Delaware Estate Planning Data Sheet is a comprehensive document containing key information and details related to estate planning in the state of Delaware. This information serves as a valuable resource for individuals and families looking to ensure a seamless transfer of assets and property upon death or incapacity. Designed to capture crucial data related to an individual's estate, the Delaware Estate Planning Data Sheet acts as a reference guide for estate planning professionals, lawyers, and financial advisors. It aids in streamlining the estate planning process by providing a consolidated view of pertinent information. Some essential details typically included in a Delaware Estate Planning Data Sheet are as follows: 1. Personal Information: This section encompasses basic information about the estate owner, including their full name, address, date of birth, and contact details. It may also include information about the estate owner's family members such as spouse, children, or other beneficiaries. 2. Assets and Property Inventory: This segment lists all major assets and properties owned by the estate owner, including real estate properties, bank accounts, investments, retirement accounts, business interests, and intellectual property. It may also include personal belongings of significant value and sentimental importance. 3. Debts and Liabilities: This section entails details about any outstanding debts, mortgages, loans, or any other financial liabilities that the estate owner may have. It is important to mention creditors' names, account numbers, outstanding balances, and contact information. 4. Insurance Coverage: This category includes information relating to life insurance policies, including policy numbers, beneficiaries, coverage amounts, and contact details of insurance providers. Additionally, it may incorporate details about other types of insurance coverage, such as health, disability, or long-term care insurance. 5. Documents and Legal Instruments: This part focuses on the identification, organization, and location of important legal documents and estate planning instruments. It may include wills, trusts, powers of attorney, advance healthcare directives, and any other legal documentation related to estate planning. Different types of Delaware Estate Planning Data Sheets may vary depending on the format and specific requirements of different individuals or estate planning professionals. For instance, some individuals may prefer a digital format, while others may opt for a physical hard copy. There might also be variations in the level of detail included, depending on the complexity of an individual's estate and specific estate planning goals. In conclusion, the Delaware Estate Planning Data Sheet is a structured and comprehensive document that assists individuals and professionals in efficiently organizing and managing the crucial information required for effective estate planning in the state of Delaware. By diligently completing this data sheet, individuals can ensure that their estate planning process is smooth, accurate, and in accordance with their wishes, ultimately providing peace of mind for both themselves and their loved ones.

Delaware Estate Planning Data Sheet

Description

How to fill out Delaware Estate Planning Data Sheet?

US Legal Forms - among the biggest libraries of legal varieties in the United States - provides a wide array of legal file themes you are able to acquire or printing. Making use of the web site, you can find 1000s of varieties for company and person uses, categorized by categories, claims, or keywords and phrases.You can get the newest variations of varieties much like the Delaware Estate Planning Data Sheet in seconds.

If you have a registration, log in and acquire Delaware Estate Planning Data Sheet through the US Legal Forms catalogue. The Download option will show up on each and every type you see. You have accessibility to all earlier downloaded varieties within the My Forms tab of your own profile.

If you want to use US Legal Forms for the first time, allow me to share simple recommendations to help you get started off:

