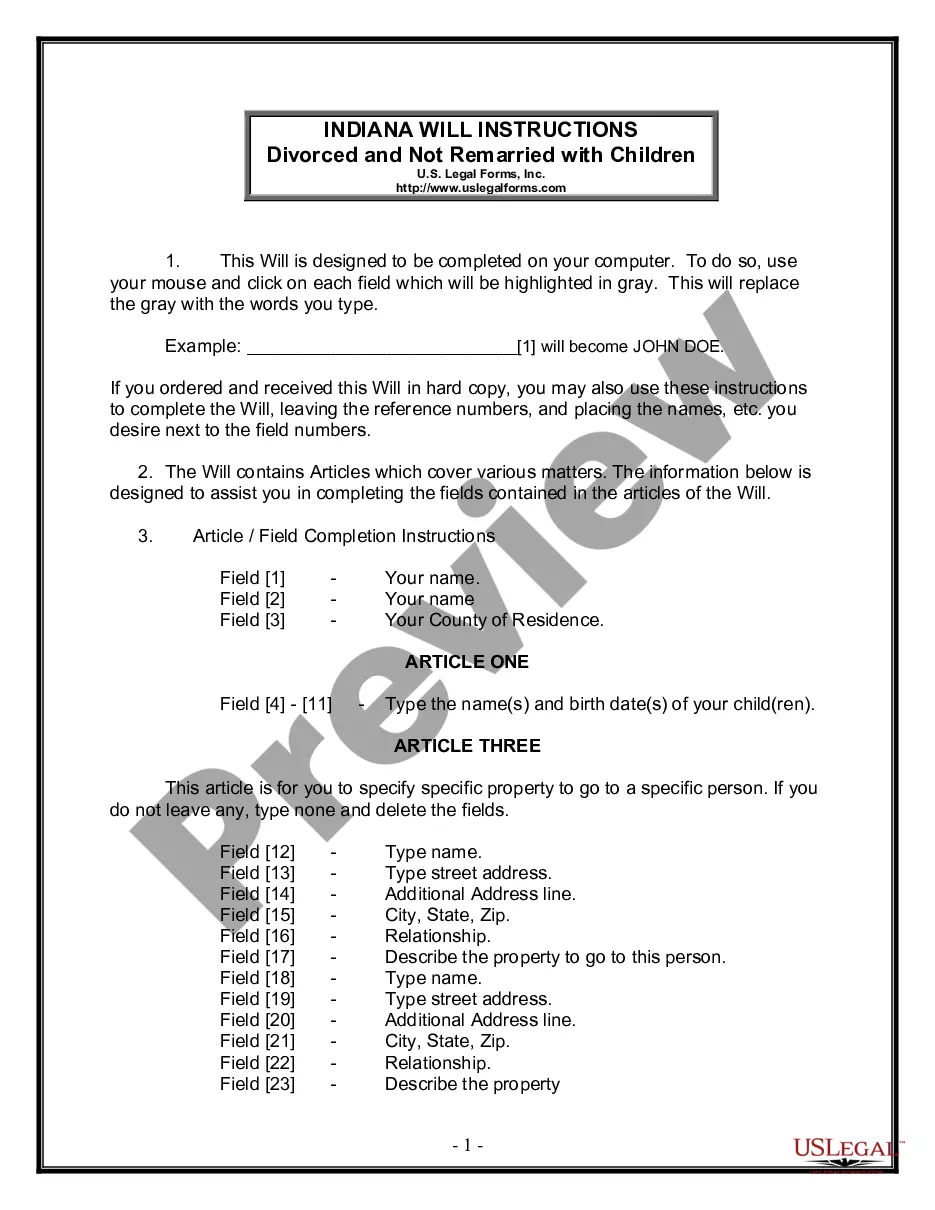

- To use US Legal Forms for the first time, here are straightforward guidelines to help you get started.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to examine the content of the form.

- Read the form description to confirm that you have chosen the appropriate document.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select the pricing plan you prefer and provide your details to register for the account.

Form popularity

FAQ

Obtaining an insurance license in Delaware involves several steps, including completing pre-licensing education and passing the required examination. After securing your license, you can explore various career opportunities in the insurance sector. For those needing help with documentation, including a Delaware Sample Letter for Explanation of Insurance Rate Increase, USLegalForms offers practical resources to streamline your application process.

The Insurance Commissioner in Delaware is a vital figure responsible for overseeing the insurance industry in the state. This role involves regulating insurance companies and protecting consumers by ensuring fair practices. If you need to address a rate increase or require a Delaware Sample Letter for Explanation of Insurance Rate Increase, contacting the Commissioner’s office can provide guidance.

Yes, contacting the insurance commissioner can be beneficial if you have questions or concerns about your insurance rates. If you receive a notice of an increase, you can use the Delaware Sample Letter for Explanation of Insurance Rate Increase to communicate your concerns. The insurance commissioner’s office is there to assist consumers in navigating these issues effectively.

The commissioner of insurance is responsible for regulating the insurance industry within Delaware. This includes overseeing insurance companies, ensuring consumer protection, and managing complaints regarding insurance practices. Their role is essential, especially when providing guidance on documents like the Delaware Sample Letter for Explanation of Insurance Rate Increase.

