Delaware Estate Planning Data Letter and Employment Agreement with Client

Description

How to fill out Estate Planning Data Letter And Employment Agreement With Client?

It is feasible to spend hours online trying to locate the legal document template that suits both state and federal requirements you have.

US Legal Forms offers thousands of legal templates that are reviewed by experts.

You can easily download or create the Delaware Estate Planning Information Letter and Client Employment Agreement from the service.

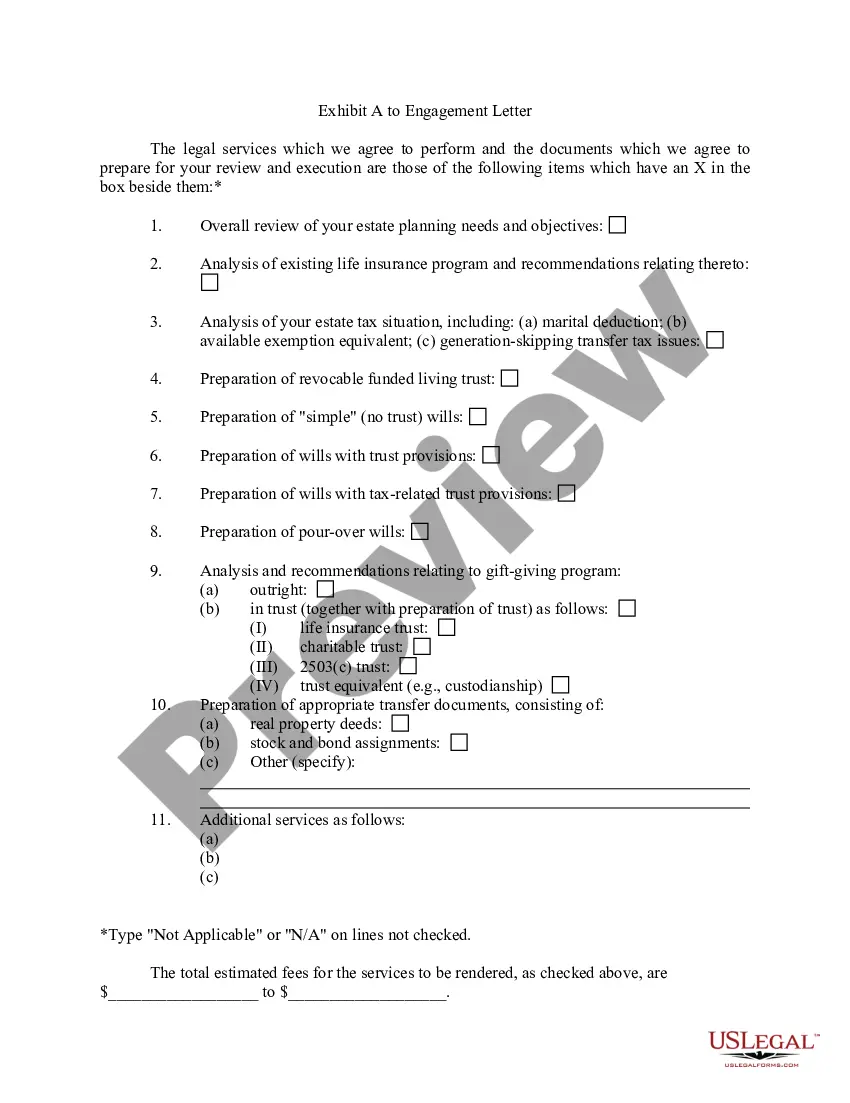

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, edit, print, or sign the Delaware Estate Planning Information Letter and Client Employment Agreement.

- Every legal document template you download is yours permanently.

- To get an additional copy of a downloaded form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions listed below.

- First, ensure that you have selected the correct document template for your area/town of choice.

- Look at the form description to make sure you have chosen the right template.

Form popularity

FAQ

In Delaware, an executor typically has 18 months from the date of the decedent's death to settle the estate. However, this period may be extended under certain circumstances if more time is needed to fulfill all obligations. Having a comprehensive Delaware Estate Planning Data Letter and Employment Agreement with Client can help prepare executors, guiding them through their responsibilities effectively.

The probate process in Delaware generally lasts between six months to a year, depending on the complexity of the estate. Factors such as the size of the estate, claims by creditors, and disputes among heirs can affect the timeline. To streamline probate, a Delaware Estate Planning Data Letter and Employment Agreement with Client can facilitate clearer communication and understanding among all parties involved.

Section 3313 of Title 12 of the Delaware Code pertains to the administration of decedent estates. This section outlines responsibilities for executors and administrators in managing and settling an estate. Utilizing tools like the Delaware Estate Planning Data Letter and Employment Agreement with Client can help simplify this process and ensure all legal requirements are met.

Yes, you can write your own will in Delaware. However, while it is legal to draft your own will, it is often beneficial to consult with professionals. Incorporating a Delaware Estate Planning Data Letter and Employment Agreement with Client can help ensure that your will complies with state laws and addresses your specific needs.

An estate planning questionnaire is a tool used to gather vital information about an individual’s assets, family, and desires for distributing those assets after death. Completing this questionnaire is essential for your attorney to create an effective Delaware Estate Planning Data Letter and Employment Agreement with Client that reflects your wishes accurately.

The estate planning process typically includes defining your goals, assessing assets, choosing beneficiaries, selecting an executor, creating essential documents, reviewing legalities, and updating your plan as needed. Each step plays a crucial role in ensuring your wishes are honored. A comprehensive Delaware Estate Planning Data Letter and Employment Agreement with Client provides guidance throughout these steps.

One of the most important decisions in estate planning involves selecting an executor or trustee who will manage your estate after your passing. This individual should be trustworthy, organized, and capable of handling financial matters. A well-defined Delaware Estate Planning Data Letter and Employment Agreement with Client can clearly outline this choice and other critical components of your estate plan.

The 5 or 5 rule in estate planning refers to the ability to withdraw up to 5% of the trust assets each year without incurring tax penalties. This flexible approach allows clients to maintain some access to their assets while still enjoying tax advantages. When working with your attorney, ensure this principle is incorporated into your Delaware Estate Planning Data Letter and Employment Agreement with Client for optimal benefit.

To hire an estate planning attorney, begin by researching local professionals with strong reputations. Schedule consultations to discuss your goals and ask about their specific experience with estate planning in Delaware. A good attorney will guide you through drafting your Delaware Estate Planning Data Letter and Employment Agreement with Client, ensuring your assets are protected.

When interviewing an estate planning attorney, start by assessing their experience and expertise in the Delaware estate planning landscape. Prepare specific questions about their approach, fees, and communication style. This process helps you gauge whether the attorney will create a comprehensive Delaware Estate Planning Data Letter and Employment Agreement with Client that fits your needs.