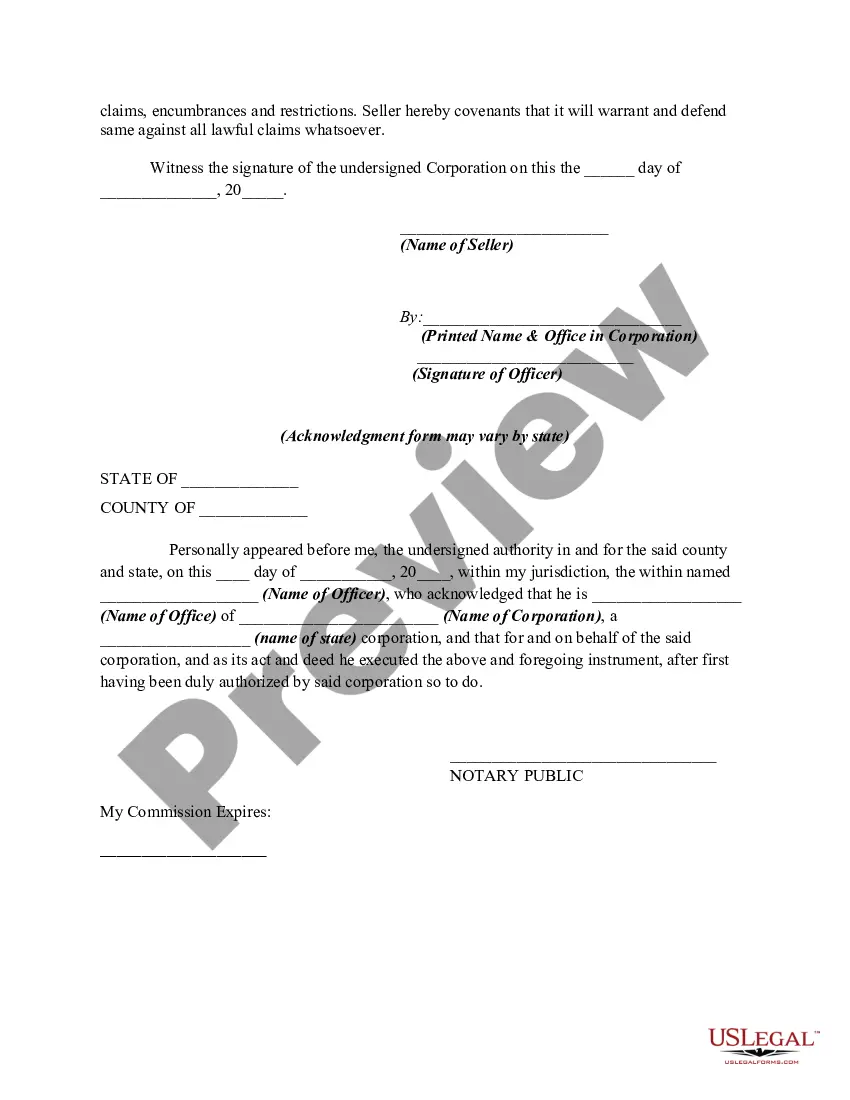

Delaware Bill of Sale by Corporation of all or Substantially all of its Assets is a legal document that facilitates the transfer of ownership rights from a corporation to another party for either all or a significant portion of its assets. This type of transaction is crucial during mergers, acquisitions, or when a corporation decides to divest a substantial portion of its business. Key elements in a Delaware Bill of Sale by Corporation of all or Substantially all of its Assets include: 1. Parties Involved: The document starts by identifying the involved parties. This includes the name and legal address of the selling corporation, referred to as the "Selling Corporation," and the name and legal address of the purchasing party, called the "Purchaser." 2. Definitions: A clear set of definitions are provided to ensure both parties understand the terms used throughout the document, such as "Assets," "Consideration," "Assumed Liabilities," and "Closing Date." 3. Sale and Purchase: The agreement explicitly declares that the Selling Corporation is selling, assigning, and transferring to the Purchaser all assets or substantially all of its assets. The assets can include tangible property, intellectual property, contracts, licenses, trademarks, goodwill, inventory, or any other relevant item. 4. Consideration: The document specifies the consideration — typically monetary – to be paid by the Purchaser to the Selling Corporation for the assets. It includes the total purchase price, terms of payment, and any additional conditions or adjustments. 5. Assumed Liabilities: The Bill of Sale may mention whether the Purchaser is assuming any liabilities of the Selling Corporation as part of the transaction. These liabilities may cover debts, loans, mortgages, duties, obligations, or pending lawsuits. 6. Closing Date and Closing Conditions: The agreement establishes a specific date for the completion of the asset transfer, known as the "Closing Date." It may also outline certain conditions that need to be satisfied before the closing, such as regulatory approvals, consents, or waivers. 7. Representations and Warranties: Both parties provide assurances regarding their legal authority to execute the transaction. They confirm that the assets being sold are free from any liens or encumbrances, and that they have the power and authority to transfer the assets as agreed. 8. Governing Law and Jurisdiction: Since this is a Delaware Bill of Sale, it includes a clause stating that the document is subject to the laws and regulations of the State of Delaware. The parties agree to submit to the jurisdiction of Delaware courts for any disputes related to the transaction. Additional Types of Delaware Bill of Sale by Corporation of all or Substantially all of its Assets: 1. Absolute Bill of Sale: This type of bill of sale signifies a complete and final transfer of all assets of a corporation to another party without any retained interests. 2. Conditional Bill of Sale: In this case, the transfer of assets is subject to certain conditions, such as the successful completion of due diligence, approval from stakeholders, or third-party consents. 3. Partial Bill of Sale: This variant involves the transfer of only a portion of the corporation's assets, as opposed to the entire or substantially all of its assets. 4. Bulk Sale Agreement: Although not precisely a "bill of sale," a bulk sale agreement is often used for transactions involving the sale of all or substantially all of a corporation's assets. It ensures proper notice to creditors and compliance with applicable laws regarding the selling corporation's obligations.

Delaware Bill of Sale by Corporation of all or Substantially all of its Assets

Description

