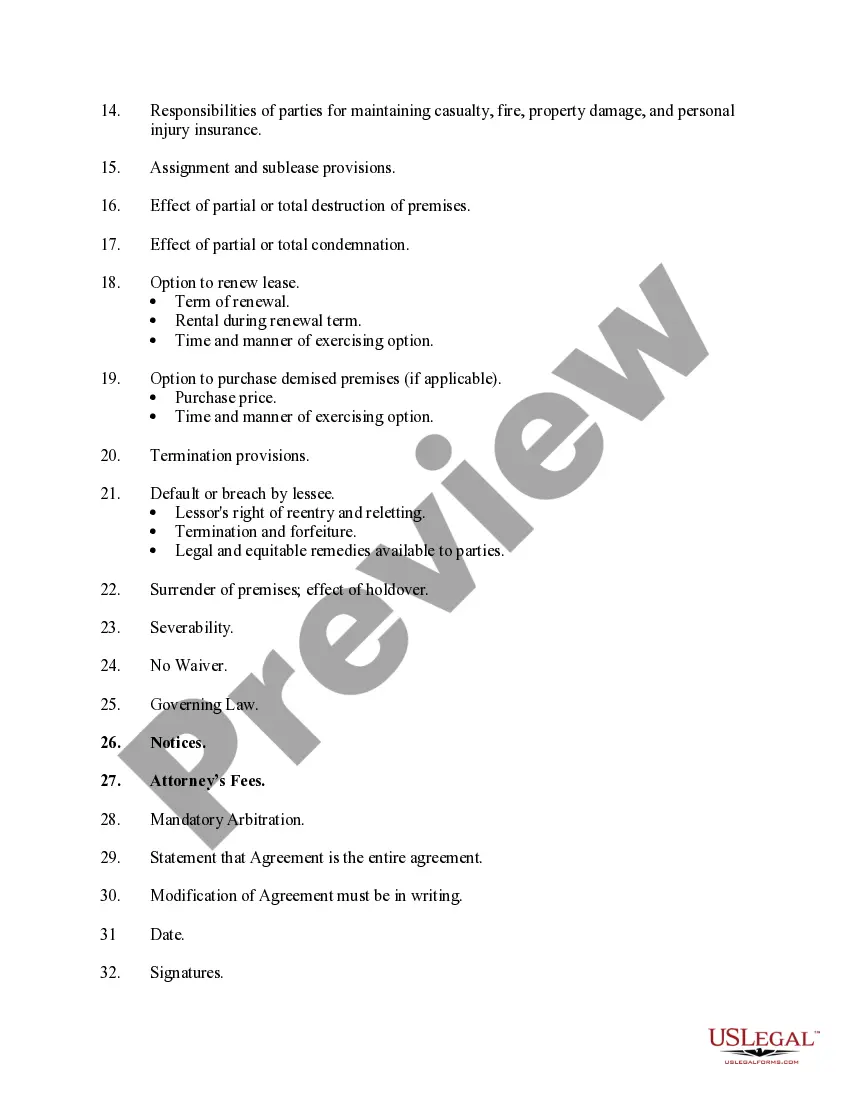

Delaware Checklist of Matters to be Considered in Drafting a Lease of a Commercial Building is an essential tool for landlords, property owners, and tenants who are involved in commercial leases in Delaware. This checklist helps ensure that all necessary aspects of a lease agreement are addressed and put in writing, protecting the rights and obligations of both parties. Here are some key areas covered by this checklist: 1. Parties involved: Clearly identify the landlord and tenant by their legal names and addresses, ensuring accuracy and proper identification for future references. 2. Lease term: Specify the duration of the lease agreement, including the start and end dates, as well as any renewal or termination options. 3. Rent and payment terms: Clearly state the amount of rent, due date, and acceptable payment methods. Include provisions for late payment penalties, grace periods, and any applicable rent increases. 4. Security deposit and other financial considerations: Specify the amount of the security deposit required, its purpose, and conditions for its return. Address any additional fees or charges, such as common area maintenance (CAM) fees, insurance costs, utilities, or property taxes. 5. Use and occupancy: Outline the permitted use of the premises, identifying if it is limited to a specific industry, retail, office, or mixed-use. Address any restrictions on subletting or assignment. 6. Maintenance and repairs: Determine the responsibilities of both parties regarding repairs and maintenance of the premises, including who is responsible for structural, mechanical, and cosmetic repairs, and establish obligations for regular inspections and upkeep. 7. Insurance coverage: Specify the types and minimum amounts of insurance coverage required, such as general liability insurance, property insurance, and worker's compensation insurance. Outline the responsibility for obtaining and maintaining insurance policies. 8. Alterations and improvements: Address any limitations on alterations or improvements that can be made to the premises, indicating who is responsible for obtaining necessary permits and approvals. 9. Indemnity and liability: Define the responsibilities of each party for any damages, injuries, or losses occurring on the property and establish provisions for indemnification and liability insurance. 10. Default and remedies: Specify the remedies available to both parties in case of default, including any notice requirements, cure periods, and mitigation efforts. These are some crucial matters to be considered while drafting a lease of a commercial building in Delaware. It is important to note that variations or additional matters may arise based on the specific needs of the parties, nature of the commercial property, and local laws and regulations. Therefore, seeking legal advice from experienced professionals is strongly recommended ensuring compliance and protection of interests in all parties involved.

Delaware Checklist of Matters to be Considered in Drafting a Lease of a Commercial Building

Description

How to fill out Delaware Checklist Of Matters To Be Considered In Drafting A Lease Of A Commercial Building?

You may commit hours on-line trying to find the authorized document template that suits the federal and state needs you will need. US Legal Forms supplies thousands of authorized forms which are reviewed by specialists. You can easily download or print the Delaware Checklist of Matters to be Considered in Drafting a Lease of a Commercial Building from my assistance.

If you already have a US Legal Forms bank account, you may log in and then click the Download switch. Next, you may complete, revise, print, or indicator the Delaware Checklist of Matters to be Considered in Drafting a Lease of a Commercial Building. Each authorized document template you acquire is the one you have permanently. To have yet another copy associated with a obtained kind, visit the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms internet site for the first time, adhere to the basic directions listed below:

- Very first, make certain you have chosen the best document template for the region/city of your choosing. Browse the kind explanation to make sure you have chosen the proper kind. If accessible, make use of the Review switch to check through the document template at the same time.

- In order to locate yet another edition in the kind, make use of the Look for industry to find the template that meets your needs and needs.

- When you have located the template you desire, simply click Acquire now to continue.

- Select the prices prepare you desire, type your qualifications, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You can use your credit card or PayPal bank account to pay for the authorized kind.

- Select the file format in the document and download it to the product.

- Make changes to the document if required. You may complete, revise and indicator and print Delaware Checklist of Matters to be Considered in Drafting a Lease of a Commercial Building.

Download and print thousands of document themes utilizing the US Legal Forms site, that provides the greatest selection of authorized forms. Use specialist and express-distinct themes to take on your company or personal requires.