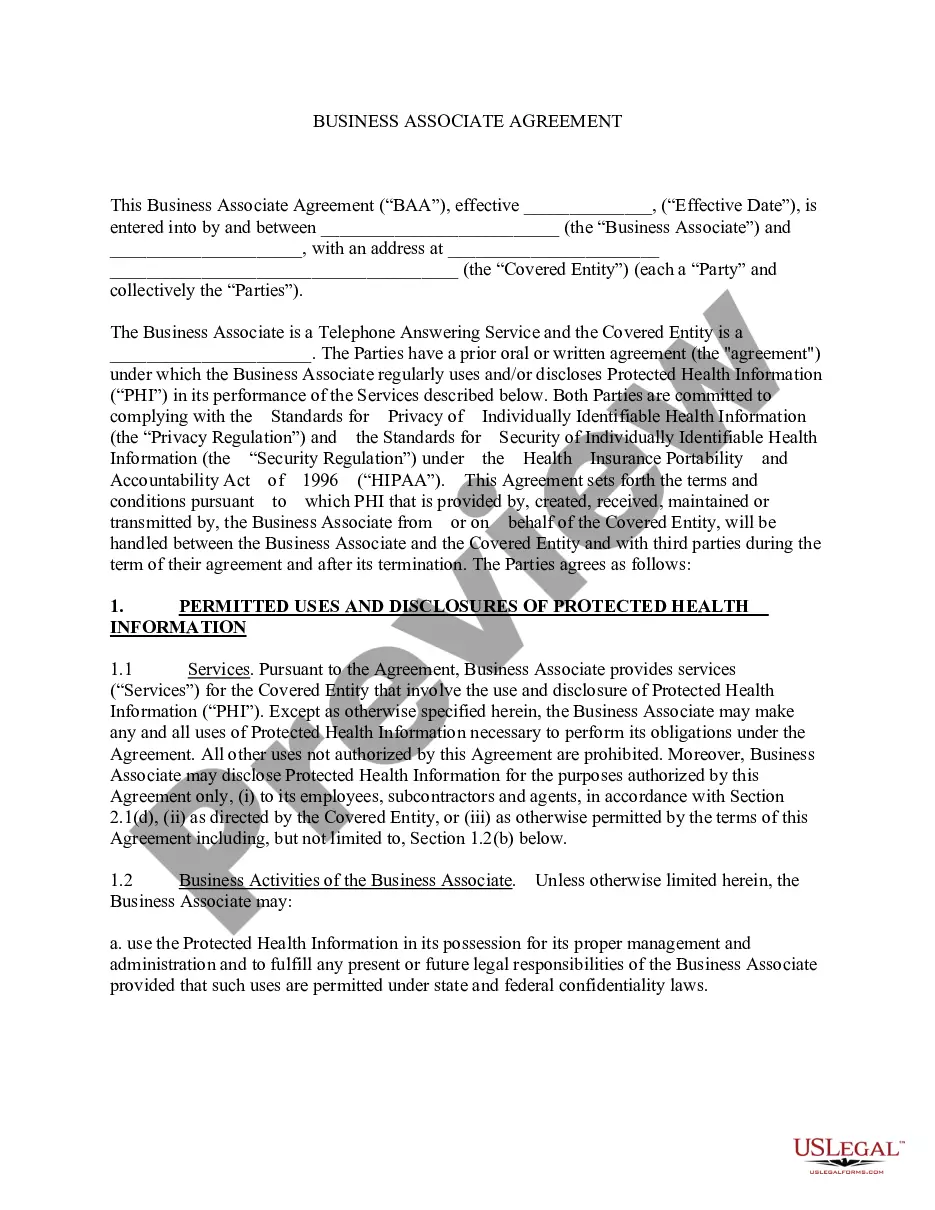

A Delaware Invoice Template for Self Employed is a pre-formatted document specifically designed for individuals who work as freelancers, consultants, or run small businesses in the state of Delaware. This template acts as a professional tool to streamline the process of creating and documenting invoices, ensuring accurate and efficient payment transactions. The Delaware Invoice Template for Self Employed follows the guidelines set by the Delaware Division of Revenue and incorporates essential elements that need to be included in an invoice. These elements typically include: 1. Business Information: The template includes sections for the freelancer or small business owner to enter their name, address, contact details, and relevant business identification numbers such as the Employer Identification Number (EIN) or Social Security number. 2. Client Information: There is an area in the template to input the client's name, address, and contact details. It is crucial to accurately record this information to ensure proper communication and payment processes. 3. Invoice Details: This section allows self-employed individuals to specify the invoice number, issue date, due date, and the payment terms agreed upon with the client. It is essential to include this information to ensure both parties are aware of the payment expectations and deadlines. 4. Detailed Description of Services: The template includes space to itemize each service or product provided, along with its corresponding quantity, unit price, and total amount. It is crucial to provide a detailed description of each item to ensure transparency and avoid any confusion regarding the billed services. 5. Subtotals, Taxes, and Discounts: The Delaware Invoice Template for Self Employed calculates subtotals automatically based on the specified quantities and prices. It also provides sections to include any applicable taxes or discounts, ensuring accurate invoicing in accordance with Delaware tax regulations. 6. Total Amount Due: The template sums up all the subtotals, taxes, and discounts to provide the total amount due from the client. This section is typically highlighted and clearly emphasized to draw attention to the payment required. 7. Terms and Conditions: A section is available within the template to outline specific terms and conditions, such as late payment fees, payment methods accepted, and any additional contractual agreements. Types of Delaware Invoice Template for Self Employed: 1. Basic Delaware Invoice Template for Self Employed: This template includes all the essential elements mentioned above, providing freelancers and self-employed individuals with a simple and straightforward invoicing solution. 2. Customizable Delaware Invoice Template for Self Employed: This type of template allows users to personalize the design and format to match their brand identity. It provides options to add a logo, change colors, and modify the layout to create a unique invoice tailored to their business. 