How to fill out Delaware Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Are you currently in the situation where you need to have papers for possibly company or individual functions just about every day time? There are plenty of authorized file layouts available online, but finding ones you can depend on isn`t effortless. US Legal Forms provides a huge number of type layouts, just like the Delaware Bill of Sale by Corporation of all or Substantially all of its Assets, that are composed in order to meet federal and state requirements.

In case you are presently acquainted with US Legal Forms site and get a merchant account, just log in. After that, you are able to down load the Delaware Bill of Sale by Corporation of all or Substantially all of its Assets template.

If you do not offer an profile and wish to start using US Legal Forms, adopt these measures:

- Discover the type you want and make sure it is for your appropriate city/state.

- Take advantage of the Review key to analyze the form.

- Read the information to ensure that you have selected the right type.

- When the type isn`t what you`re searching for, utilize the Search industry to find the type that fits your needs and requirements.

- If you get the appropriate type, simply click Get now.

- Opt for the rates plan you desire, fill out the required information to make your account, and pay money for an order utilizing your PayPal or charge card.

- Decide on a practical data file formatting and down load your version.

Discover every one of the file layouts you have bought in the My Forms menus. You can obtain a more version of Delaware Bill of Sale by Corporation of all or Substantially all of its Assets any time, if necessary. Just select the necessary type to down load or print the file template.

Use US Legal Forms, the most considerable selection of authorized types, to save time and avoid blunders. The assistance provides skillfully created authorized file layouts which can be used for a selection of functions. Produce a merchant account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

Substantial Assets means assets sold or otherwise disposed of in a single transaction or a series of related transactions representing 25% or more of the consolidated assets of the Borrower and its Consolidated Subsidiaries, taken as a whole.

A corporation is, at least in theory, owned and controlled by its members. In a joint-stock company the members are known as shareholders, and each of their shares in the ownership, control, and profits of the corporation is determined by the portion of shares in the company that they own.

Substantially all when used in relation to assets, means assets of the relevant entity or entities having a market value of at least 75% of the market value of all of the assets of such entity or entities at the date of the relevant transactions.

Section 203 of the DGCL generally prohibits any owner of 15% or more of a corporation's voting stock from engaging in a business combination with the corporation within three years after the person acquired such ownership, unless, among other options, the board approved the transaction that resulted in the person

All or substantially all means, with respect to any sale, lease, exchange or other disposition of assets in any transaction or series of related transactions (each, a Specified Transaction), such Specified Transaction that would leave the Company and its Subsidiaries, when taken as a whole, without a significant

Once incorporated, stockholders can transfer ownership of their shares to another party. This is a clear and straightforward process. Surrender your share certificate to the Corporation's transfer agent. Wait for the transfer agent to issue a certificate to a new shareholder, thereby transferring the shares.

