Delaware Disclaimer of Inheritance Rights for Stepchildren

Description

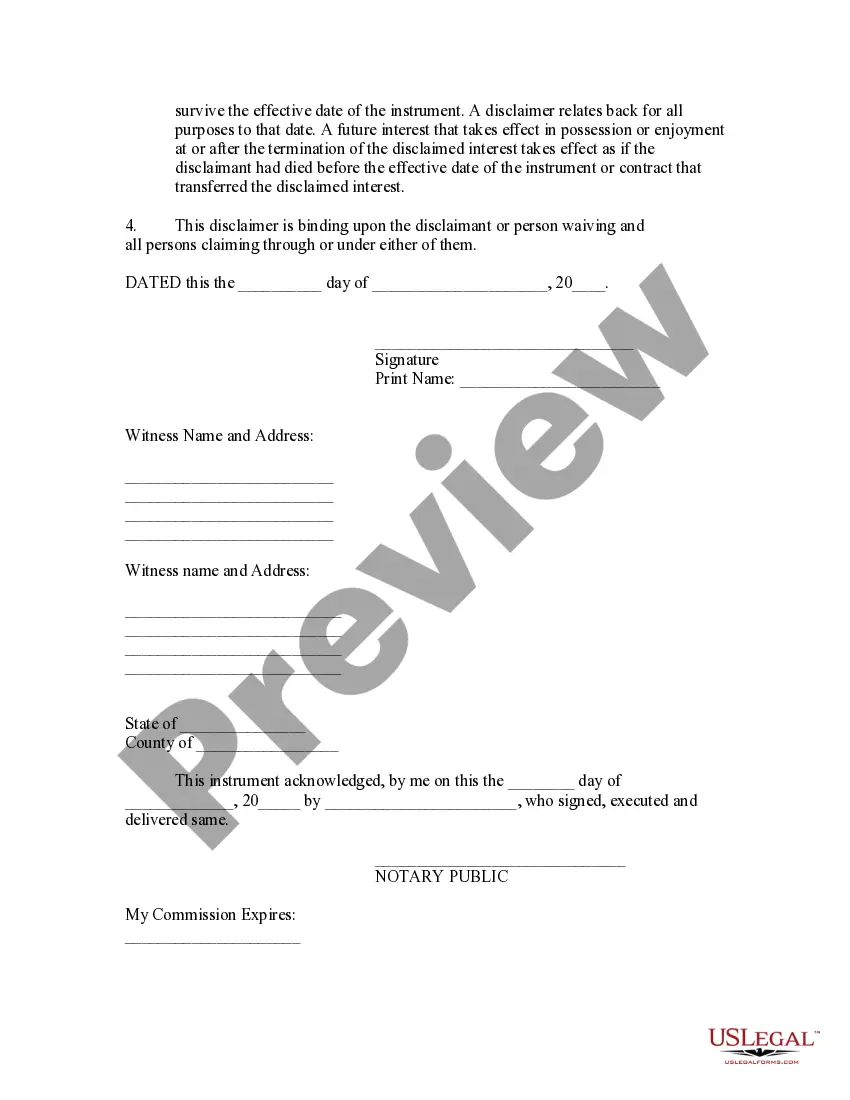

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

You may commit hrs on the Internet looking for the legitimate record design that meets the state and federal specifications you will need. US Legal Forms gives a huge number of legitimate kinds which can be evaluated by experts. You can actually download or printing the Delaware Disclaimer of Inheritance Rights for Stepchildren from the services.

If you already possess a US Legal Forms bank account, you are able to log in and click on the Obtain key. Following that, you are able to comprehensive, edit, printing, or indication the Delaware Disclaimer of Inheritance Rights for Stepchildren. Each and every legitimate record design you buy is the one you have permanently. To have one more duplicate of the obtained form, proceed to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms website the very first time, adhere to the straightforward guidelines listed below:

- Initial, make certain you have selected the best record design for that county/town of your choosing. Read the form outline to make sure you have chosen the right form. If offered, utilize the Preview key to check throughout the record design at the same time.

- If you wish to get one more edition of your form, utilize the Look for area to get the design that suits you and specifications.

- Once you have found the design you need, click Acquire now to move forward.

- Select the prices strategy you need, type your qualifications, and register for a free account on US Legal Forms.

- Total the deal. You may use your charge card or PayPal bank account to cover the legitimate form.

- Select the file format of your record and download it to your gadget.

- Make adjustments to your record if needed. You may comprehensive, edit and indication and printing Delaware Disclaimer of Inheritance Rights for Stepchildren.

Obtain and printing a huge number of record templates making use of the US Legal Forms website, which offers the biggest selection of legitimate kinds. Use professional and status-specific templates to deal with your business or individual requires.

Form popularity

FAQ

Delaware does not have an inheritance tax. However, be aware that the inheritance laws of other states may apply to you if you inherit property or assets from someone living in a state that has an inheritance tax.

Who Gets What in Delaware? If you die with:here's what happens:parents but no spouse or descendantsparents inherit everythingsiblings but no spouse, descendants, or parentssiblings inherit everything5 more rows

Except where circumstances justify a longer period, an executor or administrator shall have 1 year from the date of letters for settling the estate of the decedent; and until the expiration of that time, the executor or administrator shall not be required to make distribution, nor be chargeable with interest upon the ...

The presence or absence of a valid will after death does not determine whether an estate must be opened. Whenever there is a death in New Castle County, an estate must be probated if: The decedent had more than $30,000 in personal property in his/her name alone, or.

Definition of Next of Kin ? 1.) the nearest blood relatives of a person who has died, including the Surviving spouse. 2.) Anyone who would receive a portion of the estate by the laws of descent and distribution if there were no will ? blood related 3.)

Some of the strategic ways you can avoid probate include: Titling securities and vehicles with Transfer on Death (TOD) registrations. Opening accounts and policies with Payable on Death (POD) designations. Setting up and fund a Living Trust.