3. Multi-Purpose Delaware Invoice Template for Self Employed: This template caters to those who provide various services or sell products. It includes sections to list multiple items or services, ensuring comprehensive invoicing for diverse business offerings. Using a Delaware Invoice Template for Self Employed can significantly simplify the billing process and help self-employed individuals maintain professionalism and accuracy in their financial transactions.

Delaware Invoice Template for Self Employed

Description

How to fill out Delaware Invoice Template For Self Employed?

If you have to complete, download, or print legitimate papers themes, use US Legal Forms, the greatest variety of legitimate types, that can be found on the web. Utilize the site`s simple and easy hassle-free research to discover the paperwork you want. A variety of themes for organization and specific purposes are sorted by classes and says, or keywords and phrases. Use US Legal Forms to discover the Delaware Invoice Template for Self Employed within a number of mouse clicks.

In case you are already a US Legal Forms consumer, log in for your bank account and click on the Download button to obtain the Delaware Invoice Template for Self Employed. Also you can entry types you formerly delivered electronically within the My Forms tab of your own bank account.

If you use US Legal Forms initially, refer to the instructions under:

- Step 1. Make sure you have selected the form for the appropriate town/region.

- Step 2. Take advantage of the Preview solution to look through the form`s articles. Do not neglect to see the description.

- Step 3. In case you are not happy using the type, make use of the Search industry towards the top of the display to locate other types of your legitimate type format.

- Step 4. When you have found the form you want, click the Purchase now button. Choose the rates prepare you prefer and put your references to register to have an bank account.

- Step 5. Procedure the financial transaction. You can use your bank card or PayPal bank account to accomplish the financial transaction.

- Step 6. Find the file format of your legitimate type and download it on your own device.

- Step 7. Full, change and print or signal the Delaware Invoice Template for Self Employed.

Each and every legitimate papers format you get is yours for a long time. You possess acces to each and every type you delivered electronically inside your acccount. Select the My Forms section and select a type to print or download once more.

Compete and download, and print the Delaware Invoice Template for Self Employed with US Legal Forms. There are millions of skilled and condition-particular types you can use for your personal organization or specific needs.