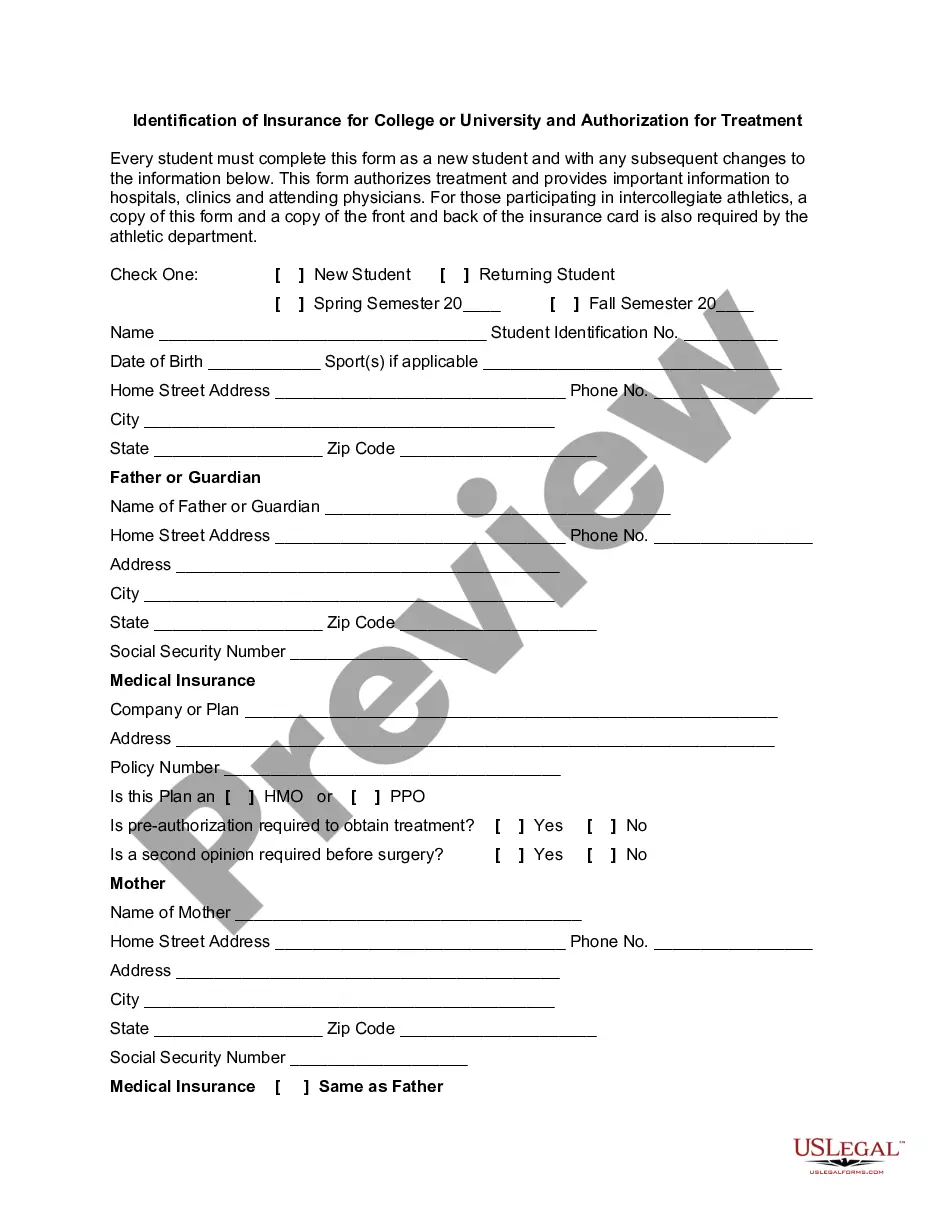

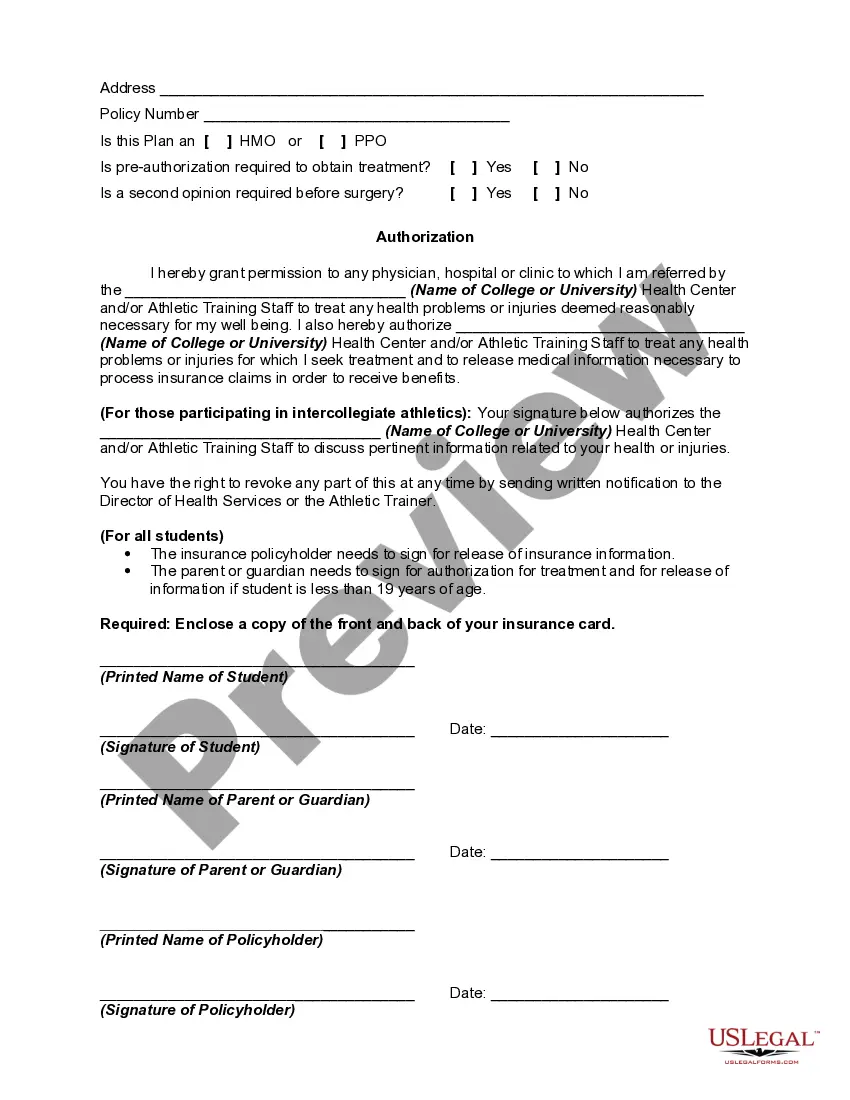

This form authorizes treatment for athletes and students of a college and university and provides important information to hospitals, clinics and attending physicians. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Identification of Insurance for College or University and Authorization: A Comprehensive Overview In the state of Delaware, it is crucial for colleges and universities to ensure appropriate insurance coverage to protect their institutions, students, faculty, and staff in case of unforeseen events or accidents. Delaware's identification of insurance for colleges and universities encompasses different types of insurance policies designed to meet specific coverage needs. This detailed description aims to identify and explain the various types of insurance policies required and commonly obtained by these educational institutions. 1. General Liability Insurance: General Liability Insurance is a fundamental coverage that all colleges and universities in Delaware must possess. It protects against claims related to bodily injury, property damage, personal injury, or advertising injury caused by the institution's operations, products, or services. This policy provides financial protection in situations such as slip and fall accidents, property damage caused by the institution, or allegations of defamation. 2. Property Insurance: Colleges and universities possess valuable and often extensive property, including buildings, equipment, and supplies. Property Insurance safeguards these assets against damage or loss caused by perils like fire, theft, vandalism, or natural disasters such as storms or earthquakes. This policy helps institutions recover financially and repair or replace damaged assets. 3. Workers' Compensation Insurance: Workers' Compensation Insurance is essential for colleges and universities as it provides coverage for employees in case of work-related injuries or illnesses. It offers employees benefits such as medical expenses, lost wages, disability benefits, and rehabilitation costs. This insurance ensures compliance with state laws and helps protect employees and the institution from potential lawsuits arising from work-related accidents. 4. Automobile Insurance: Colleges and universities often operate a fleet of vehicles, ranging from vans to buses, for transportation needs such as student shuttles or field trips. Automobile Insurance protects against damages resulting from accidents involving these vehicles. It includes liability coverage for bodily injury and property damage caused by the institution's vehicles, as well as coverage for medical expenses and property repairs. Additionally, this insurance can cover theft, vandalism, and other non-collision incidents. 