Sale of all or substantially all of the assets means the sale, lease, transfer, conveyance or other disposition in one or more related transactions (other than by way of merger or consolidation by the Company) of assets of the Company and its Restricted Subsidiaries equal to at least 80% of Total Assets.

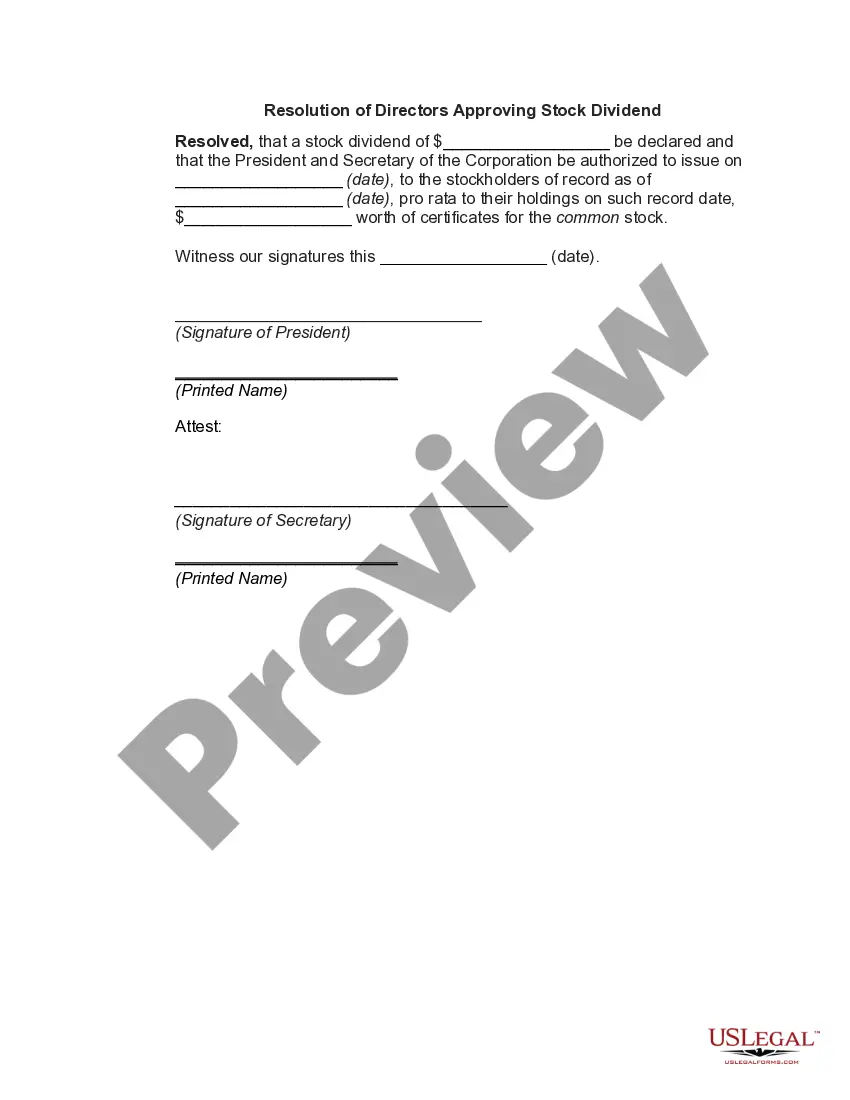

Stockholder Approval Required to: Amend the Certificate of Incorporation. Enter into fundamental corporate transactions (sale of company, merger, sale of substantially all assets of corporation, etc.) Elect Directors (though vacant seats from departed directors can often be filled by Board)

Under Delaware law, a shareholder has a to right to vote on any amendment to the corporation's governing documents, whether such class of shares is entitled to vote or not under the governing documents, for actions that would (i) increase or decrease the number of authorized shares of such class; (ii) increase or

Interested stockholder means any person who owns at least 15% of the outstanding voting stock of the corporation, or who owned such 15% at any time during the previous three years and presently holds the power to direct management or a position as director or officer of the corporation.