The Delaware Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is a crucial document that outlines the process and terms for the redemption of stock in a close corporation. Close corporations are privately-held companies with a limited number of shareholders, usually operating within a single state. When a close corporation decides to redeem stock, the directors must pass a resolution approving the redemption. This resolution confirms the corporation's intent to buy back shares from a shareholder at a specified price. It is important for the redemption process to be authorized properly to ensure legal compliance and protect the rights of both the corporation and its shareholders. Keywords: Delaware resolution, directors, close corporation, redemption of stock, shareholders, buy-back shares, legal compliance, authorization, rights There are several types of Delaware Resolutions of Directors of a Close Corporation Authorizing Redemption of Stock, depending on the specific circumstances and requirements of the corporation. Some notable types include: 1. Voluntary Redemption Resolution: This document is used when shareholders are ready to sell their shares voluntarily and the corporation agrees to redeem them. It outlines the terms, conditions, and timeline for the redemption process, including the purchase price, payment method, and any restrictions on the redemption. 2. Mandatory Redemption Resolution: This resolution is applicable when certain events or conditions stipulated in the corporation's bylaws or shareholder agreements trigger the mandatory redemption of stock. These events may include the death, disability, retirement, or termination of a shareholder. The resolution outlines the specific conditions, procedures, and timelines for the redemption process. 3. Fractional Share Redemption Resolution: In some situations, a shareholder may hold fractional shares that cannot be traded easily or don't have sufficient market value. This resolution addresses the redemption of these fractional shares, determining the method for calculating the redemption price and providing a fair and practical solution for the shareholder. 4. Partial Share Redemption Resolution: When a shareholder wants to sell only a portion of their shares back to the corporation, a partial share redemption resolution is used. It outlines the procedure to determine the number of shares to be redeemed, the purchase price, and any relevant terms or conditions. In conclusion, the Delaware Resolution of Directors of a Close Corporation Authorizing Redemption of Stock is a fundamental document that governs the redemption process in a close corporation. Whether it is voluntary or mandatory redemption, or involves fractional or partial shares, these resolutions ensure that the redemption is executed legally and fairly, protecting the rights of both the corporation and its shareholders.

Delaware Resolution of Directors of a Close Corporation Authorizing Redemption of Stock