5. Professional Liability (Errors and Omissions) Insurance: Professional Liability Insurance, also known as Errors and Omissions (E&O) Insurance, can be crucial for educational institutions with faculty and staff providing professional services or advice. This coverage protects the institution and its employees against claims resulting from alleged negligence, errors, or omissions in professional duties. It can include legal defense costs as well as settlements or judgments arising from such claims. 6. Cyber Liability Insurance: As colleges and universities increasingly rely on technology and handle sensitive student and employee data, Cyber Liability Insurance has become vital. This policy protects against cyber-related risks such as data breaches, phishing attacks, or hacking incidents. It assists in covering expenses related to data breach notifications, forensic investigations, credit monitoring services for affected individuals, and potential legal liabilities. It is important for educational institutions to review their insurance needs regularly and work with experienced insurance agents or brokers to tailor policies specifically suited to their unique requirements. Implementing the appropriate types of insurance coverage ensures that colleges and universities in Delaware are adequately protected in the face of various unforeseen situations, promoting the safety and security of their campus communities.Delaware Identification of Insurance for College or University and Authorization: A Comprehensive Overview In the state of Delaware, it is crucial for colleges and universities to ensure appropriate insurance coverage to protect their institutions, students, faculty, and staff in case of unforeseen events or accidents. Delaware's identification of insurance for colleges and universities encompasses different types of insurance policies designed to meet specific coverage needs. This detailed description aims to identify and explain the various types of insurance policies required and commonly obtained by these educational institutions. 1. General Liability Insurance: General Liability Insurance is a fundamental coverage that all colleges and universities in Delaware must possess. It protects against claims related to bodily injury, property damage, personal injury, or advertising injury caused by the institution's operations, products, or services. This policy provides financial protection in situations such as slip and fall accidents, property damage caused by the institution, or allegations of defamation. 