A Delaware Agreement to Compromise Debt by Returning Secured Property is a legally binding document used in the state of Delaware when a debtor wishes to negotiate a settlement with a creditor by returning a secured asset instead of making payments in cash. This agreement is designed to facilitate a compromise between the parties involved, ensuring a fair resolution and avoiding a more lengthy and costly legal process. The key component of this agreement is the return of the secured property to the creditor in exchange for the forgiveness or reduction of the outstanding debt. The agreement outlines the terms and conditions of the compromise, including the description of the property to be returned, its estimated value, and any necessary transfer of ownership or rights. It also states the total amount of debt being compromised and the terms of any remaining obligations, if applicable. The Delaware Agreement to Compromise Debt by Returning Secured Property serves as a safeguard for both the debtor and the creditor. By agreeing to return the secured property, the debtor alleviates the financial burden of the debt. The creditor, on the other hand, benefits by reclaiming an asset that may hold some value, which can be sold or used to recoup a portion of the outstanding debt. Furthermore, this agreement provides legal protection to both parties, preventing potential disputes in the future. Types of Delaware Agreement to Compromise Debt by Returning Secured Property: 1. Residential Property Compromise: This type of agreement pertains to properties such as houses, apartments, or condominiums that were used as collateral for a debt. It allows the debtor to transfer ownership of the property back to the creditor in exchange for debt forgiveness or reduction. 2. Vehicle Compromise: This agreement applies to vehicles including cars, trucks, motorcycles, or recreational vehicles that were used as collateral for a debt. It enables the debtor to surrender the vehicle to the creditor, who may then sell it or retain it as compensation for the outstanding debt. 3. Personal Asset Compromise: In certain cases, debtors may have used valuable personal assets like jewelry, electronics, or artwork as collateral. This type of agreement allows the debtor to return these assets to the creditor in order to settle the debt. In summary, a Delaware Agreement to Compromise Debt by Returning Secured Property is a legally binding contract used when a debtor chooses to settle their debt by returning a secured asset to the creditor. By considering this approach, debtors can alleviate their financial burdens, while creditors can reclaim some value from the assets used as collateral. It is crucial for both parties to carefully review and understand the terms of the agreement to ensure a fair and satisfactory compromise.

