Delaware Invoice Template for Accountant: Accountants in Delaware often require professional, easy-to-use invoice templates to streamline their billing processes and maintain accurate records. A Delaware Invoice Template for Accountant is a customizable document designed specifically for accountants practicing in Delaware. These templates assist in clearly outlining the services rendered, corresponding fees, and payment terms. They help track financial transactions, maintain transparency, and ensure compliance with state regulations. Key Features of a Delaware Invoice Template for Accountant: 1. Professional Design: A professionally designed invoice template allows accountants to create customized invoices that reflect their brand image. It should include the accountant's contact information, such as their name, address, phone number, and email address, prominently displayed at the top. 2. Invoice Number: A unique invoice number should be assigned to each invoice for easy identification and tracking. Incorporating a sequential numbering system simplifies record-keeping and helps in case of any billing disputes or discrepancies. 3. Client Information: An invoice template must include the client's details, including their name, address, phone number, and email address. This information ensures accurate communication and helps both parties to keep track of financial transactions. 4. Itemized Services: Accountants need to itemize the services provided to clients to establish transparency in billing. The template should allow accountants to include descriptions of the services rendered, along with the corresponding rates and quantities, creating a clear breakdown of the charges. 5. Tax Calculation: Delaware has specific tax laws that accountants need to adhere to while invoicing clients. The invoice template should provide fields for calculating applicable taxes, such as sales tax, and allow for adjustments based on Delaware's tax regulations. 6. Payment Terms: To ensure efficient payment processing and avoid confusion, the template should clearly specify the payment terms, including due dates, accepted payment methods, and late payment penalties, if any. This information helps accountants maintain an organized cash flow. 7. Branding and Customization: The Delaware Invoice Template for an Accountant should allow for branding and customization options, such as adding a logo, a letterhead, or a personalized footer. These customizable features enable accountants to present a professional image to their clients. Types of Delaware Invoice Templates for Accountants: 1. Hourly Rate Invoice Template: This template suits accountants who charge clients on an hourly basis. It allows for documenting the number of hours worked, the hourly rate, and any additional costs, ensuring accurate billing. 2. Fixed Fee Invoice Template: Accountants who perform specific services for a flat fee can utilize this template. It allows them to list each service provided and the corresponding fixed fee, enabling clients to understand the total charges effortlessly. 3. Recurring Invoice Template: Accountants who offer recurring services, such as monthly bookkeeping or quarterly tax filings, can use this template to set up automated billing cycles. This type of template maintains continuity, reduces administrative efforts, and ensures timely payments. 4. Expense Invoice Template: Accountants who need to include reimbursable expenses or miscellaneous costs can utilize this template. It enables accountants to itemize expenses separately and provides a clear record of all additional charges. In conclusion, a Delaware Invoice Template for an Accountant is a customizable document tailored to meet the invoicing needs of accountants practicing in Delaware. It assists in maintaining accurate records, transparent billing, and adherence to state-specific tax regulations. With various types available, accountants can select the template that best fits their billing requirements.

Delaware Invoice Template for Accountant

Description

How to fill out Delaware Invoice Template For Accountant?

US Legal Forms - one of many most significant libraries of authorized forms in the States - gives a variety of authorized document themes you can acquire or produce. While using site, you may get 1000s of forms for company and specific purposes, sorted by classes, says, or key phrases.You can get the most up-to-date variations of forms like the Delaware Invoice Template for Accountant within minutes.