Description

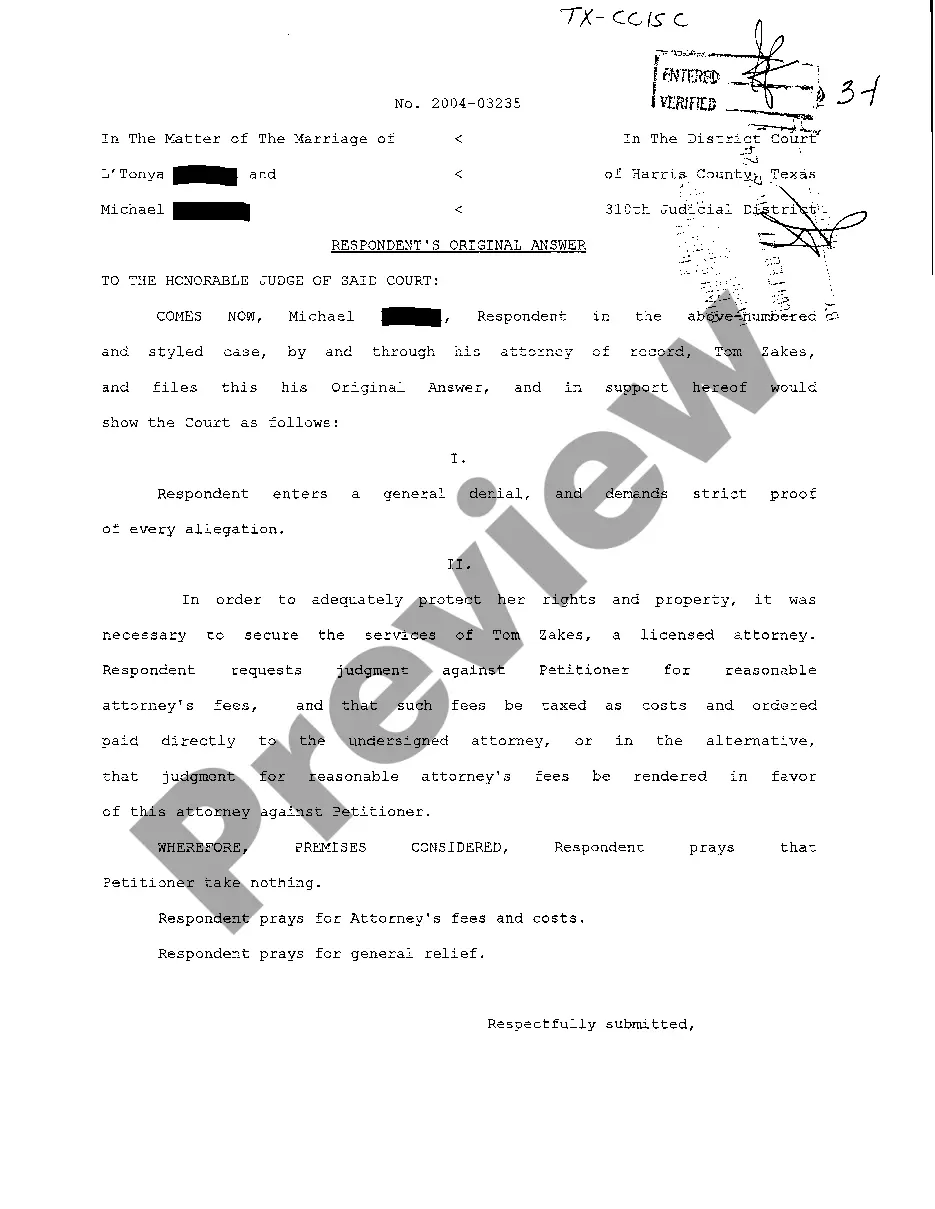

How to fill out Delaware Resolution Of Directors Of A Close Corporation Authorizing Redemption Of Stock?

US Legal Forms - one of the greatest libraries of lawful forms in the USA - delivers a variety of lawful record web templates you may down load or printing. While using website, you may get thousands of forms for company and specific purposes, categorized by classes, claims, or keywords and phrases.You can find the newest versions of forms much like the Delaware Resolution of Directors of a Close Corporation Authorizing Redemption of Stock within minutes.

If you currently have a registration, log in and down load Delaware Resolution of Directors of a Close Corporation Authorizing Redemption of Stock from your US Legal Forms local library. The Acquire switch can look on every kind you perspective. You have accessibility to all in the past downloaded forms within the My Forms tab of your own accounts.

If you want to use US Legal Forms the very first time, listed below are basic guidelines to help you get began:

- Ensure you have picked the best kind for your personal metropolis/county. Go through the Preview switch to check the form`s content material. Look at the kind description to actually have selected the correct kind.

- If the kind does not satisfy your demands, make use of the Look for field near the top of the display to find the one that does.

- If you are satisfied with the shape, validate your selection by clicking on the Buy now switch. Then, choose the pricing strategy you favor and provide your credentials to register for an accounts.

- Process the purchase. Make use of your bank card or PayPal accounts to perform the purchase.

- Find the format and down load the shape on your own gadget.

- Make changes. Load, change and printing and indicator the downloaded Delaware Resolution of Directors of a Close Corporation Authorizing Redemption of Stock.

Each web template you included with your bank account does not have an expiry particular date and is also your own property permanently. So, if you wish to down load or printing another backup, just go to the My Forms portion and then click about the kind you want.

Get access to the Delaware Resolution of Directors of a Close Corporation Authorizing Redemption of Stock with US Legal Forms, probably the most substantial local library of lawful record web templates. Use thousands of professional and state-distinct web templates that fulfill your company or specific demands and demands.