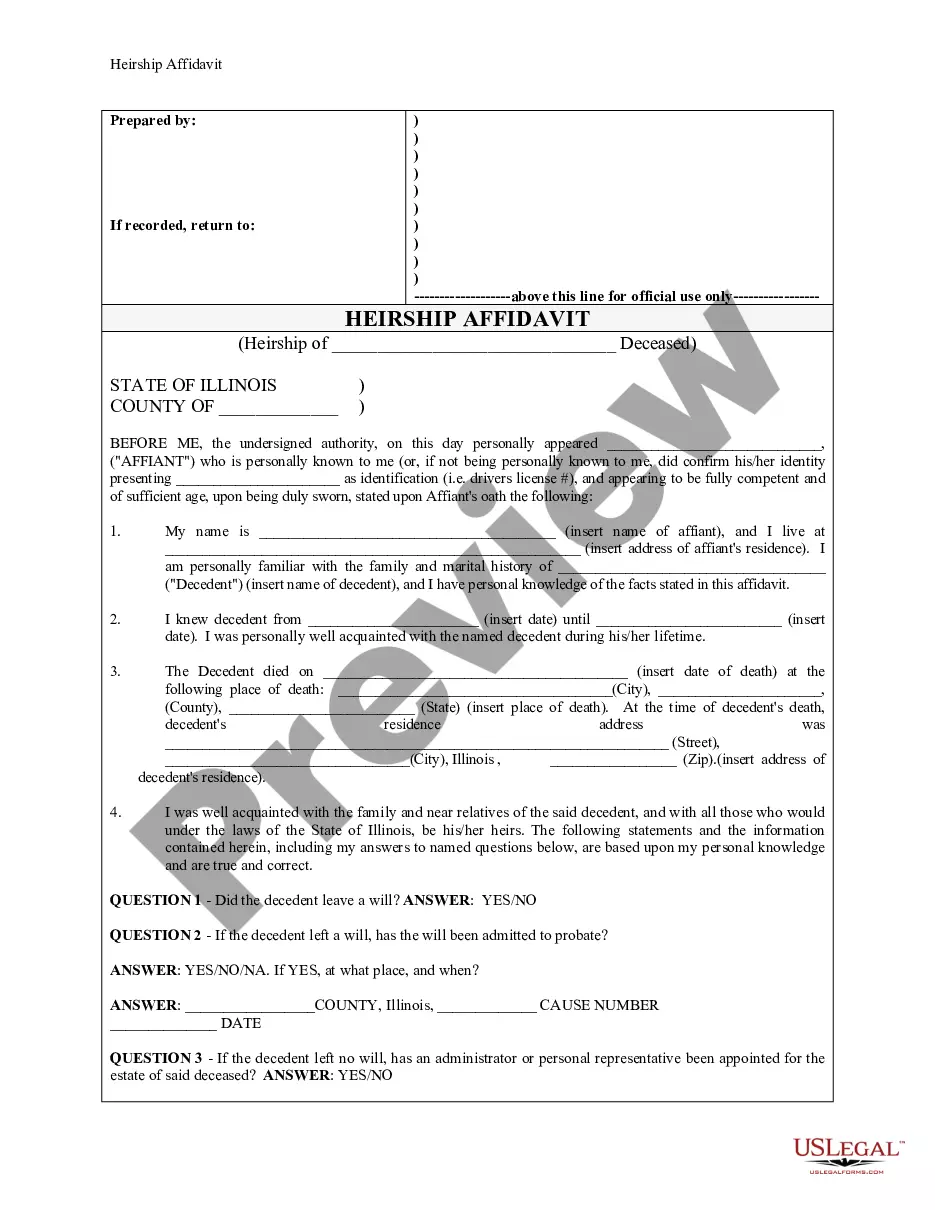

Any interested party in an estate of a decedent generally has the right to make objections to the accounting of the executor, the compensation paid or

proposed to be paid, or the proposed distribution of assets. Such objections must be filed within within a certain period of time from the date of service of the Petition for approval of the accounting.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Delaware Objection to Allowed Claim in Accounting refers to the legal process in Delaware where an objection is raised against a claim that has been deemed allowable in a bankruptcy case. This objection arises within the field of accounting and plays a crucial role in determining the distribution of assets among creditors. By highlighting specific keywords extensively, such as "Delaware," "objection," "allowed claim," and "accounting," the content below aims to provide a detailed description of this concept. In Delaware bankruptcy cases, a claim refers to the right of a creditor to receive payment for a debt owed by a debtor. When a claim is deemed "allowed" by the bankruptcy court, it means that the debtor's liability towards that creditor has been recognized and will be considered for payment during the distribution process. However, sometimes there are situations where a party disagrees with the allowance of a specific claim and seeks to challenge it through an objection. Delaware Objection to Allowed Claim in Accounting involves a thorough review of the allowed claim, associated supporting documentation, and any relevant legal provisions. This objection can be raised by various stakeholders, including the debtor, other creditors, or even the bankruptcy trustee. The objecting party must present convincing evidence and valid reasons to dispute the claim's allowance. One type of Delaware Objection to Allowed Claim in Accounting pertains to disputes regarding the validity or enforceability of the underlying debt. In this scenario, the objector questions the legitimacy of the claim itself, casting doubt on its accuracy, legality, or compliance with established accounting principles. These objections might arise due to inadequate documentation, improperly calculated debt amounts, or even allegations of fraud. Another type of objection focuses on the priority or classification of the claim. Creditors' claims are categorized into different classes based on their specific rights to repayment. For example, secured creditors often have priority over unsecured creditors. In some cases, an objector may argue that a claim has been misclassified or misplaced, highlighting potential consequences on the distribution priority among creditors. Such disputes might involve complex legal interpretations and calculations of priority levels. Additionally, objections can target the amount of the allowed claim, specifically disputing the calculation or valuation methods employed. Objectors may argue that the claim amount is inflated, improperly assessed, or inconsistent with accounting standards. This type of objection would require a detailed examination of financial records, calculations, supporting documentation, and applicable accounting principles. It is important to note that Delaware Objection to Allowed Claim in Accounting is subject to the rules and procedures established by the Delaware Bankruptcy Court. Objecting parties must adhere to strict timelines and provide compelling evidence and legal arguments to support their objections. Failure to do so may result in the court dismissing the objection and upholding the allowance of the claim. In conclusion, Delaware Objection to Allowed Claim in Accounting denotes the process of challenging an allowed claim in a Delaware bankruptcy case. Stakeholders can raise objections based on various grounds, including questioning the validity of the debt, disputing the classification or priority assigned to the claim, or challenging the calculated amount itself. By pursuing objections, parties aim to influence the distribution of assets and protect their respective interests in the bankruptcy proceedings.