If you have a subscription, log in and acquire Delaware Invoice Template for Accountant through the US Legal Forms library. The Acquire switch will show up on every single type you view. You gain access to all formerly delivered electronically forms inside the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, here are straightforward directions to help you started out:

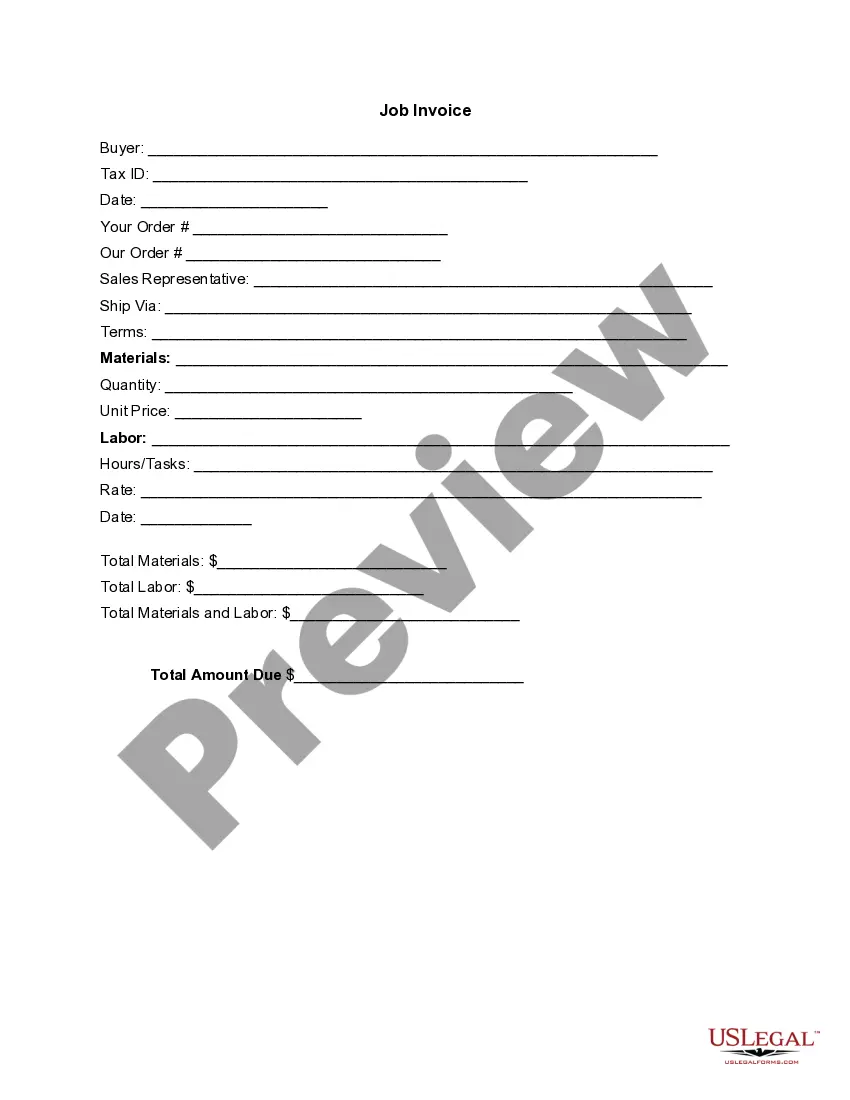

- Be sure to have selected the proper type to your area/county. Click on the Review switch to analyze the form`s content. See the type information to actually have selected the right type.

- If the type does not satisfy your demands, use the Lookup discipline towards the top of the monitor to discover the one which does.

- When you are content with the shape, verify your option by visiting the Get now switch. Then, select the rates program you prefer and offer your credentials to sign up on an account.

- Process the transaction. Make use of your Visa or Mastercard or PayPal account to finish the transaction.

- Select the structure and acquire the shape on your own system.

- Make adjustments. Load, edit and produce and signal the delivered electronically Delaware Invoice Template for Accountant.

Each and every design you included with your account does not have an expiry date and is also your own property forever. So, in order to acquire or produce yet another version, just go to the My Forms portion and click in the type you want.

Gain access to the Delaware Invoice Template for Accountant with US Legal Forms, the most comprehensive library of authorized document themes. Use 1000s of professional and condition-certain themes that meet your small business or specific needs and demands.