The Delaware Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase is a legal document that outlines the process of buying or selling a sole proprietorship business in Delaware. This type of agreement is essential for ensuring a smooth and legally binding transaction between the buyer and seller. The agreement specifies the terms and conditions of the sale, including the purchase price, payment terms, and any contingencies that must be met before the sale is finalized. It also details the assets being transferred, such as inventory, equipment, real estate, intellectual property, and goodwill. There are several types of Delaware Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase that may be used based on the specific circumstances of the transaction. These variations include: 1. Basic Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase: This is the standard agreement template used for most sole proprietorship asset purchases in Delaware. It covers all the essential elements of the sale, ensuring both parties are protected. 2. Confidentiality Agreement: In some cases, the buyer may require the seller to sign a separate confidentiality agreement to protect sensitive business information and trade secrets during the negotiation process. 3. Non-compete Agreement: If the seller agrees not to compete in the same industry for a specified period within a certain geographic area, a non-compete agreement may be included. This ensures that the buyer is protected from potential competition from the seller. 4. Installment Sale Agreement: This type of agreement is used when the buyer agrees to make payments over time instead of paying the entire purchase price upfront. It outlines the terms of the installment payment plan, including interest rates, payment schedule, and consequences for non-payment. 5. Seller's Representations and Warranties Agreement: This agreement is used to address any representations or warranties made by the seller regarding the business, its assets, or financial condition. It clarifies the accuracy of these statements and allows for appropriate remedies in case of misrepresentation. 6. Bill of Sale: In addition to the main agreement, a bill of sale may be included to legally transfer the ownership of the specific assets being sold. This document acts as proof that the assets have been properly transferred from the seller to the buyer. It's important to note that these are just a few examples of the different types of Delaware Agreement for Sale of Business — SolProprietorshiphi— - Asset Purchase. Each transaction may have unique requirements, and it's advisable to consult with a qualified attorney to ensure all necessary provisions are included in the agreement to protect both parties involved.

Delaware Agreement for Sale of Business - Sole Proprietorship - Asset Purchase

Description

How to fill out Agreement For Sale Of Business - Sole Proprietorship - Asset Purchase?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online. Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

An assortment of templates for business and individual needs are organized by categories and states, or keywords. Use US Legal Forms to quickly obtain the Delaware Agreement for Sale of Business - Sole Proprietorship - Asset Purchase with just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the Delaware Agreement for Sale of Business - Sole Proprietorship - Asset Purchase. You can also access forms you previously downloaded in the My documents section of your account.

Every legal document template you purchase is yours indefinitely. You have access to every form you've downloaded through your account. Visit the My documents section and select a form to print or download again.

Act decisively and obtain, and print the Delaware Agreement for Sale of Business - Sole Proprietorship - Asset Purchase using US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal requirements.

- Step 1. Ensure that you have selected the form for your specific city/state.

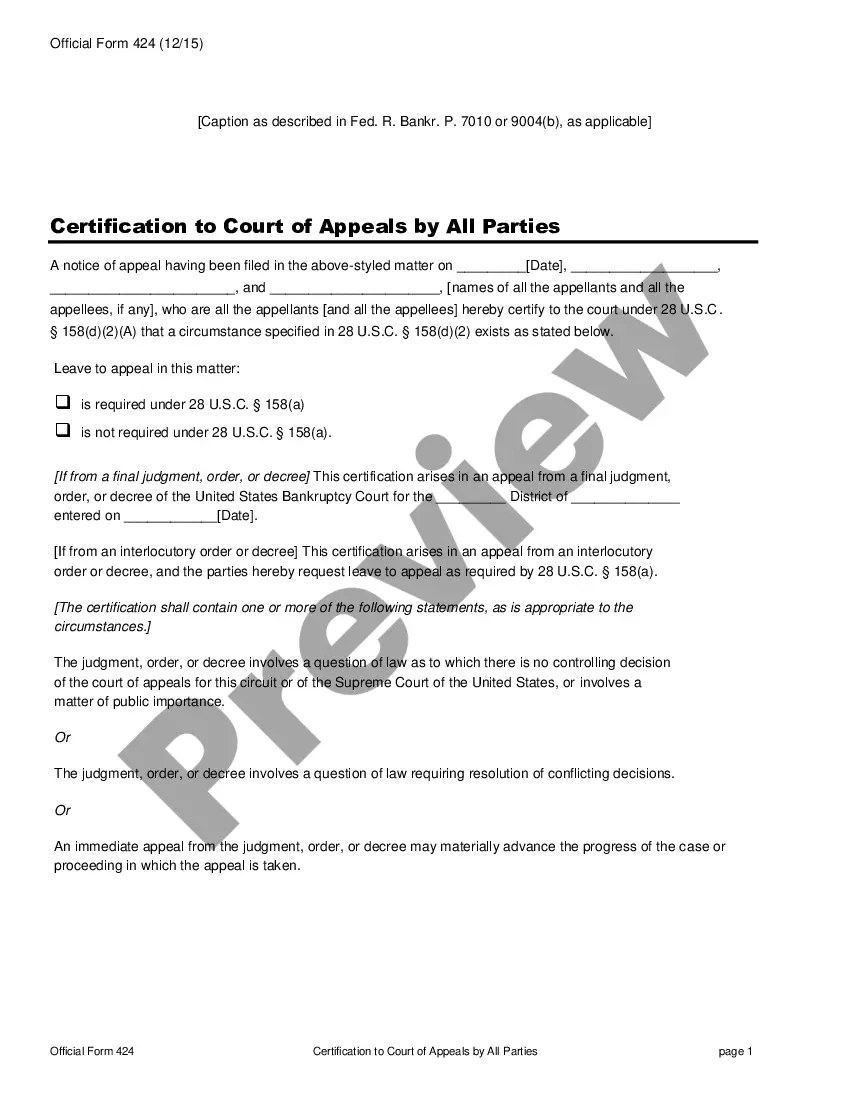

- Step 2. Utilize the Preview option to review the form’s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search bar at the top of the page to find other versions of the legal document template.

- Step 4. Once you have found the form you require, click the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Delaware Agreement for Sale of Business - Sole Proprietorship - Asset Purchase.

Form popularity

FAQ

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...