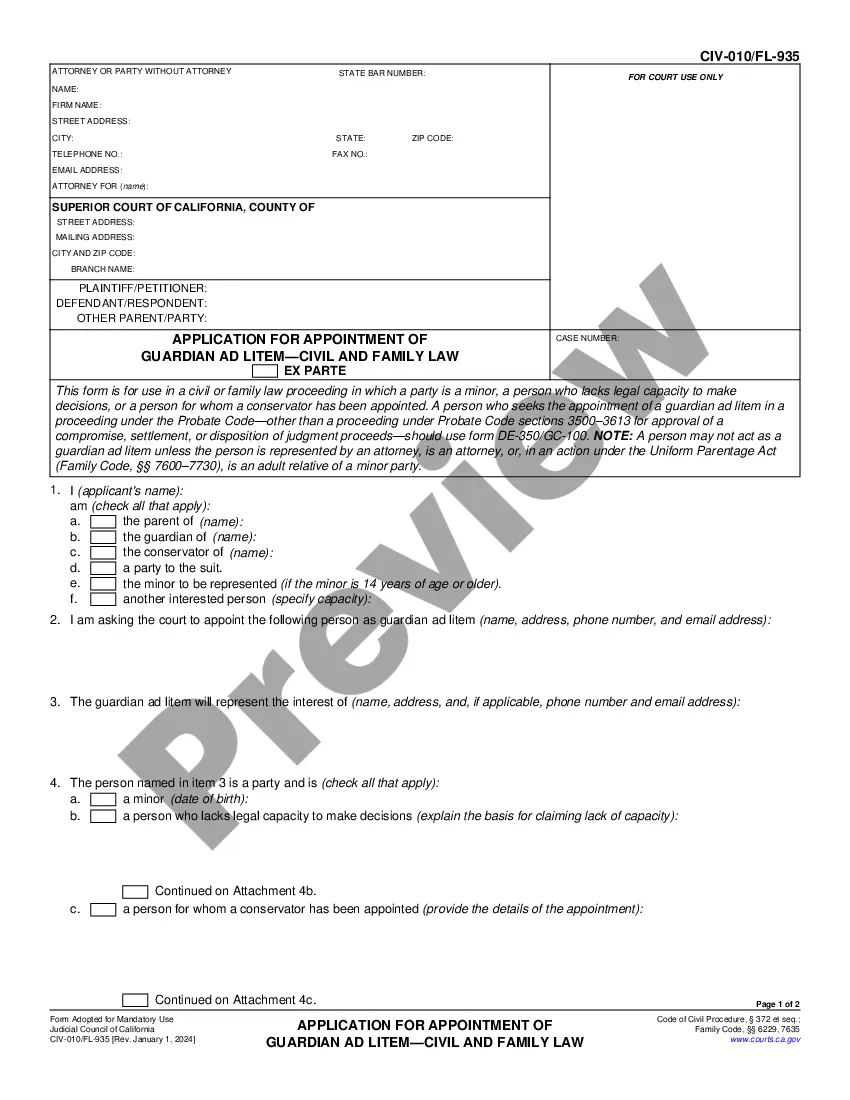

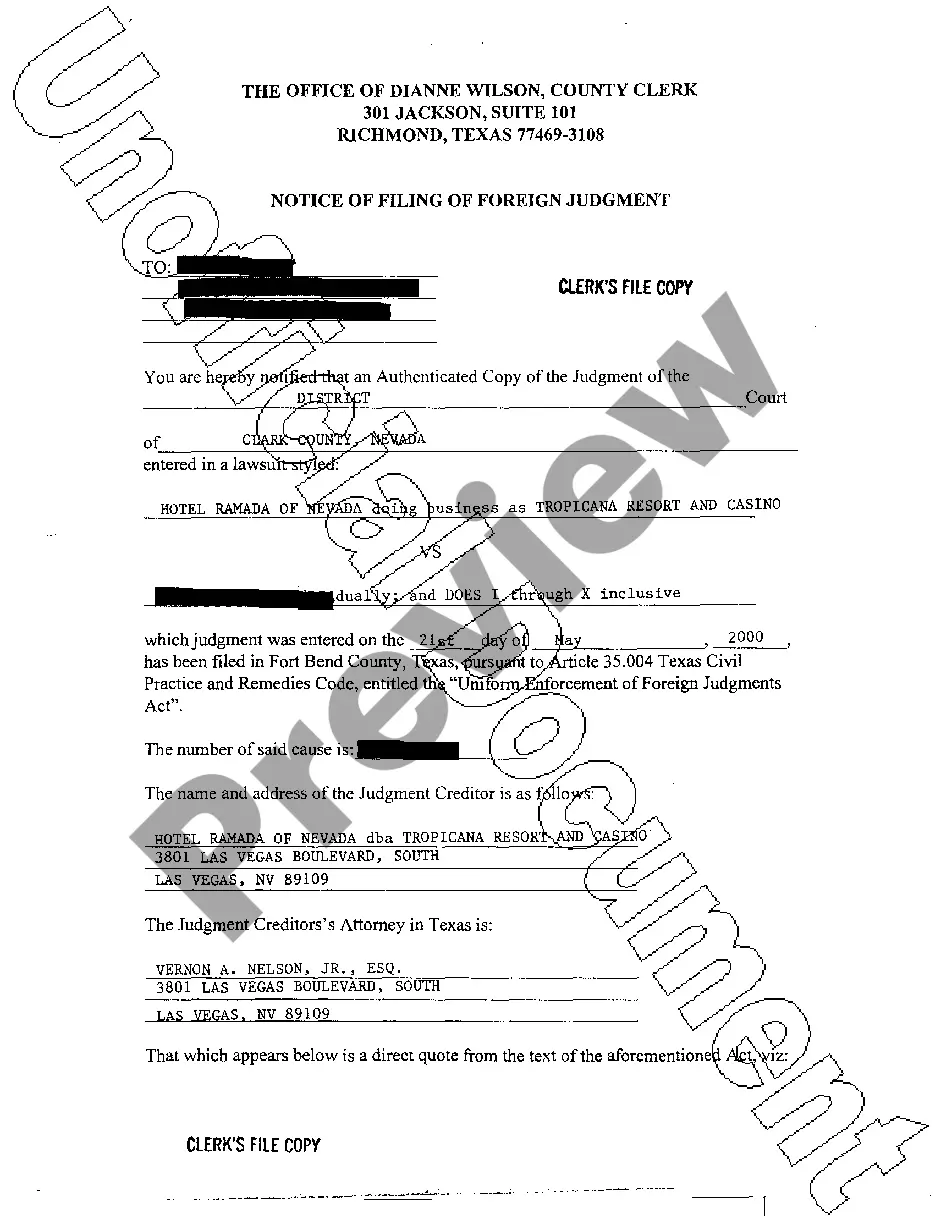

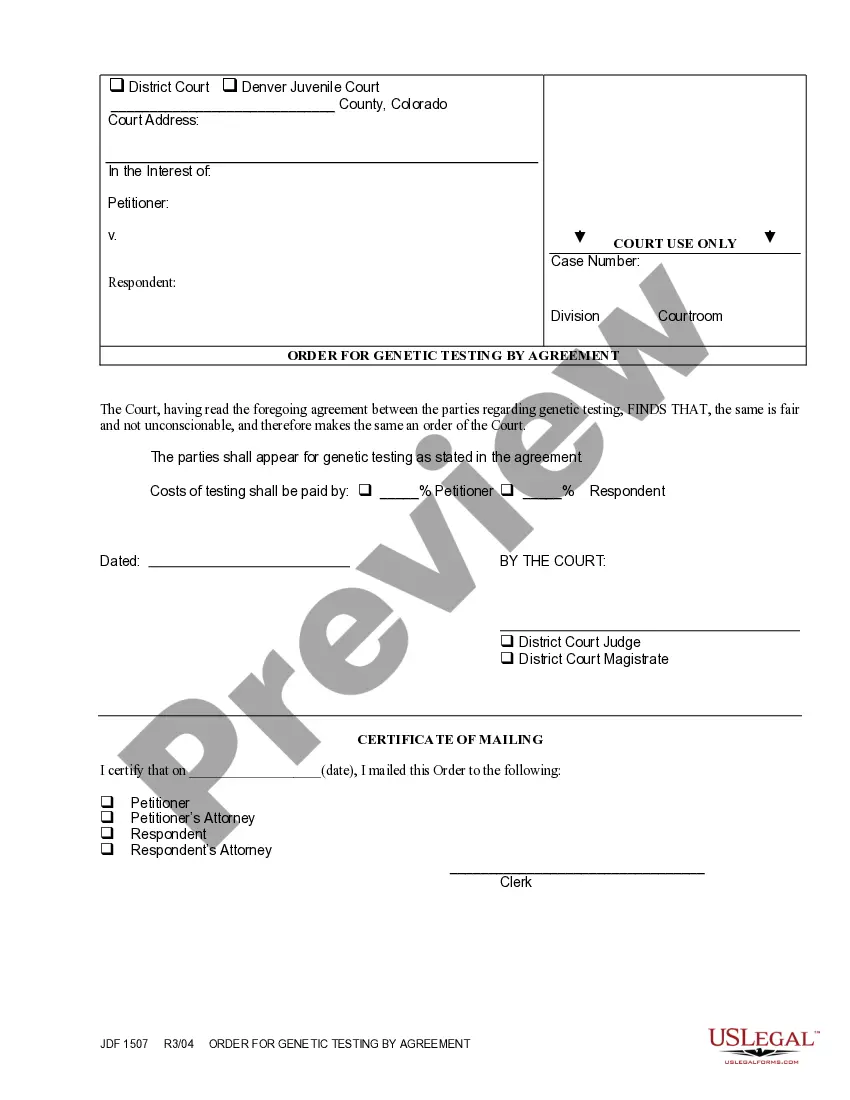

- Be sure you have selected the proper type for your personal city/region. Click the Review option to examine the form`s content material. Browse the type description to ensure that you have selected the proper type.

- In case the type doesn`t fit your demands, take advantage of the Research field on top of the monitor to obtain the one which does.

- If you are content with the shape, verify your decision by simply clicking the Purchase now option. Then, choose the costs strategy you favor and supply your qualifications to register to have an profile.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal profile to finish the purchase.

- Find the file format and acquire the shape on your gadget.

- Make changes. Fill out, revise and printing and indication the downloaded Delaware Estate Planning Data Sheet.

Every design you included in your account does not have an expiration time which is your own property forever. So, in order to acquire or printing one more backup, just proceed to the My Forms portion and click on on the type you will need.

Gain access to the Delaware Estate Planning Data Sheet with US Legal Forms, probably the most considerable catalogue of legal file themes. Use 1000s of professional and express-certain themes that satisfy your small business or person needs and demands.

Form popularity

FAQ

How much does a Will cost in Delaware? In Delaware, the average cost of a will ranges from $200 to $1,000, based on the attorney's fees and estate complexity.

Another reason why many statutory trusts are filed in the State of Delaware is because the state does not impose any ongoing franchise taxes or annual fees. In order to form a DST, a sponsor must file a Certificate of Statutory Trust with the Delaware Division of Corporations. This certificate has a $500 filing fee.

Tax Savings Delaware does not impose income tax on accumulated income or capital gains if the irrevocable Delaware trust has only nonresident remainder beneficiaries. In addition, Delaware imposes no income tax on required income distributions to beneficiaries not residing in Delaware. Transfer tax savings.

The cost of setting up a trust in Delaware varies depending on the complexity of the trust and the attorney's fees. A basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts can cost several thousand dollars more.

Delaware Statutory Trusts (DSTs) typically offer a cash-on-cash return of 5-9% per year, with the potential for additional appreciation. The overall return on a DST investment will depend on a number of factors, including the properties that the DST invests in, the management team, and the overall market conditions.

A living trust is created in Delaware by signing a Declaration of Trust, which will name the trustee, beneficiary and terms of the trust. You need to sign the declaration in the presence of a notary. Once that is complete, the trust must be funded by transferring assets into it.

No. You can make your own will in Delaware, using Nolo's Quicken WillMaker & Trust.

To make a living trust in Delaware, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.