Delaware Agreement to Compromise Debt by Returning Secured Property

Description

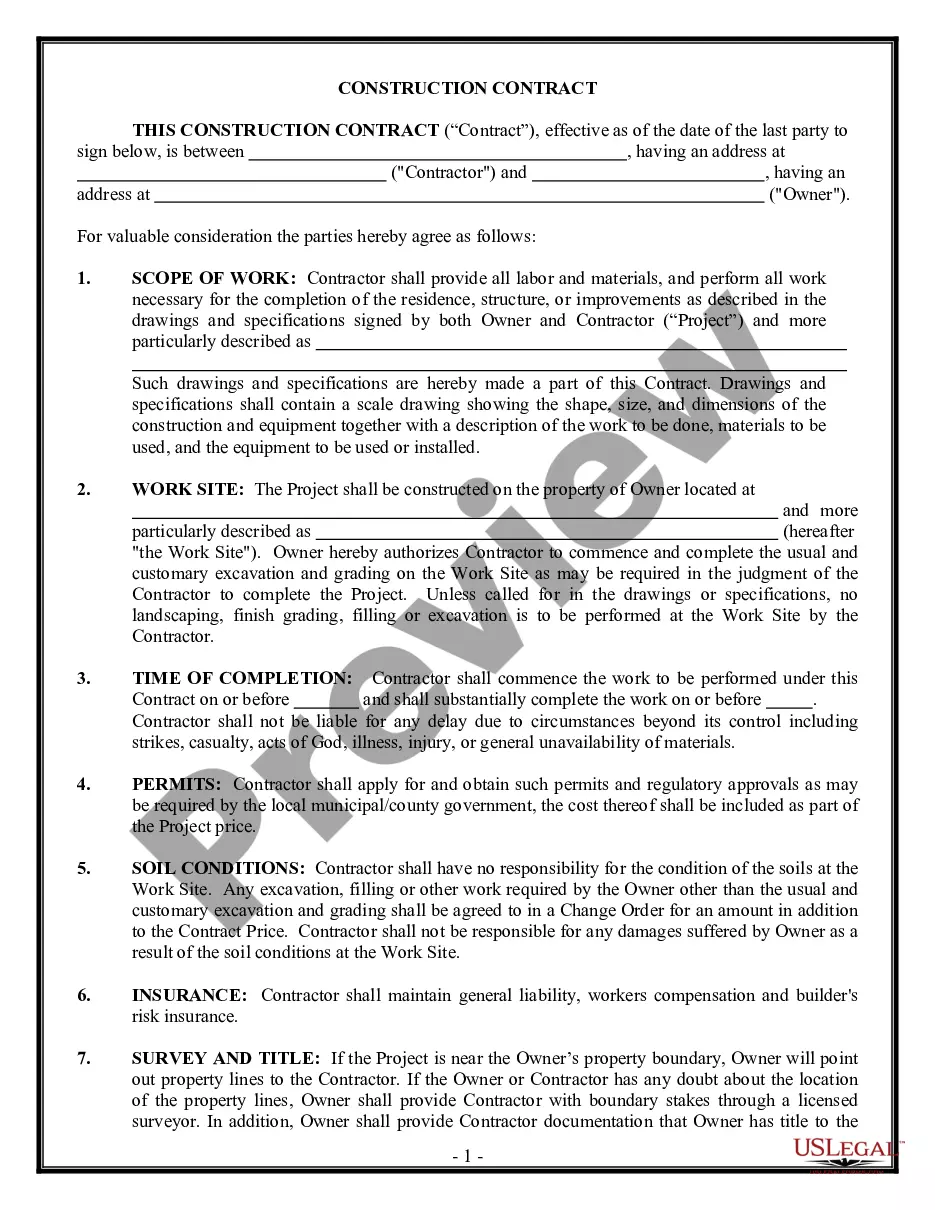

How to fill out Delaware Agreement To Compromise Debt By Returning Secured Property?

If you need to complete, acquire, or print out lawful papers layouts, use US Legal Forms, the most important assortment of lawful kinds, which can be found online. Utilize the site`s easy and convenient lookup to obtain the documents you require. Numerous layouts for company and person uses are sorted by classes and suggests, or key phrases. Use US Legal Forms to obtain the Delaware Agreement to Compromise Debt by Returning Secured Property with a number of click throughs.

In case you are currently a US Legal Forms buyer, log in in your bank account and click on the Obtain key to obtain the Delaware Agreement to Compromise Debt by Returning Secured Property. You may also access kinds you earlier delivered electronically within the My Forms tab of your bank account.

If you work with US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the shape for your appropriate metropolis/country.

- Step 2. Use the Preview option to look over the form`s articles. Do not neglect to read through the description.

- Step 3. In case you are unsatisfied together with the kind, make use of the Search field at the top of the display screen to discover other types of your lawful kind template.

- Step 4. Upon having discovered the shape you require, click on the Get now key. Opt for the prices strategy you choose and put your accreditations to register on an bank account.

- Step 5. Process the deal. You should use your bank card or PayPal bank account to perform the deal.

- Step 6. Select the structure of your lawful kind and acquire it on your own product.

- Step 7. Full, modify and print out or indicator the Delaware Agreement to Compromise Debt by Returning Secured Property.

Every single lawful papers template you acquire is yours for a long time. You possess acces to every single kind you delivered electronically within your acccount. Select the My Forms segment and choose a kind to print out or acquire yet again.

Compete and acquire, and print out the Delaware Agreement to Compromise Debt by Returning Secured Property with US Legal Forms. There are millions of expert and condition-particular kinds you can use for the company or person needs.

Form popularity

FAQ

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.

Your debt settlement proposal letter should contain the following:Your current financial situation.Debt settlement offer.Personal information.What you expect in return.Acceptance of the proposal.Acceptance of the proposal upon adjusting (negotiating) the amount to be paid.Rejection of the proposal.

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Contents of a Debt Settlement AgreementDate of the agreement.Name and address of the creditor.Name and address of the debtor.Original loan amount and its date.Rate of interest.Due date of the loan.Final settlement amount.Signatures of both parties.More items...?12-Oct-2021

Once you've done your research and put aside some cash, it's time to determine what your settlement offer will be. Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor.

It depends on what you can afford, but you should offer equal amounts to each creditor as a full and final settlement. For example, if the lump sum you have is 75% of your total debt, you should offer each creditor 75% of the amount you owe them.

Generally speaking, having a debt listed as paid in full on your credit reports sends a more positive signal to lenders than having one or more debts listed as settled. Payment history accounts for 35% of your FICO credit score, so the fewer negative marks you havesuch as late payments or settled debtsthe better.

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of amount (inclusive of interests and costs) as the full and final settlement of the above claim/debt.

Here are the steps to write a letter of agreement:Title the document. Add the title at the top of the document.List your personal information.Include the date.Add the recipient's personal information.Address the recipient.Write an introduction paragraph.Write your body.Conclude the letter.More items...?