2. Property Insurance: Colleges and universities possess valuable and often extensive property, including buildings, equipment, and supplies. Property Insurance safeguards these assets against damage or loss caused by perils like fire, theft, vandalism, or natural disasters such as storms or earthquakes. This policy helps institutions recover financially and repair or replace damaged assets. 3. Workers' Compensation Insurance: Workers' Compensation Insurance is essential for colleges and universities as it provides coverage for employees in case of work-related injuries or illnesses. It offers employees benefits such as medical expenses, lost wages, disability benefits, and rehabilitation costs. This insurance ensures compliance with state laws and helps protect employees and the institution from potential lawsuits arising from work-related accidents. 4. Automobile Insurance: Colleges and universities often operate a fleet of vehicles, ranging from vans to buses, for transportation needs such as student shuttles or field trips. Automobile Insurance protects against damages resulting from accidents involving these vehicles. It includes liability coverage for bodily injury and property damage caused by the institution's vehicles, as well as coverage for medical expenses and property repairs. Additionally, this insurance can cover theft, vandalism, and other non-collision incidents. 5. Professional Liability (Errors and Omissions) Insurance: Professional Liability Insurance, also known as Errors and Omissions (E&O) Insurance, can be crucial for educational institutions with faculty and staff providing professional services or advice. This coverage protects the institution and its employees against claims resulting from alleged negligence, errors, or omissions in professional duties. It can include legal defense costs as well as settlements or judgments arising from such claims. 6. Cyber Liability Insurance: As colleges and universities increasingly rely on technology and handle sensitive student and employee data, Cyber Liability Insurance has become vital. This policy protects against cyber-related risks such as data breaches, phishing attacks, or hacking incidents. It assists in covering expenses related to data breach notifications, forensic investigations, credit monitoring services for affected individuals, and potential legal liabilities. It is important for educational institutions to review their insurance needs regularly and work with experienced insurance agents or brokers to tailor policies specifically suited to their unique requirements. Implementing the appropriate types of insurance coverage ensures that colleges and universities in Delaware are adequately protected in the face of various unforeseen situations, promoting the safety and security of their campus communities.