An independent contractor is a person or business who performs services for another person pursuant to an agreement and who is not subject to the other's control, or right to control, the manner and means of performing the services. The exact nature of the independent contractor's relationship with the hiring party is important since an independent contractor pays his/her own Social Security, income taxes without payroll deduction, has no retirement or health plan rights, and often is not entitled to worker's compensation coverage.

There are a number of factors which to consider in making the decision whether people are employees or independent contractors. One of the most important considerations is the degree of control exercised by the company over the work of the workers. An employer has the right to control an employee. It is important to determine whether the company had the right to direct and control the workers not only as to the results desired, but also as to the details, manner and means by which the results were accomplished. If the company had the right to supervise and control such details of the work performed, and the manner and means by which the results were to be accomplished, an employer-employee relationship would be indicated. On the other hand, the absence of supervision and control by the company would support a finding that the workers were independent contractors and not employees.

Another factor to be considered is the connection and regularity of business between the independent contractor and the hiring party. Important factors to be considered are separate advertising, procurement of licensing, maintenance of a place of business, and supplying of tools and equipment by the independent contractor. If the service rendered is to be completed by a certain time, as opposed to an indefinite time period, a finding of an independent contractor status is more likely.

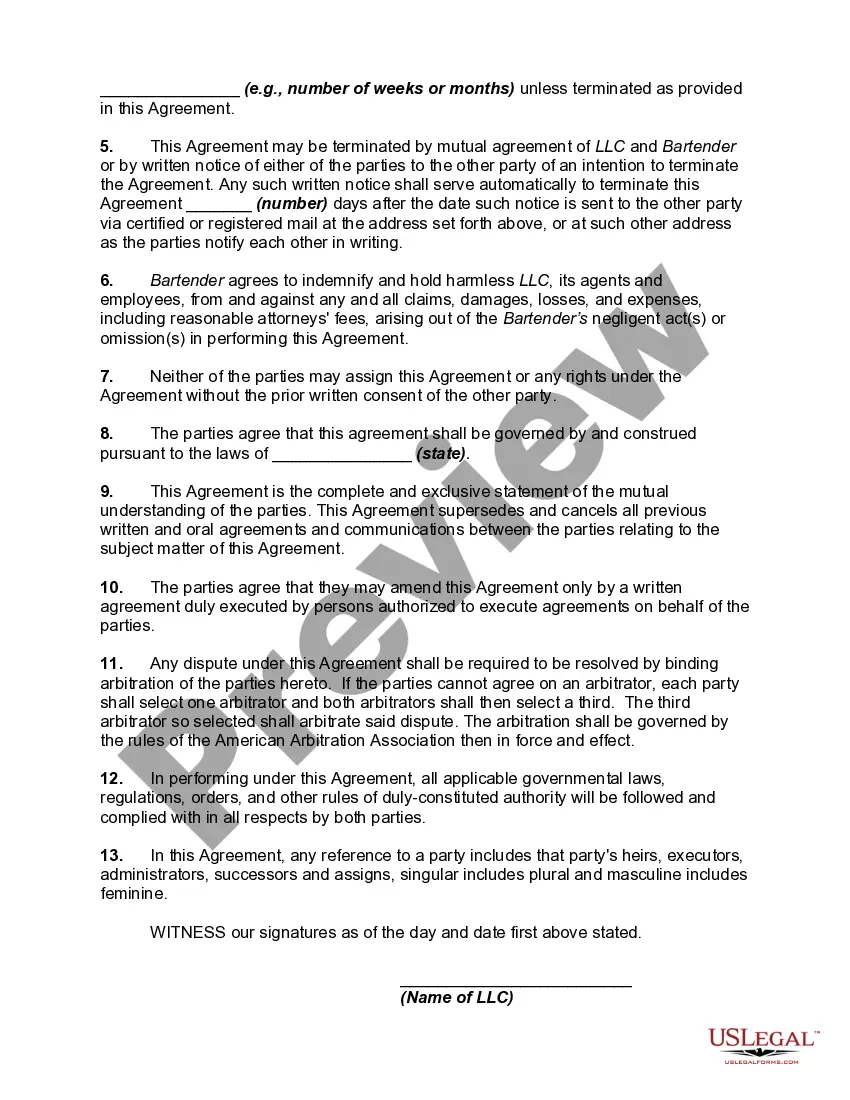

A Delaware Agreement Between a Bartender — as an IndependenContractto— - and a Business that Supplies Bartenders to Parties and Special Events is a legal contract that outlines the terms and conditions of the working relationship between a bartender operating as an independent contractor and a business (such as a bartending staffing agency) that provides bartenders for parties and special events in Delaware. This agreement is important to ensure clarity, protection, and mutual understanding between the bartender and the business. Key Elements in a Delaware Agreement Between a Bartender and a Business that Supplies Bartenders to Parties and Special Events: 1. Parties Involved: Clearly identify the bartender (as the independent contractor) and the business (as the employer or staffing agency) by stating their legal names, addresses, and contact information at the beginning of the agreement. 2. Scope of Services: Clearly define the services the bartender is expected to perform, including tasks like mixing and serving beverages, ensuring cleanliness, handling cash transactions, and providing excellent customer service at parties and special events. 3. Independent Contractor Status: Establish that the bartender is an independent contractor and not an employee of the business. This clause should outline that the bartender is responsible for their own taxes, insurance, licensing, tools, and any necessary certifications, as required by Delaware law. 4. Compensation and Payment Terms: Detail how the bartender will be compensated for their services, such as an hourly rate, tips allocation, or any other mutually agreed-upon payment structure. Additionally, specify the payment schedule, how and when payments will be made (weekly, bi-weekly, etc.), and any other relevant payment terms. 5. Duration and Termination: Specify the start date and duration of the agreement. Include termination clauses, such as the conditions under which either party may terminate the agreement, notice periods required, and any potential penalties or consequences for early termination. 6. Confidentiality and Non-Competition: Include provisions protecting the business's confidential information, trade secrets, and clients. Add a non-competition clause that restricts the bartender from working for direct competitors or starting a similar business in the same geographical area during the contract and for a specific period thereafter. 7. Liability and Insurance: Clearly outline the liabilities and responsibilities of both parties. Address who will be responsible for any damages, accidents, injuries, or loss of property that may occur during the performance of the services. Specify that the bartender should hold appropriate liability insurance to cover potential risks. 8. Dispute Resolution and Governing Law: Determine how disputes will be handled, whether through mediation, arbitration, or litigation, and specify the governing law of Delaware that will apply to the agreement. 