The head of Delaware is the Governor, who leads the state's executive branch. As of my last update, the Governor plays a crucial role in shaping policies and making decisions that affect Delaware residents. For issues like insurance rate increases, the Governor can influence legislation and regulations, including aspects related to the Delaware Sample Letter for Explanation of Insurance Rate Increase.

Trinidad Navarro is an American national. He serves as the Delaware Insurance Commissioner, making significant contributions to the state's insurance landscape. Understanding his role is vital when discussing matters related to insurance regulations, including the Delaware Sample Letter for Explanation of Insurance Rate Increase.

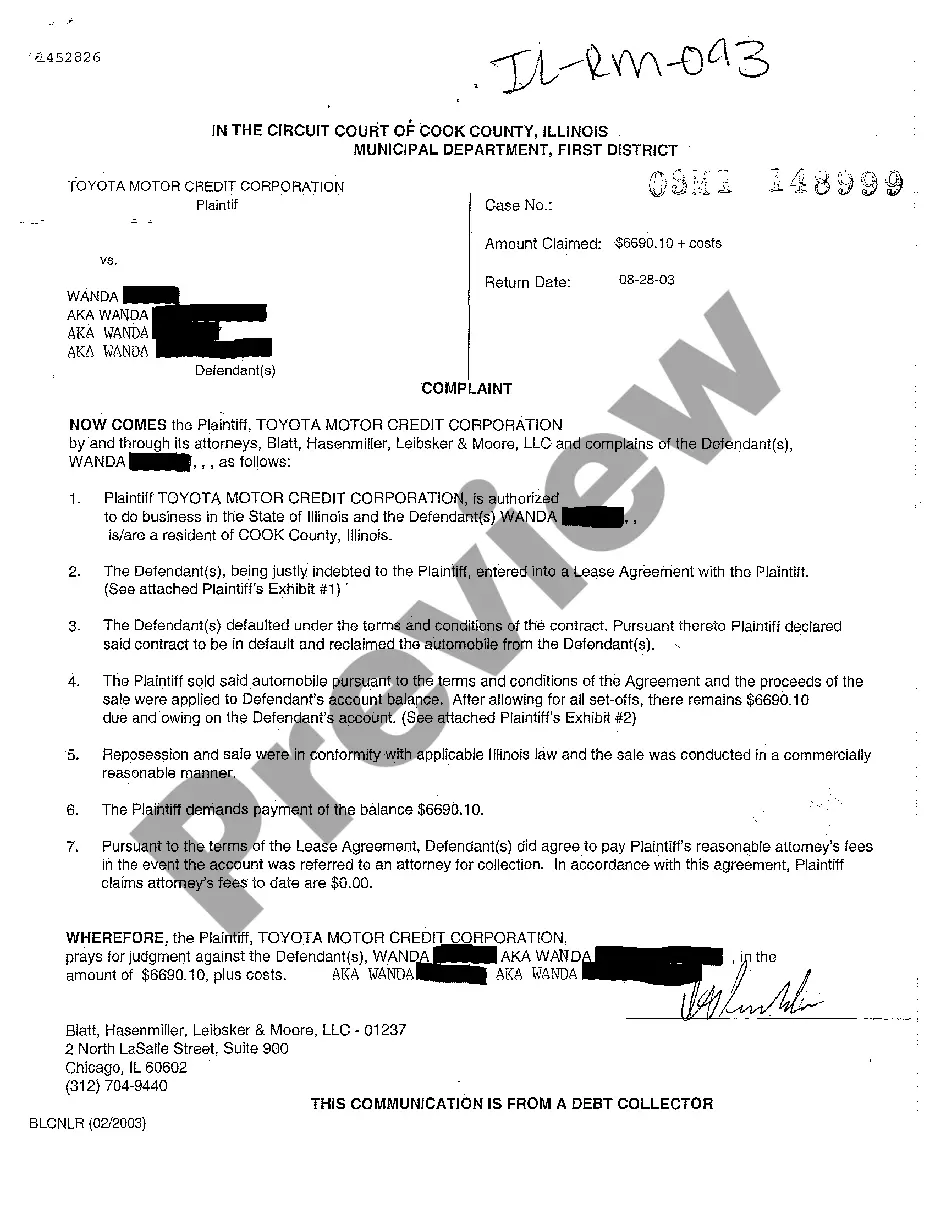

Writing a grievance letter to an insurance company involves clearly stating your concern and providing a detailed account of the issue at hand. Begin with your policy details, followed by a robust explanation of your grievance. A Delaware Sample Letter for Explanation of Insurance Rate Increase can serve as an excellent template to organize your thoughts and present your case clearly.

The Insurance Commissioner for Delaware oversees the regulation of the insurance industry in the state. As of now, the office has a specific individual responsible for enforcing laws that protect consumers. For accurate and up-to-date information, you can visit the official Delaware government website, where you might find additional resources like the Delaware Sample Letter for Explanation of Insurance Rate Increase.

A good appeal letter to an insurance company should begin with a clear statement of your appeal's purpose. Make sure to detail your policy information, articulate your concerns, and attach any supporting documentation. You may want to consult a Delaware Sample Letter for Explanation of Insurance Rate Increase for guidance on effective expressions and formats.

In a grievance appeal letter, explain the situation clearly and outline why you disagree with the insurance company's decision. Provide specific details about your policy and include any evidence that supports your case. Utilizing a Delaware Sample Letter for Explanation of Insurance Rate Increase can help you format your message professionally.