9. Entire Agreement and Amendments: Include a clause stating that the written agreement represents the entire agreement between the parties and that any modifications must be in writing and signed by both parties. Different types or variations of this agreement may include: — Exclusive Bartending Agreement: This agreement states that the bartender will exclusively work for the business and will not provide services to other similar organizations during the duration of the contract. — Temporary Staffing Agreement: This agreement might cover bartenders who are hired on a temporary basis for a specific event or a series of events rather than an ongoing arrangement. — Franchise Agreement: If the business operates on a franchising model, a franchise agreement might be required, outlining the specific terms and conditions for operating as a bartending franchisee. Remember, it is critical to consult with a legal professional experienced in Delaware contract law to ensure that your Agreement Between a Bartender — as an Independent Contractor — and a Business that Supplies Bartenders to Parties and Special Events complies with all relevant laws and regulations.A Delaware Agreement Between a Bartender — as an IndependenContractto— - and a Business that Supplies Bartenders to Parties and Special Events is a legal contract that outlines the terms and conditions of the working relationship between a bartender operating as an independent contractor and a business (such as a bartending staffing agency) that provides bartenders for parties and special events in Delaware. This agreement is important to ensure clarity, protection, and mutual understanding between the bartender and the business. Key Elements in a Delaware Agreement Between a Bartender and a Business that Supplies Bartenders to Parties and Special Events: 1. Parties Involved: Clearly identify the bartender (as the independent contractor) and the business (as the employer or staffing agency) by stating their legal names, addresses, and contact information at the beginning of the agreement. 2. Scope of Services: Clearly define the services the bartender is expected to perform, including tasks like mixing and serving beverages, ensuring cleanliness, handling cash transactions, and providing excellent customer service at parties and special events. 3. Independent Contractor Status: Establish that the bartender is an independent contractor and not an employee of the business. This clause should outline that the bartender is responsible for their own taxes, insurance, licensing, tools, and any necessary certifications, as required by Delaware law. 4. Compensation and Payment Terms: Detail how the bartender will be compensated for their services, such as an hourly rate, tips allocation, or any other mutually agreed-upon payment structure. Additionally, specify the payment schedule, how and when payments will be made (weekly, bi-weekly, etc.), and any other relevant payment terms. 5. Duration and Termination: Specify the start date and duration of the agreement. Include termination clauses, such as the conditions under which either party may terminate the agreement, notice periods required, and any potential penalties or consequences for early termination. 6. Confidentiality and Non-Competition: Include provisions protecting the business's confidential information, trade secrets, and clients. Add a non-competition clause that restricts the bartender from working for direct competitors or starting a similar business in the same geographical area during the contract and for a specific period thereafter. 7. Liability and Insurance: Clearly outline the liabilities and responsibilities of both parties. Address who will be responsible for any damages, accidents, injuries, or loss of property that may occur during the performance of the services. Specify that the bartender should hold appropriate liability insurance to cover potential risks. 8. Dispute Resolution and Governing Law: Determine how disputes will be handled, whether through mediation, arbitration, or litigation, and specify the governing law of Delaware that will apply to the agreement. 9. Entire Agreement and Amendments: Include a clause stating that the written agreement represents the entire agreement between the parties and that any modifications must be in writing and signed by both parties. Different types or variations of this agreement may include: — Exclusive Bartending Agreement: This agreement states that the bartender will exclusively work for the business and will not provide services to other similar organizations during the duration of the contract. — Temporary Staffing Agreement: This agreement might cover bartenders who are hired on a temporary basis for a specific event or a series of events rather than an ongoing arrangement. — Franchise Agreement: If the business operates on a franchising model, a franchise agreement might be required, outlining the specific terms and conditions for operating as a bartending franchisee. Remember, it is critical to consult with a legal professional experienced in Delaware contract law to ensure that your Agreement Between a Bartender — as an Independent Contractor — and a Business that Supplies Bartenders to Parties and Special Events complies with all relevant laws and regulations.